ICICI Bank 2008 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F98

The Bank evaluates industry risk by considering:

l certain industry characteristics, such as the importance of the industry to the economy, its growth outlook,

cyclicality and government policies relating to the industry.

l the competitiveness of the industry and

l certain industry financials, including return on capital employed, operating margins and earnings

stability.

Credit approval authorities

The Board of Directors has delegated the authority to the Credit Committee, consisting of a majority of

independent Directors, the Committee of Directors (COD), consisting of whole time Directors, the Committee

of Executives-Credit, the Regional Committee-Credit, Retail Credit Forums, Small Enterprise Group Forums

and Agri Credit Forums, all consisting of designated executives, and to individual executives in the case

of program / policy based products, to approve financial assistance within certain individual and group

exposure limits set by our Board of Directors. The authorization is based on the level of risk. The delegation

of structure has been designed to ensure that the transactions with higher exposure and level of risk are put

up to correspondingly higher forum / committee for approval.

In respect of retail loans, ICICI Bank’s credit officers evaluate credit proposals on the basis of the product

policy approved by the Retail Credit Forum and the risk assessment criteria defined by the GCRMG. These

criteria vary across product segments but typically include factors such as the borrower’s income, the loan-

to-value ratio, demographic parameters and certain stability factors.

The risk assessment for small enterprises involves identification of appropriate credit norms for the concerned

market segment and use of scoring models for enterprises that satisfy these norms.

Structure and organisation of the credit risk management function

The Bank has adopted a framework for risk management, including setting up of an independent Global

Risk Management Group (GRMG) which ensures that the requirements for effective management of key

risks such as credit, market, liquidity and operational risks are addressed in the Bank’s policies, procedures

and operating instructions and has separate focussed groups to carry out credit, market and operational risk

analysis of each portfolio within various business groups (corporate, retail, small enterprises, agriculture,

banks and financial institutions). GRMG is responsible for formulating policies, risk evaluation methodologies,

assigning internal ratings and reporting to the senior management. The head of GRMG reports to the Joint

Managing Director and Chief Financial Officer (JMD & CFO) of ICICI Bank.

The subsidiaries of the Bank have also established appropriate structures to ensure adequate risk management,

factoring in the risks particular to the respective businesses and the regulatory and statutory guidelines. The

Bank also has in place a Group Risk Management Framework which forms the basis of developing consistent

risk principles across the group. The objective of this framework is to ensure that the risk management

principles are uniform across the parent and the various overseas banking subsidiaries.

Reporting and measurement

Credit exposure for ICICI Bank is measured & monitored using a centralized exposure management system.

The analysis of the composition of the portfolio is presented to the Risk Committee on a quarterly basis.

ICICI Bank complies with the norms on exposure stipulated by RBI for both single borrower as well as borrower

group at the consolidated level. Limits have been set by the risk management group as a percentage of

the Bank’s consolidated capital funds and are regularly monitored. The utilization against specified limits is

reported to the COD and Credit Committee on a periodic basis.

Definition and classification of non-performing assets (NPA)

The Bank classifies its advances (loans and debentures in the nature of an advance) into performing and

non-performing loans (NPL) in accordance with the extant RBI guidelines.

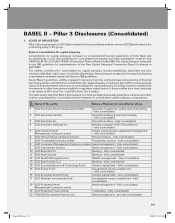

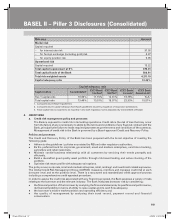

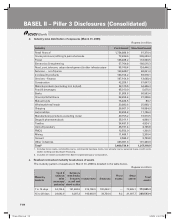

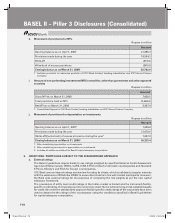

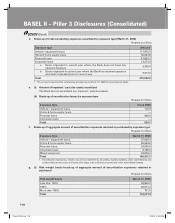

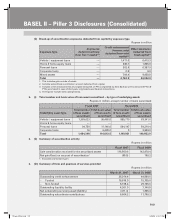

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 981P-less_(Pillar).indd 98 6/20/08 4:52:40 PM6/20/08 4:52:40 PM