ICICI Bank 2008 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F110

mitigation of operational risk and help business and operation groups to improve internal controls. The

Bank aims to minimize losses and customer dissatisfaction due to failure in processes. The key elements

in the operational risk management process in the Bank include:

l Identification, assessment and control of key operational risks

l Establishment of key risk indicators

l Monitoring

l Mitigation and

l Reporting.

The operational risk standards facilitate the effective communication of operational risk both within and

across businesses. Information about the businesses’ operational risk, historical losses, and the control

environment is reported by each major business segment and functional area, and summarized for senior

management and the Board of Directors.

In each of the banking subsidiaries, local management is responsible for implementing the Bank’s

operational risk management framework as per the operational risk management policy approved by

respective Boards.

b. Approaches for computation of capital charge for operational risk

As per the mandate from RBI, the Bank has adopted Basic Indicator Approach for computing capital

charge for operational risk. Both quantitative and qualitative steps have been initiated to migrate to

advanced approaches for capital computation.

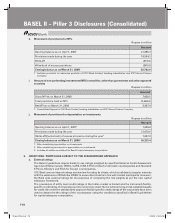

10. INTEREST RATE RISK IN THE BANKING BOOK (IRRBB)

a. Risk Management Framework for IRRBB

Interest rate risk is the risk of potential variability in earnings and capital value resulting from changes

in market interest rates. The Bank holds assets, liabilities and off balance sheet items across various

markets with different maturity or re-pricing dates and linked to different benchmark rates, thus creating

exposure to unexpected changes in the level of interest rates in such markets. Interest rate risk in the

banking book refers to the risk associated with interest rate sensitive instruments that are not held in

the trading book of the Bank.

Risk management framework

The Asset Liability Committee (ALCO) decides strategies and specifies prudential limits for management

of interest rate risk in the banking book within the broad parameters laid down by Board of Directors

/Risk Committee of the Board (RCB). Structural Rate Risk Management Group (SRMG) in the treasury

and the Asset Liability Management (ALM) groups in overseas branches and overseas business units

(OBUs) are responsible for management of interest rate risk on the domestic and the specific offshore

branch banking book respectively by assuming risks within the interest rate risk limits specified by

ALCO. The policy formulation for management of this interest rate risk is done by the GRMG. TMOG is

responsible for preparing the various reports required for monitoring the interest rate risk in the Bank.

These limits are monitored periodically and the breaches, if any, are reported to ALCO. The ALCOs of

individual banking subsidiaries decide on strategies to optimize the interest rate risk carried within their

respective banking book.

Strategies and processes

The Bank proactively manages impact of interest rate in its banking book as a part of its ALM activities.

ALCO of the Bank decides strategies for managing the IRRBB at the desired level. ALCO periodically

gives direction for management of interest rate risk on the basis of its expectations of future interest

rates and various tools viz. gap statement, DoE, earning at risk (EaR), credit spread risk, simulation for

basis risk etc, used to measure the impact of interest rates in the banking book.

Further, certain ratios are monitored for overseas branches, such as Liquidity ratio, Long Term Asset

ratio among others. These provide an appropriate framework for decision making on interest rate

management.

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 1101P-less_(Pillar).indd 110 6/20/08 4:53:20 PM6/20/08 4:53:20 PM