ICICI Bank 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14th Annual Report and Accounts 2007-2008

Towards a better life

Cover2008.indd 1Cover2008.indd 1 6/23/08 10:30:49 AM6/23/08 10:30:49 AM

Table of contents

-

Page 1

Towards a better life 14th Annual Report and Accounts 2007-2008 Cover2008.indd 1 6/23/08 10:30:49 AM -

Page 2

...of financial services in India and a major global bank. Mission We will leverage our people, technology, speed and financial capital to: be the banker of first choice for our customers by delivering high quality, world-class products and services. expand the frontiers of our business globally. play... -

Page 3

... Organisational Excellence Management's Discussion and Analysis Key Financial Indicators Particulars of Employees under Section 217 (2A) of the Companies Act, 1956 2 4 6 6 6 7 33 34 45 48 49 64 65 Financials : Auditors' Report Balance Sheet Profit and Loss Account Cash Flow Statement Schedules... -

Page 4

... of living among our people; regional and urban-rural asymmetries in development and economic growth; and the resultant inability of significant portions of our population to participate in our country's extraordinary growth and wealth creation. Indian business must take cognizance of these issues... -

Page 5

... ICICI Group will continue to leverage growth opportunities in India and overseas, seek to make a significant contribution to the integrated development of our country and build a platform for sustained growth that will create value for our stakeholders. N. VAGHUL Chairman Annual Report 2007-2008... -

Page 6

... and globally. Our non-banking businesses, namely insurance, asset management, private equity and securities, continue to sustain their leadership positions. We see robust growth in financial services in India and in the select segments of international markets where we operate. With our capital... -

Page 7

... growth strategy is enhancing, indeed universalising, access to financial services. This implies access not only to credit, but to a basic bank account, transaction capability and risk mitigants like insurance. The ICICI Group, as part of its banking and insurance businesses, is working towards... -

Page 8

... 22, 2007) Senior Management K. Ramkumar Group Chief Human Resources Officer Pravir Vohra Group Chief Technology Officer Sandeep Batra Group Compliance Officer & Company Secretary Board Committees Audit Committee Sridar Iyengar, Chairman Narendra Murkumbi M. K. Sharma Customer Service Committee... -

Page 9

... The Sangli Bank Limited with the Bank. 2. Includes dividend for fiscal 2007 paid on shares issued pursuant to exercise of employee stock options after the balance sheet date and prior to the record date. 3. After taking into account transfer to Reserve Fund Rs. 3.14 million for fiscal 2008, making... -

Page 10

... profit of over Rs. 2400 every week selling betel leaves- a remarkable improvement over the Rs. 140 she used to earn working as an agricultural labourer. As one of the 3.5 million people who have benefited from the ICICI Group's micro-finance initiatives, Satyamma today walks with her head held high... -

Page 11

...USD 49.25, representing a premium of 6.6% over the domestic issue price. SUBSIDIARY COMPANIES At March 31, 2008, ICICI Bank had 17 subsidiaries as listed below: Domestic Subsidiaries ICICI Securities Limited ICICI Securities Primary Dealership Limited ICICI Prudential Life Insurance Company Limited... -

Page 12

... a better life. Housing loans have made many Indians secure. Riddhi Sawant now enjoys in her own homea significant improvement over the little but steep rental flat she lived in earlier. Housing loans have given pride and security to people across the country. As Riddhi believes, home is where... -

Page 13

...his guidance and contribution as a Member of the Board. Arun Ramanathan, Secretary (Financial Sector), Department of Financial Services, Ministry of Finance, Government of India was nominated as a Director of the Bank by Government of India effective January 18, 2008. In terms of Article 128A of the... -

Page 14

Directors' Report my "When I progress, country progresses as well" -Sahir Khatib Towards a better life. SME banking solutions have made thousands of businesses flourish. Sahir is now a proud owner of a Rs. 1.70 billion business whose clients include major pharmaceutical companies - a big jump from ... -

Page 15

...terms of listing agreements with stock exchanges, but also several voluntary practices aimed at a high level of business ethics, effective supervision and enhancement of value for all stakeholders. Whistle Blower Policy ICICI Bank has formulated a Whistle Blower Policy for the ICICI Group. In terms... -

Page 16

Directors' Report "My dream is to become a doctor" -Riya Towards a better life. ICICI Bank's 'Read to Lead' initiative aims to bridge gaps in the access to formal schooling for a large number of children from disadvantaged backgrounds. This initiative aims to reach out to 100,000 children through ... -

Page 17

... operational areas. The Board has constituted nine committees, namely, Audit Committee, Board Governance & Remuneration Committee, Credit Committee, Customer Service Committee, Fraud Monitoring Committee, Risk Committee, Share Transfer & Shareholders'/ Investors' Grievance Committee, Strategy... -

