ICICI Bank 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F58

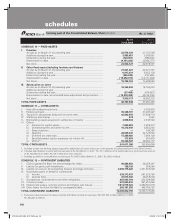

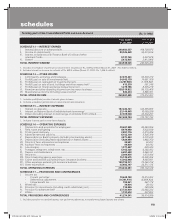

SCHEDULE 10 — FIXED ASSETS

I. Premises

At cost as on March 31 of preceding year ................................................. 23,574,338 21,157,589

Additions during the year ............................................................................ 3,985,851 3,306,091

Deductions during the year ......................................................................... (324,857) (889,342)

Depreciation to date ................................................................................... (4,181,205) (3,054,777)

Net block ..................................................................................................... 23,054,127 20,519,561

II. Other fixed assets (including furniture and fixtures)

At cost as on March 31 of preceding year ................................................. 27,621,021 22,521,357

Additions during the year ............................................................................ 6,917,431 5,832,130

Deductions during the year ......................................................................... (686,835) (732,466)

Depreciation to date ................................................................................... (18,092,913) (14,771,468)

Net block ..................................................................................................... 15,758,704 12,849,553

III. Assets given on Lease

At cost as on March 31 of preceding year ................................................. 18,346,532 19,165,523

Additions during the year ............................................................................ — —

Deductions during the year ......................................................................... (57,460) (818,991)

Depreciation to date, accumulated lease adjustment and provisions ....... (10,318,355) (8,314,159)

Net block ..................................................................................................... 7,970,717 10,032,373

TOTAL FIXED ASSETS ..................................................................................... 46,783,548 43,401,487

SCHEDULE 11 — OTHER ASSETS

I. Inter-office adjustments (net) ...................................................................... — 3,762,923

II. Interest accrued .......................................................................................... 39,368,197 31,972,407

III. Tax paid in advance/tax deducted at source (net) ...................................... 42,802,815 37,839,774

IV. Stationery and stamps ................................................................................ 574 1,552

V. Non-banking assets acquired in satisfaction of claims1 ............................ 3,658,544 3,536,564

VI. Others

a) Advance for capital assets .................................................................. 7,060,893 2,410,477

b) Outstanding fees and other income ................................................... 10,212,038 4,852,253

c) Swap suspense ................................................................................... — 168,266

d) Deposits .............................................................................................. 28,665,435 32,125,652

e) Deferred tax asset (net) ....................................................................... 17,280,466 7,659,104

f) Early Retirement Option expenses not written off ............................. 117,979 501,979

g) Others 2,3 .............................................................................................. 92,444,325 58,062,137

TOTAL OTHER ASSETS .................................................................................... 241,611,266 182,893,088

1. Includes certain non-banking assets acquired in satisfaction of claims which are in the process of being transferred in the Bank’s name.

2. Includes debit balance in profit and loss account of Rs. Nil (March 31, 2007: Rs. 73.7 million) net of credit balance in profit and loss account

of Rs. Nil (March 31, 2007: Rs. 88.7 million) for joint ventures.

3. Includes goodwill on consolidation amounting to Rs. 630.5 million (March 31, 2007: Rs. 624.0 million).

SCHEDULE 12 — CONTINGENT LIABILITIES

I. Claims against the Bank not acknowledged as debts ................................ 40,886,452 39,265,351

II. Liability for partly paid investments ............................................................ 128,126 254,249

III. Liability on account of outstanding forward exchange contracts .............. 3,090,775,426 1,341,835,648

IV. Guarantees given on behalf of constituents

a) In India ................................................................................................. 338,313,937 241,625,700

b) Outside India ....................................................................................... 76,613,035 58,018,630

V. Acceptances, endorsements and other obligations ................................... 252,963,794 233,328,898

VI. Currency swaps .......................................................................................... 591,090,810 391,431,046

VII. Interest rate swaps, currency options and interest rate futures1 ............... 7,913,019,024 3,984,601,670

VIII. Other items for which the Bank is contingently liable ................................ 202,161,555 445,755,763

TOTAL CONTINGENT LIABILITIES .................................................................. 12,505,952,159 6,736,116,955

1. Excludes notional amount of options sold by ICICI Bank Limited amounting to Rs. 597,333.2 million (March 31,2007:

Rs. 444,221.2 million).

schedules

(Rs. in ‘000s)

forming part of the Consolidated Balance Sheet (Contd.)

As on As on

31.03.2008 31.03.2007

ICICI_BK_AR_2008_(F47_F92).indd 58ICICI_BK_AR_2008_(F47_F92).indd 58 6/20/08 3:31:51 PM6/20/08 3:31:51 PM