ICICI Bank 2008 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F97

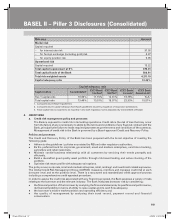

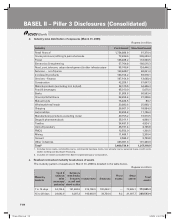

Risk area Amount

Market risk

Capital required

– for interest rate risk 37.92

– for foreign exchange (including gold) risk 2.97

– for equity position risk 9.05

Operational risk

Capital required 15.22

Total capital requirement at 9% 379.01

Total capital funds of the Bank 566.81

Total risk weighted assets 4,211.19

Capital adequacy ratio 13.46%

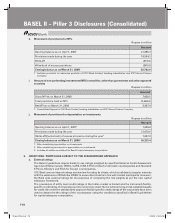

Capital adequacy ratio

Capital ratios Consolidated1ICICI Bank

Limited1ICICI Bank

UK PLC2ICICI Bank

Canada2ICICI Bank

Eurasia LLC2

Tier-1 capital ratio 10.66% 11.76% 12.31% 19.78% N.A.3

Total capital ratio 13.46% 13.97% 18.97% 22.33% 15.57%

1. Computed as per Basel II guidelines

2. Computed as per capital adequacy framework guidelines issued by regulators of respective jurisdictions

3. Total capital ratio is required to be reported in line with regulatory norms stipulated by Central Bank of Russia

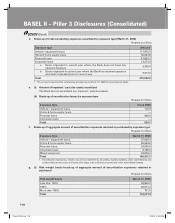

4. CREDIT RISK

a. Credit risk management policy and processes

The Bank is exposed to credit risk in its lending operations. Credit risk is the risk of loss that may occur

from the failure of any counterparty to abide by the terms and conditions of any financial contract with the

Bank, principally the failure to make required payments as per the terms and conditions of the contracts.

Management of credit risk in the Bank is governed by a Board-approved Credit and Recovery Policy.

Policies and processes

The Credit and Recovery Policy of the Bank has been prepared with the broad objective of meeting the

following goals:

l Adhere to the guidelines / policies enunciated by RBI and other regulatory authorities.

l Be the preferred bank for corporate, government, small and medium enterprises, rural/micro banking,

agriculture and retail customers.

l Maintain cordial business relationship with all customers by servicing their needs promptly and

efficiently.

l Build a diversified good quality asset portfolio through risk based lending and active churning of the

portfolio.

l Optimise risk return profile with adequate exit options.

The policy covers corporate, small and medium enterprise, retail, rural/agri and investment related exposures.

The Global Credit Risk Management Group (GCRMG) measures, monitors and manages credit risk at each

borrower level and at the portfolio level. There is a structured and standardized credit approval process

including a comprehensive credit appraisal procedure.

In order to assess the credit risk associated with any financing proposal, the Bank assesses a variety of risks

relating to the borrower and the relevant industry. The Bank evaluates borrower risk by considering:

l the financial position of the borrower by analyzing the financial statements, its past financial performance,

its financial flexibility in terms of ability to raise capital and its cash flow adequacy.

l the borrower’s relative market position and operating efficiency and

l the quality of management by analyzing their track record, payment record and financial

conservatism.

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 971P-less_(Pillar).indd 97 6/20/08 4:52:35 PM6/20/08 4:52:35 PM