ICICI Bank 2008 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F107

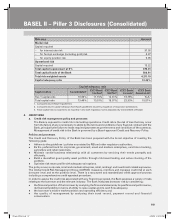

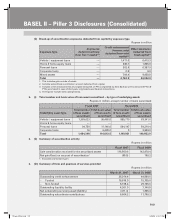

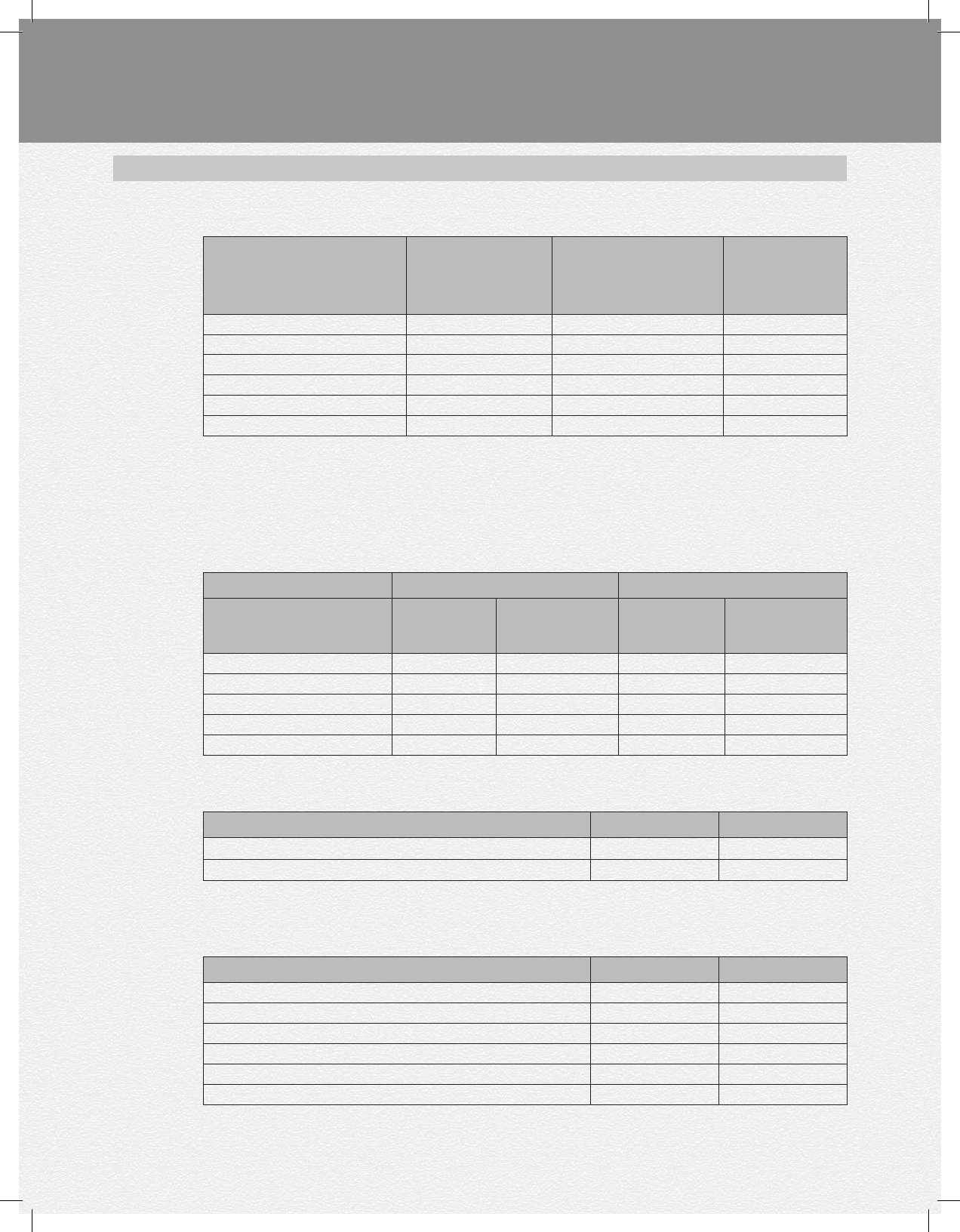

(ii) Break-up of securitisation exposures deducted from capital by exposure type

Rupees in million

Exposure type

Exposures

deducted entirely

from Tier-1 capital1,4

Credit enhancement

(interest only)

deducted from total

capital2,4

Other exposures

deducted from

total capital3,4

Vehicle / equipment loans — 1,417.0 6,419.3

Home & home equity loans — 338.7 1,855.9

Personal loans — 302.9 6,357.9

Corporate loans — 0.0 0.0

Mixed assets — 704.4 9,458.8

Total — 2,762.9 24,092.0

1. This includes gain on sale of assets.

2. Includes subordinate contribution amount deducted from capital.

3. Includes credit enhancements and capital deducted on PTCs originated by ICICI Bank as well as devolved PTCs &

PTCs purchased in case of third party originated securitisation transactions.

4. The figures exclude direct assignments.

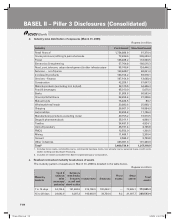

h. (i) Total number and book value of loan assets securitised – by type of underlying assets

Rupees in million, except number of loans securitised

Fiscal 2007 Fiscal 2008

Underlying asset type Total number

of loan assets

securitised

Total book value

of loan assets

securitised

Total number

of loan assets

securitised

Total book value

of loan assets

securitised

Vehicle / equipment loans 1,389,623 95,466.0 585,779 83,341.6

Home & home equity loans — — — —

Personal loans 94,759 11,146.6 564,147 54,210.4

Corporate loans 16 9,400.0 5 3,300.0

Total 1,484,398 116,012.5 1,149,931 140,852.0

h. (ii) Summary of securitisation activity

Rupees in million

Fiscal 2007 Fiscal 2008

Sale consideration received for the securitised assets 116,500.6 142,470.4

Net gain/(loss) on account of securitisation1(65.5) 168.2

1. Excludes unamortized gain.

h. (iii) Summary of form and quantum of services provided

Rupees in million

March 31, 2007 March 31, 2008

Outstanding credit enhancement 25,014.4 44,860.6

– Funded 16,816.0 15,705.0

– Non-funded 8,198.4 29,155.6

Outstanding liquidity facility 4,361.0 7,740.8

Net outstanding servicing asset/(liability) (371.4) 1,355.4

Outstanding subordinate contributions 8,604.2 11,798.2

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 1071P-less_(Pillar).indd 107 6/20/08 4:53:11 PM6/20/08 4:53:11 PM