ICICI Bank 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Towards a better life

Management’s Discussion & Analysis

FINANCIALS AS PER INDIAN GAAP

Summary

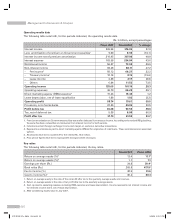

Profit before provisions and tax increased by 35.5% to Rs. 79.61 billion in fiscal 2008 from Rs. 58.74 billion in

fiscal 2007 primarily due to an increase in net interest income by 29.6% to Rs. 73.04 billion in fiscal 2008 from

Rs. 56.37 billion in fiscal 2007 and an increase in non-interest income by 27.2% to Rs. 88.11 billion in fiscal 2008

from Rs. 69.28 billion in fiscal 2007, offset, in part, by an increase in non-interest expenses by 21.9% to Rs. 81.54

billion in fiscal 2008 from Rs. 66.91 billion in fiscal 2007. Provisions and contingencies (excluding provision for tax)

increased by 30.5% during fiscal 2008 primarily due to a higher level of specific provisioning on non-performing

loans, offset, in part by a reduction in general provision on loans. Profit before tax increased by 38.6% to Rs. 50.56

billion in fiscal 2008 from Rs. 36.48 billion in fiscal 2007. Profit after tax increased by 33.7% to Rs. 41.58 billion in

fiscal 2008 from Rs. 31.10 billion in fiscal 2007.

Net interest income increased by 29.6% to Rs. 73.04 billion in fiscal 2008 from Rs. 56.37 billion in fiscal 2007,

reflecting an increase of 27.6% or Rs. 711.07 billion in the average volume of interest-earning assets and an

increase in net interest margin to 2.22% in fiscal 2008 compared to 2.19% in fiscal 2007.

Non-interest income increased by 27.2% to Rs. 88.11 billion in fiscal 2008 from Rs. 69.28 billion in fiscal 2007

primarily due to a 32.2% increase in fee income and a 14.0% increase in treasury and other non-interest

income.

Non-interest expenses increased by 21.9% to Rs. 81.54 billion in fiscal 2008 from Rs. 66.91 billion in fiscal

2007 primarily due to a 28.6% increase in employee expenses and a 31.6% increase in other administrative

expenses.

Provisions and contingencies (excluding provision for tax) increased to Rs. 29.05 billion in fiscal 2008 from

Rs. 22.26 billion in fiscal 2007 primarily due to higher level of specific provisioning on retail loans due to change in

the portfolio mix towards non-collateralised loans and seasoning of the loan portfolio, offset in part by a reduction

in general provision on loans due to lower growth in the loan portfolio relative to fiscal 2007.

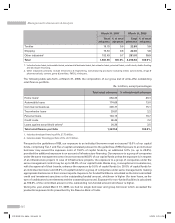

Total assets increased by 16.0% to Rs. 3,997.95 billion at year-end fiscal 2008 from Rs. 3,446.58 billion at year-end

fiscal 2007 primarily due to an increase in advances by 15.2% and an increase in investments by 22.1%.

During the year, we made a follow-on public offering of equity shares in India and an issuance of American

Depository Shares (ADSs) aggregating to Rs. 199.67 billion.

The Sangli Bank Limited (Sangli Bank) was amalgamated with ICICI Bank with effect from April 19, 2007 in

terms of the scheme of amalgamation approved by Reserve Bank of India (RBI) vide its order DBOD No. PSBD

10268/16.01.128/2006-07 dated April 18, 2007 under section 44A (4) of the Banking Regulation Act, 1949. Sangli

Bank was a banking company incorporated under the Companies Act, 1956 and licensed by RBI under the Banking

Regulation Act, 1949. The consideration for the amalgamation was 100 equity shares of ICICI Bank of face value

Rs. 10 each fully paid-up for every 925 equity shares of face value of Rs. 10 each of Sangli Bank. Accordingly,

on May 28, 2007, ICICI Bank allotted 3,455,008 equity shares of Rs. 10 each, credited as fully paid up, to the

shareholders of Sangli Bank. The excess of the paid-up value of the shares issued over the fair value of the net

assets acquired (including reserves) of Rs. 3.26 billion and amalgamation expenses of Rs. 0.22 billion have been

deducted from the securities premium account.

Annual Report 2007-2008 49

ICICI BANK_(Fin_Matter 1-64).ind49 49ICICI BANK_(Fin_Matter 1-64).ind49 49 6/20/08 5:03:11 PM6/20/08 5:03:11 PM