ICICI Bank 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Towards a better life

On the basis of the recommendation of the Board Governance & Remuneration Committee, the Board at

its meeting held on April 26, 2008 approved a grant of approximately 5.6 million options for fiscal 2008

to eligible employees and wholetime Directors. Each option confers on the employee a right to apply for

one equity share of face value of Rs. 10 of ICICI Bank at Rs. 915.65, which was the last closing price on the

stock exchange, which recorded the highest trading volume in ICICI Bank shares on April 25, 2008.

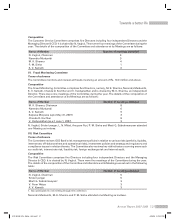

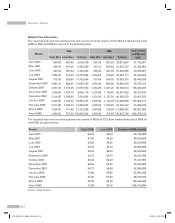

Particulars of options granted by ICICI Bank upto April 26, 2008 are given below:

Options granted 50,918,4551

Options vested 27,227,624

Options exercised 23,726,081

Number of shares allotted pursuant to exercise of options 23,726,081

Options forfeited/lapsed 6,013,919

Extinguishment or modification of options Nil

Amount realised by exercise of options (Rs.) 4,498,141,120

Total number of options in force 21,178,4551

1. Includes 825,000 options granted to wholetime Directors for fiscal 2008, pending RBI approval.

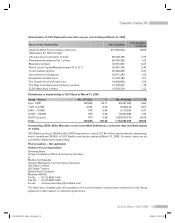

Options granted by ICICI Bank to senior managerial personnel for fiscal 2008 are as follows: K. V. Kamath

– 270,000, Chanda D. Kochhar - 180,000, V. Vaidyanathan - 125,000, Madhabi Puri Buch – 125,000, Sonjoy

Chatterjee – 125,000, K. Ramkumar – 125,000, and Pravir Vohra – 125,000. No employee was granted

options during any one year equal to or exceeding 0.05% of the issued equity shares of ICICI Bank at the

time of the grant.

The diluted earnings per share (EPS) pursuant to issue of shares on exercise of options calculated in

accordance with AS-20 was Rs. 39.15 in fiscal 2008 against basic EPS of Rs. 39.39. Since the exercise

price of ICICI Bank’s options is the last closing price on the stock exchange, which recorded the highest

trading volume preceding the date of grant of options, there is no compensation cost in fiscal 2008 based

on the intrinsic value of options. However, if ICICI Bank had used the fair value of options based on the

Black-Scholes model, compensation cost in fiscal 2008 would have been higher by Rs. 1,259.9 million and

proforma profit after tax would have been Rs. 40.32 billion. On a proforma basis, ICICI Bank’s basic and

diluted earnings per share would have been Rs. 38.19 and Rs. 37.96, respectively. The key assumptions

used to estimate the fair value of options are:

Risk-free interest rate 7.12% – 8.11%

Expected life 2 – 6 years

Expected volatility 36.26% – 38.01%

Expected dividend yield 1.07%

In respect of options granted in fiscal 2008, the weighted average exercise price of the options and

the weighted average fair value of the options were Rs. 938.41 per option and Rs. 376.39 per option

respectively.

Annual Report 2007-2008 31

ICICI BANK_(Fin_Matter 1-64).ind31 31ICICI BANK_(Fin_Matter 1-64).ind31 31 6/20/08 5:03:06 PM6/20/08 5:03:06 PM