ICICI Bank 2008 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F76

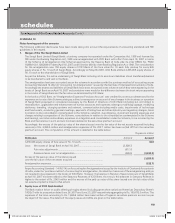

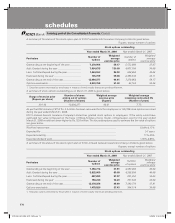

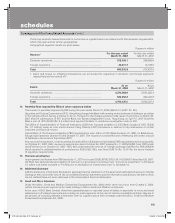

7.3 Maturity profile of present value of lease rentals

The details of maturity profile of present value of finance lease receipts are given below.

Rupees in million

Period As on March 31, 2008 As on March 31, 2007

Not later than one year ........................................................................ 193.0 282.6

Later than one year and not later than five years ................................ 132.6 266.2

Later than five years ............................................................................. ——

Total ..................................................................................................... 325.6 548.8

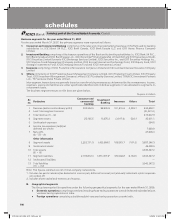

8. Early retirement option (“ERO”)

The Bank had implemented in July 2003 an Early Retirement Option Scheme 2003 for its employees. All employees who had

completed 40 years of age and seven years of service with the Bank (including period of service with entities amalgamated

with the Bank) were eligible for the ERO.

The ex-gratia payments under ERO, termination benefits and leave encashment in excess of the provision made (net of tax

benefits), aggregating to Rs. 1,910.0 million is being amortised over a period of five years commencing August 1, 2003 (the

date of retirement of employees exercising the option being July 31, 2003).

On account of the above ERO scheme, an amount of Rs. 384.0 million (March 31, 2007: Rs. 384.0 million) has been charged

to revenue being the proportionate amount amortised for the year ended March 31, 2008.

9. Preference shares

Certain government securities amounting to Rs. 2,331.8 million (March 31, 2007: Rs. 2,104.8 million) have been earmarked

against redemption of preference share capital, which falls due for redemption on April 20, 2018, as per the original issue

terms.

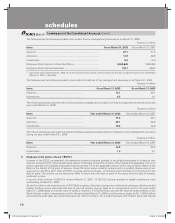

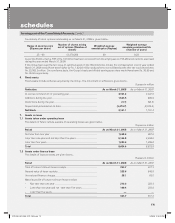

10. Staff retirement benefits

Reconciliation of opening and closing balance of the present value of the defined benefit obligation for pension and gratuity

benefits of the Group is given below.

Rupees in million

Particulars Year ended March 31, 2008 Year ended March 31, 2007

Pension Gratuity Pension Gratuity

Defined benefit obligation liability

Opening obligations ...................................................... 1,029.4 1,352.2 1,038.5 1,116.2

Add: Addition due to amalgamation ............................. 1,807.4 506.6 ——

Service cost ................................................................... 54.0 384.9 6.7 292.3

Interest cost .................................................................. 230.7 153.6 78.0 83.2

Actuarial (gain)/loss ....................................................... (172.3) (32.9) (28.2) (43.4)

Past service cost ........................................................... — 115.5 ——

Transitional obligation/(Asset) ....................................... — (0.2)

Liabilities extinguished on settlement .......................... (1,071.0) — (2.3) —

Benefits paid ................................................................. (200.1) (191.2) (63.3) (96.1)

Obligations at the end of the year 1,678.1 2,288.5 1,029.4 1,352.2

forming part of the Consolidated Accounts (Contd.)

schedules

ICICI_BK_AR_2008_(F47_F92).indd 76ICICI_BK_AR_2008_(F47_F92).indd 76 6/20/08 3:32:49 PM6/20/08 3:32:49 PM