ICICI Bank 2008 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F109

market risk management and recommends changes in processes and methodologies for measuring

market risk.

To comply with the home and host country regulatory guidelines and to have independent control groups

there are clear functional separation of:

l Trading i.e. Front Office

l Monitoring & control i.e. Middle Office and

l Settlements.

The scope and nature of risk reporting and/or measurement systems

Reporting

The Bank periodically reports on the various investments and their related risk measures to the senior

management and the committees of the Board. Also, the Bank periodically makes reporting to its various

regulators in compliance with regulatory requirements.

Measurement

The Bank along with its subsidiaries has devised various risk metrics for different products and investments

in line with global best practices. These risk metrics are measured and reported to the senior management

independently by TMOG. Some of the risk metrics adopted by the Bank for monitoring its risks are Value-

at-Risk, Duration of Equity (DoE), Modified Duration / PV01, Stop Loss, amongst others. Based on the

risk appetite of the Bank, limits are placed on the risk metrics which is monitored on a periodic basis.

Hedging & mitigation

Limits on positions that can be maintained are laid out in the relevant policies. All business groups are

required to operate within these limits.

Hedge transactions for banking book transactions are periodically assessed for hedge effectiveness as

per home and host country financial guidelines.

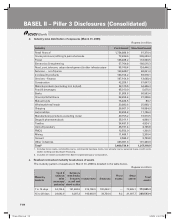

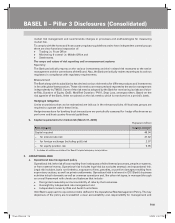

b. Capital requirements for market risk (March 31, 2008)

Rupees in billion

Risk category Capital charge1

Capital required 49.94

– for interest rate risk 37.92

– for foreign exchange (including gold) risk 2.97

– for equity position risk 9.05

1. Includes all entities considered for Basel II capital adequacy computation.

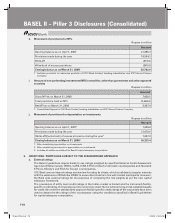

9. OPERATIONAL RISK

a. Operational risk management policy

Operational risk is the risk of loss resulting from inadequate or failed internal processes, people or systems,

or from external events. Operational risk includes legal risk but excludes strategic and reputational risk.

Legal risk includes, but is not limited to, exposure to fines, penalties, or punitive damages resulting from

supervisory actions, as well as private settlements. Operational risk is inherent in ICICI Bank’s business

activities in both domestic as well as overseas operations and, like other risk types, is managed through

an overall framework with checks and balances that include:

l Recognized ownership and accountability of risks by the businesses

l Oversight by independent risk management and

l Independent review by Risk and Audit Committees.

ICICI Bank’s approach to operational risk is defined in the Operational Risk Management Policy. The key

objectives of the policy are to establish a clear accountability and responsibility for management and

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 1091P-less_(Pillar).indd 109 6/20/08 4:53:17 PM6/20/08 4:53:17 PM