ICICI Bank 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F18

schedules

forming part of the Accounts (Contd.)

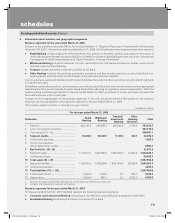

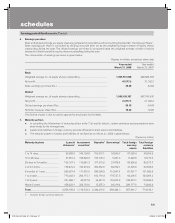

3. Capital adequacy ratio

The Bank is subject to the capital adequacy norms stipulated by the Reserve Bank of India (‘RBI’). As per the earlier

applicable capital adequacy guidelines (Basel I), the Bank was required to maintain a minimum ratio of total capital to risk

adjusted assets and off-balance sheet items of 9.0%, at least half of which must be Tier I capital. On April 27, 2007, the

Reserve Bank of India issued Prudential Guidelines on Capital Adequacy and Market Discipline - Implementation of the

New Capital Adequacy Framework, which are applicable to all Indian banks having operational presence outside India from

March 31, 2008. Under the new guidelines (Basel II), which are now applicable to the Bank, the Bank is required to maintain

a minimum ratio of total capital to risk adjusted assets of 9.0%, with a minimum Tier I capital ratio of 6.0%.

In order to comply with prudential floor prescribed by RBI under the new guidelines (100% of minimum capital requirement

computed as per Basel I framework as on March 31, 2008), the Bank has computed and reported the capital adequacy

position as per Basel I and Basel II norms. Since the capital charge as per the new capital adequacy framework (Basel II) is

higher than the Basel I framework, the Bank has maintained capital as per Basel II norms.

Rupees in million

As per Basel I framework As per Basel II

framework

As on

March 31, 2008 As on

March 31, 2007 As on

March 31, 2008

Tier I capital .......................................................................... 381,340.1 215,033.4 421,724.0

(of which Lower Tier I).......................................................... 26,573.4 22,577.9 26,573.4

Tier II capital ......................................................................... 121,212.1 123,928.5 78,861.0

(of which Upper Tier II) ......................................................... 24,510.0 20,012.5 24,510.0

Total capital .......................................................................... 502,552.2 338,961.9 500,585.0

Total risk weighted assets ................................................... 3,367,547.0 2,899,930.6 3,584,566.2

CRAR (%) ............................................................................. 14.92% 11.69% 13.97%

CRAR – Tier I capital (%) ...................................................... 11.32% 7.42% 11.76%

CRAR – Tier II capital (%) ..................................................... 3.60% 4.27% 2.20%

Amount of subordinated debt raised as

Tier I capital/Tier II capital during the year ........................... 22,350.0 64,903.5 22,350.0

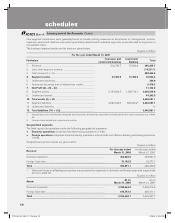

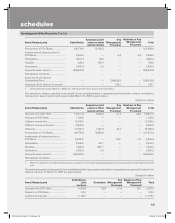

4. Business/information ratios

The business/information ratios for the year ended March 31, 2008 and March 31, 2007 are given in the table below:

Year ended

March 31, 2008 Year ended

March 31, 2007

(i) Interest income to working funds1, 4 ............................................................. 8.29% 7.69%

(ii) Non-interest income to working funds1, 4 ..................................................... 2.37% 2.42%

(iii) Operating profit to working funds1, 4 ............................................................. 2.14% 2.05%

(iv) Return on assets2 ....................................................................................... 1.12% 1.09%

(v) Profit per employee (Rs. in million) ............................................................... 1.0 0.9

(vi) Business per employee (average deposits plus average advances)3

(Rs. in million) ................................................................................................ 100.8 102.7

1. For the purpose of computing the ratios, working funds represent the average of total assets as reported to RBI under Section 27 of

the Banking Regulation Act, 1949.

2. For the purpose of computing the ratio, assets represent average total assets as reported to RBI in Form X under Section 27 of the

Banking Regulation Act, 1949.

3. For the purpose of computing the ratio, deposits and advances are the total deposits and total advances as reported to RBI in Form A

under Section 27 of the Banking Regulation Act, 1949. The average deposits and the average advances represent the simple average

of the figures reported in Form A to RBI under Section 27 of the Banking Regulation Act, 1949.

4. Previous year figures have been regrouped/re-classified to compare with current year classification.

ICICI_BK_AR_2008_(F1_F46).indd 18ICICI_BK_AR_2008_(F1_F46).indd 18 6/20/08 3:24:48 PM6/20/08 3:24:48 PM