ICICI Bank 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F63

l In case of general insurance business, premium is recorded for the policy period at the commencement of risk and

for instalment cases, it is recorded on instalment due dates. Premium earned is recognised as income over the period

of risk or the contract period based on 1/365 method, whichever is appropriate, on a gross basis, net of service tax.

Any subsequent revision to premium is recognised over the remaining period of risk or contract period. Adjustments

to premium income arising on cancellation of policies are recognised in the period in which the policies are cancelled.

Commission on re-insurance business is recognised as income in the period of ceding the risk. Profit commission

under reinsurance treaties, wherever applicable, is recognised as income in the period of determination of profits and

combined with commission on reinsurance ceded.

l In case of general insurance business, insurance premium on ceding of the risk is recognised in the period in which the

risk commences. Any subsequent revision to premium ceded is recognised in the period of such revision. Adjustment

to reinsurance premium arising on cancellation of policies is recognised in the period in which it is cancelled. In case

of life insurance business, cost of reinsurance ceded is accounted for at the time of recognition of premium income

in accordance with the treaty or in-principle arrangement with the reinsurer. Profit commission on reinsurance ceded

is netted off against premium ceded on reinsurance.

l In case of general insurance business, premium deficiency is recognised when the sum of expected claim costs and

related expenses exceed the reserve for unexpired risks and is computed at a business segment level.

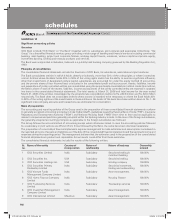

3. Stock based compensation

The following entities within the group have granted stock options to their employees.

l ICICI Bank Limited

l ICICI Prudential Life Insurance Company Limited

l ICICI Lombard General Insurance Company Limited

l ICICI Securities Limited.

The Employee Stock Option Scheme (“the Scheme”) of ICICI Bank Limited provides for grant of equity shares of the Bank to

wholetime directors and employees of the Bank and its subsidiaries. The Scheme provides that employees are granted an

option to acquire equity shares of the Bank that vests in a graded manner. The options may be exercised within a specified

period. ICICI Prudential Life Insurance Company Limited and ICICI Lombard General Insurance Company Limited have also

formulated similar stock option schemes for their employees. ICICI Securities Limited has approved an Employees Stock

Option Scheme for its employees.

The Group follows the intrinsic value method to account for its stock-based employee’s compensation plans. Compensation

cost is measured as the excess, if any, of the fair market price of the underlying stock over the exercise price. The fair market

price is the latest closing price, immediately prior to the date of the Board of Directors meeting in which the options are

granted, on the stock exchange on which the shares of the Bank are listed. If the shares are listed on more than one stock

exchange, then the stock exchange where there is highest trading volume on the said date shall be considered. In case of

ICICI Prudential Life Insurance Company Limited, ICICI Lombard General Insurance Company Limited and ICICI Securities

Limited, the fair value of the shares is determined based on an external valuation report.

Since the exercise price of the Bank’s stock options is equal to the fair value price there is no compensation cost under the

intrinsic value method.

The Group’s venture capital subsidiary i.e. ICICI Venture Funds Management Company Limited settled carried interest trusts

for the benefit of its employees. These trusts have investment in a separate class of units of certain fully consolidated funds.

These carried interest entitlements are treated as employee compensation and are accounted for at the time of granting

of the awards by the trust to the employees. The liability is re-measured at each reporting date and the carried interest

entitlements are recognised as expense in the period of realisation of proceeds from the underlying investments of the

funds.

The Finance Act, 2007 introduced Fringe Benefit Tax (“FBT”) on employee stock options. The FBT liability crystallises on

the date of exercise of stock options by employees and is computed on the difference between fair market value on date

of vesting and the exercise price. FBT is recovered from employees as per the Scheme.

4. Income taxes

Income tax expense is the aggregate amount of current tax, deferred tax and fringe benefit tax borne by the bank. Current

year taxes are determined in accordance with the Income Tax Act, 1961. Deferred tax adjustments comprise of changes in

the deferred tax assets or liabilities during the period.

Deferred tax assets and liabilities are recognised on a prudent basis for the future tax consequences of timing differences

arising between the carrying values of assets and liabilities and their respective tax basis, and carry forward losses. Deferred

tax assets and liabilities are measured using tax rates and tax laws that have been enacted or substantively enacted at

the balance sheet date. The impact of changes in the deferred tax assets and liabilities is recognised in the profit and loss

account.

Deferred tax assets are recognised and reassessed at each reporting date, based upon management’s judgement as to

whether their realisation is considered certain.

forming part of the Consolidated Accounts (Contd.)

schedules

ICICI_BK_AR_2008_(F47_F92).indd 63ICICI_BK_AR_2008_(F47_F92).indd 63 6/20/08 3:32:08 PM6/20/08 3:32:08 PM