ICICI Bank 2008 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F90

v) Un-realised loss/(gain) on trading portfolio of participating funds

Under Indian GAAP, accounting for investments is in accordance with the guidelines issued by the Insurance

Regulatory and Development Authority, which do not allow the unrealised gain to be routed through the

revenue account except in the case of linked businesses. Under US GAAP, as per the requirements of

Statement No. 115 on “Accounting for Certain Investments in Debt and Equity Securities” unrealised loss/(gain)

on investments classified as held for trading is taken to the revenue account.

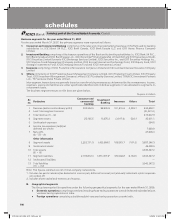

The details of the significant differences between Indian GAAP and US GAAP for the general insurance

subsidiary are given below:

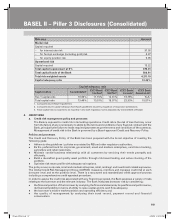

Rupees in million

Reconciling items Year ended March 31,

2006 2007 2008

Profit as per Indian GAAP ............................................................ 503 684 1,029

Adjustments on account of:

Provision for re-insurance commission ......................................... (480) (1,304) (956)

Amortisation of deferred acquisition costs ................................... 423 931 420

Premium deficiency ....................................................................... (87) (215) 341

Compensation costs ...................................................................... — (39) (46)

Deferred taxes ................................................................................ 55 211 79

Others ............................................................................................ (19) — 8

Profit as per US GAAP .................................................................. 395 268 875

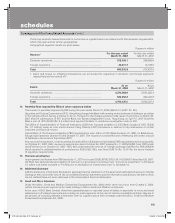

The aforesaid differences in respect of our general insurance subsidiary are described below:

i) Provision for re-insurance commission

Under Indian GAAP in the absence of any specific guidance, re-insurance commission on business

ceded is recognised as income in the year of the ceding of the risk. Under US GAAP, proceeds from

re-insurance transactions that represent recovery of acquisition costs are reduced from un-amortised

acquisition costs in such a manner that net acquisition costs are capitalised and charged to expense in

proportion to net revenue recognised.

ii) Amortisation of deferred acquisition costs

Under Indian GAAP, acquisition cost is charged as expense to the revenue account in the year in which

it is incurred whereas under US GAAP the same is capitalised and charged to expense in proportion to

premium revenue recognised.

iii) Premium deficiency

Under Indian GAAP, premium deficiency is recognised if the sum of the expected claims costs, related

expenses and maintenance costs exceeds related unearned premiums. Indian regulations require

assessment and recognition of premium deficiency under “Fire”, “Marine” and “Miscellaneous” segments

of business and not under each line of businesses in the revenue account. Under US GAAP, a premium

deficiency relating to short-term insurance contracts indicates a probable loss. A premium deficiency for

each line of business is assessed and recognised in the revenue account if the sum of expected claim

costs and claim adjustment expenses, expected dividends to policyholders, un-amortised acquisition

costs and maintenance costs exceeds related unearned premiums.

A premium deficiency is recognised by first charging un-amortised acquisition costs to expense to

the extent required to eliminate the deficiency. If the premium deficiency is greater than un-amortised

acquisition costs, a liability for the excess deficiency is required to be accrued.

iv) Compensation costs

Under Indian GAAP, stock compensation costs are accounted for by the intrinsic value method as

compared to US GAAP where the compensation costs have been accounted for at the fair value method

in accordance with the requirement of Statement No. 123(R).

d) Valuation of debt and equity securities

Under Indian GAAP, net unrealised gains on investments by category are ignored, except for the venture capital

investments wherein the unrealised gains and losses are transferred to Reserves and Surplus.

Under US GAAP, unrealised gains or losses on trading assets are recognised in the profit and loss account and unrealised

gains or losses on securities classified as ‘available for sale’ are recognised in ‘Accumulated Other Comprehensive

Income’ under stockholders’ equity. Under US GAAP, unrealised gains or losses on investments of venture capital

subsidiaries are recognised in the profit and loss account.

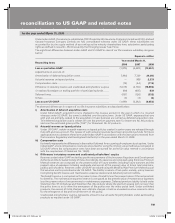

reconciliation to US GAAP and related notes

for the year ended March 31, 2008

ICICI_BK_AR_2008_(F47_F92).indd 90ICICI_BK_AR_2008_(F47_F92).indd 90 6/20/08 3:33:35 PM6/20/08 3:33:35 PM