ICICI Bank 2008 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

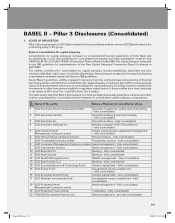

F94

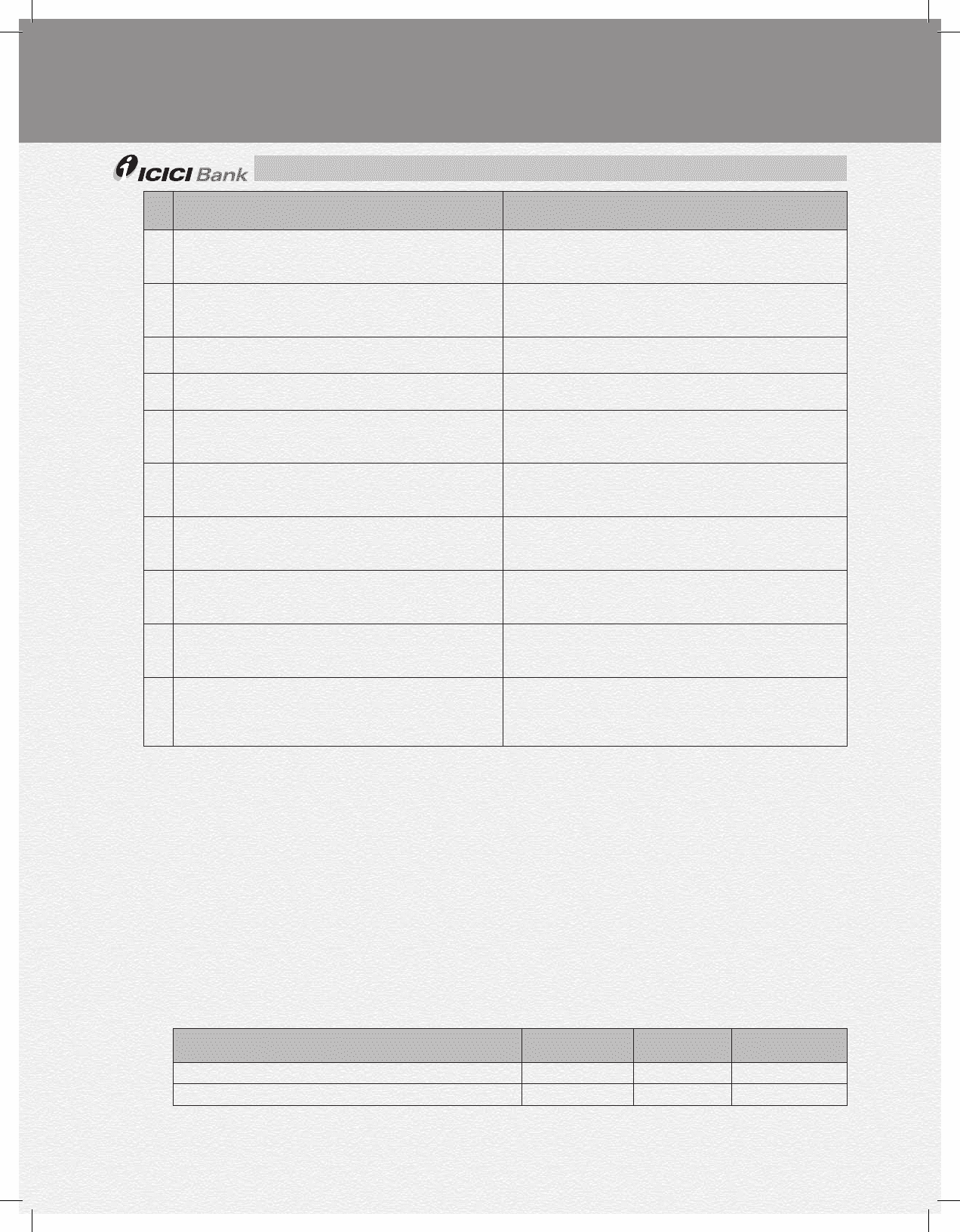

Sr.

No. Name of the entity Nature of business & consolidation status

21 ICICI Prudential Life Insurance Company Limited Life insurance – consolidated for financial

reporting but not for capital adequacy and

deducted from capital for capital adequacy

22 ICICI Lombard General Insurance

Company Limited General Insurance – consolidated for financial

reporting but not for capital adequacy and

deducted from capital for capital adequacy

23 ICICI Venture Value Fund1Unregistered venture capital fund – consolidated

by equity method

24 TSI Ventures (India) Private Limited Real estate consultancy – consolidated for

financial reporting but not for capital adequacy

25 ICICI Kinfra Limited Infrastructure development consultancy

– consolidated for financial reporting but not for

capital adequacy

26 ICICI West Bengal Infrastructure

Development Corporation Limited Infrastructure development consultancy

– consolidated for financial reporting but not for

capital adequacy

27 Financial Information Network and

Operations Limited Service provider – consolidated by equity method

for financial reporting but not consolidated for

capital adequacy

28 I-Process Services (India) Private Limited Service provider – consolidated by equity method

for financial reporting but not consolidated for

capital adequacy

29 I-Solutions Providers (India) Private Limited Service provider – consolidated by equity method

for financial reporting but not consolidated for

capital adequacy

30 NIIT Institute of Finance, Banking and

Insurance Training Limited Education and training in banking and finance

– consolidated by equity method for financial

reporting but not consolidated for capital

adequacy

1. Consolidating entities under Accounting Standard 21

a. Capital deficiencies

Majority owned financial entities that are not consolidated for capital adequacy purposes and for which

the investment in equity and other instruments eligible for regulatory capital status is deducted from

capital, meet their respective regulatory capital requirements at all times. There is no deficiency in capital

in any of the subsidiaries of the Bank as on March 31, 2008. ICICI Bank maintains an active oversight

on all its subsidiaries through their respective Boards and regular updates to the Board of ICICI Bank.

On a quarterly basis the capital adequacy position of subsidiaries (banking, non-banking & insurance

subsidiaries), as per applicable regulations, is reported to their respective Boards as well as to the Board

of the Bank.

b. Bank’s interest in insurance entities

The book value of the Bank’s total interest in its insurance subsidiaries, which is deducted from capital

for capital adequacy under Basel II is detailed in the table below.

Rupees in million

Name of the entity Country of

incorporation Ownership

interest Book value of

investment

ICICI Prudential Life Insurance Company Limited India 73.87% 27,819.0

ICICI Lombard General Insurance Company Limited India 73.83% 7,170.6

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 941P-less_(Pillar).indd 94 6/20/08 4:52:24 PM6/20/08 4:52:24 PM