ICICI Bank 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F22

schedules

forming part of the Accounts (Contd.)

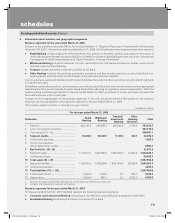

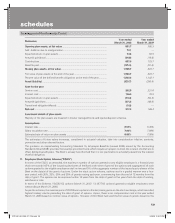

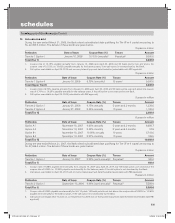

b) The maturity pattern of assets and liabilities of the Bank as on March 31, 2007 is given below:

Rupees in million

Maturity buckets Loans &

Advances1

Investment

securities1

Deposits1Borrowings1Total foreign

currency

assets

Total foreign

currency

liabilities

1 to 14 days ........................... 92,885.1 45,292.9 223,743.2 9,453.3 94,285.0 47,662.5

15 to 28 days ......................... 24,562.0 97,922.7 104,126.2 5,694.1 12,626.0 10,878.7

29 days to 3 months ............. 96,063.1 97,022.5 341,989.9 44,171.4 34,763.7 54,592.9

3 to 6 months ........................ 128,770.4 85,208.4 322,724.8 70,423.4 28,473.7 56,766.2

6 months to 1 year ................ 208,006.2 173,803.9 594,972.4 82,016.6 92,005.7 83,910.9

1 to 3 years ............................ 763,016.1 156,450.4 674,036.1 158,216.9 56,812.0 137,945.8

3 to 5 years ............................ 251,094.3 68,280.5 31,354.7 122,375.6 68,987.5 103,222.6

Above 5 years ........................ 394,258.8 188,597.1 12,154.6 20,209.0 105,876.0 71,292.1

Total ...................................... 1,958,656.0 912,578.4 2,305,101.9 512,560.3 493,829.6 566,271.7

1. Includes foreign currency balances.

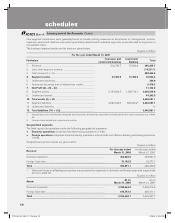

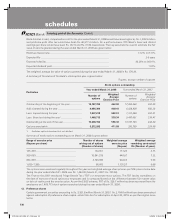

8. Related party transactions

The Bank has transactions with its related parties comprising of subsidiaries, associates/joint ventures/other related entities

and key management personnel.

Subsidiaries

ICICI Venture Funds Management Company Limited, ICICI Securities Primary Dealership Limited, ICICI Securities Limited,

ICICI International Limited, ICICI Trusteeship Services Limited, ICICI Home Finance Company Limited, ICICI Investment

Management Company Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Bank UK PLC, ICICI Bank Canada,

ICICI Prudential Life Insurance Company Limited1, ICICI Lombard General Insurance Company Limited1, ICICI Prudential

Asset Management Company Limited1, ICICI Prudential Trust Limited1, ICICI Bank Eurasia Limited Liability Company and

ICICI Wealth Management Inc.

1. Jointly controlled entities.

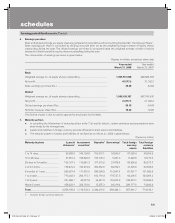

Associates/Joint Ventures/other related entities

ICICI Equity Fund1, ICICI Eco-net Internet and Technology Fund1, ICICI Emerging Sectors Fund1, ICICI Strategic Investments

Fund1, ICICI Kinfra Limited1,2, ICICI West Bengal Infrastructure Development Corporation Limited1,2, ICICI Property Trust,

Financial Information Network and Operations Limited2, TCW/ICICI Investment Partners LLC, TSI Ventures (India) Private

Limited, I-Process Services (India) Private Limited2, I-Solutions Providers (India) Private Limited2, NIIT Institute of Finance,

Banking and Insurance Training Limited2, ICICI Venture Value Fund2, Comm Trade Services Limited2, Loyalty Solutions &

Research Limited2, Café Network Limited2, Traveljini.com Limited2 and Firstsource Solutions Limited2 (Bank’s holding is

24.97% as on March 31, 2008).

1. Entities consolidated under Accounting Standard - 21 (AS-21) on “Consolidated Financial Statements”.

2. With respect to entities, which have been identified as related parties from the financial year ended March 31, 2008, previous year’s

comparative figures have not been reported..

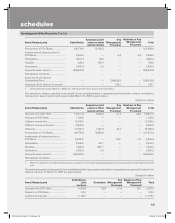

The following are the significant transactions between the Bank and its related parties.

Insurance services

During the year ended March 31, 2008, the Bank paid insurance premium to insurance subsidiaries amounting to

Rs. 1,065.3 million (March 31, 2007: Rs. 1,191.1 million). During the year ended March 31, 2008, the Bank received claims

from insurance subsidiaries amounting to Rs. 713.9 million (March 31, 2007: Rs. 725.4 million).

ICICI_BK_AR_2008_(F1_F46).indd 22ICICI_BK_AR_2008_(F1_F46).indd 22 6/20/08 3:25:00 PM6/20/08 3:25:00 PM