ICICI Bank 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F28

schedules

forming part of the Accounts (Contd.)

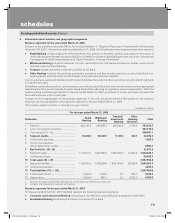

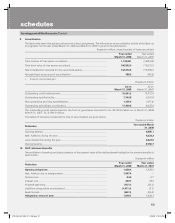

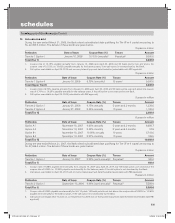

Particulars Year ended

March 31, 2008

Year ended

March 31, 2007

Opening plan assets, at fair value .................................................................... 988.5 1,079.5

Add: Addition due to amalgamation ................................................................... 584.8 —

Expected return on plan assets .......................................................................... 115.8 78.9

Actuarial gain/(loss) ............................................................................................. (118.0) (110.1)

Assets distributed on settlement ....................................................................... (1,145.2) (2.3)

Contributions ....................................................................................................... 1,264.3 5.8

Benefits paid ....................................................................................................... (200.1) (63.3)

Closing plan assets, at fair value ...................................................................... 1,490.1 988.5

Fair value of plan assets at the end of the year .................................................. 1,490.1 988.5

Present value of the defined benefit obligations at the end of the year ............ 1,678.1 1,029.4

Asset/(liability) .................................................................................................. (188.0) (40.9)

Cost for the year

Service cost ......................................................................................................... 54.0 6.7

Interest cost ........................................................................................................ 230.7 78.0

Expected return on plan assets .......................................................................... (115.8) (78.9)

Actuarial (gain)/loss ............................................................................................. (54.3) 81.9

Curtailments & settlements (gain)/loss ............................................................... 74.2 —

Net cost .............................................................................................................. 188.8 87.7

Investment details of plan assets

Majority of the plan assets are invested in Government securities and corporate bonds.

Assumptions

Interest rate ......................................................................................................... 8.57% 8.35%

Salary escalation rate .......................................................................................... 7.00% 7.00%

Estimated rate of return on plan assets ............................................................. 8.00% 7.50%

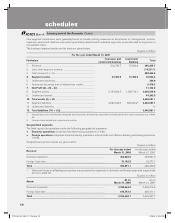

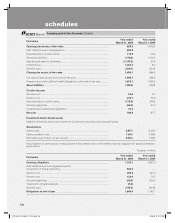

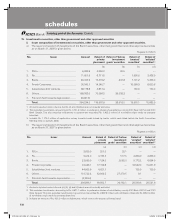

Reconciliation of opening and closing balance of the present value of the defined benefit obligation for gratuity benefits is

given below:

Rupees in million

Particulars Year ended

March 31, 2008

Year ended

March 31, 2007

Opening obligations .......................................................................................... 1,142.1 1,001.0

Add: Addition due to amalgamation/initial

recognition of foreign branches.......................................................................... 506.6 —

Service cost ......................................................................................................... 292.8 221.0

Interest cost ........................................................................................................ 136.4 75.5

Actuarial (gain)/loss ............................................................................................. (62.0) (63.6)

Transitional obligation/(Asset) ............................................................................. (0.2) —

Benefits paid (175.3) (91.8)

Obligations at end of year ................................................................................ 1,840.4 1,142.1

ICICI_BK_AR_2008_(F1_F46).indd 28ICICI_BK_AR_2008_(F1_F46).indd 28 6/20/08 3:25:19 PM6/20/08 3:25:19 PM