Page 18

Directors' Report of other directorships and board committee memberships held by them at March 31, 2008 are set out in the following table: Board Number of other Attendance Number Meetings directorships at last AGM of other attended 3 (July 21, committee Of other Of Indian during 2007) companies1 ... -

Page 19

... for appropriate funding for compensation to be paid to any firm/advisors. In addition, the Audit Committee also exercises oversight on the compliance of risk management framework by providing directions to the regulatory compliance function of the Bank. Annual Report 2007-2008 17 ICICI BANK_... -

Page 20

.... The following table sets out the details of remuneration (including perquisites, bonus and retiral benefits) paid to wholetime Directors for fiscal 2008 and details of stock options granted for the three years ended March 31, 2008: K. V. Kamath Break-up of remuneration (Rupees) Basic Performance... -

Page 21

... dated July 24, 2003. Approval of the Members for payment of sitting fees to the Directors was obtained at the AGM held on August 20, 2005. Information on the total sitting fees paid to each of the independent Directors during fiscal 2008 for attending Meetings of the Board and its Committees is set... -

Page 22

... of the Committee include review of developments in key industrial sectors and approval of credit proposals as per authorisation approved by the Board. Composition The Credit Committee comprises five Directors including four independent Directors and the Managing Director & CEO. It is chaired by... -

Page 23

.... VII. Risk Committee Terms of reference The Committee reviews ICICI Bank's risk management policies in relation to various risks (portfolio, liquidity, interest rate, off-balance sheet and operational risks), investment policies and strategy and regulatory and compliance issues in relation thereto... -

Page 24

... of shares and securities issued from time to time, including those under stock options, review and redressal of shareholders' and investors' complaints, delegation of authority for opening and operation of bank accounts for payment of interest, dividend and redemption of securities and the listing... -

Page 25

... AGM Day August 20, 2005 Resolution l l Amendment to the Articles of Association of the Company for re-classification of the authorised share capital. Approval for issue of preference shares subject to applicable laws and regulations. Nil Merger of The Sangli Bank Limited with ICICI Bank Limited... -

Page 26

... on ICICI Bank's share price is released through leading domestic and global wire agencies. The information is also disseminated to the National Stock Exchange of India (NSE), the Bombay Stock Exchange Limited (BSE), New York Stock Exchange (NYSE), Luxembourg Stock Exchange, Singapore Stock Exchange... -

Page 27

... (Vadodara). The financial results, official news releases and presentations are also available on the website of ICICI Bank. The Management's Discussion & Analysis forms part of the Annual Report. General Shareholder Information Fourteenth AGM Day, Date Saturday, July 26, 2008 Time 1.30 p.m. Venue... -

Page 28

...' Report Market Price Information The reported high and low closing prices and volume of equity shares of ICICI Bank traded during fiscal 2008 on BSE and NSE are set out in the following table: BSE High (Rs.) Low (Rs.) April 2007 May 2007 June 2007 July 2007 August 2007 September 2007 October 2007... -

Page 29

...ICICI Bank Share Transfer System ICICI Bank's investor services are handled by 3i Infotech Limited (3i Infotech). 3i Infotech operates in the following main areas of business: software consultancy and development, IT-enabled services, IT infrastructure and network and facilities management services... -

Page 30

... and in the physical form with the total issued/paid up equity capital of ICICI Bank. Certificates issued in this regard are placed before the Share Transfer and Shareholders'/Investors' Grievance Committee and forwarded to BSE and NSE, where the equity shares of ICICI Bank are listed. Registrar and... -

Page 31

... for ADS holders) Life Insurance Corporation of India Allamanda Investments Pte. Limited Bajaj Auto Limited Merrill Lynch Capital Markets Espana S. A. S. V. Crown Capital Limited Government of Singapore Europacific Growth Fund The Growth Fund of America Inc The New India Assurance Company Limited... -

Page 32

... as amended from time to time, the maximum number of options granted to any employee/director in a year is limited to 0.05% of ICICI Bank's issued equity shares at the time of the grant, and the aggregate of all such options is limited to 5% of ICICI Bank's issued equity shares on the date of the... -

Page 33

...to issue of shares on exercise of options calculated in accordance with AS-20 was Rs. 39.15 in fiscal 2008 against basic EPS of Rs. 39.39. Since the exercise price of ICICI Bank's options is the last closing price on the stock exchange, which recorded the highest trading volume preceding the date of... -

Page 34

... Code of Business Conduct and Ethics I confirm that all Directors and members of the senior management have affirmed compliance with ICICI Bank Code of Business Conduct and Ethics for the year ended March 31, 2008. K. V. Kamath Managing Director & CEO Place : Mumbai Date : April 26, 2008 32 ICICI... -

Page 35

...on Corporate Governance To the Members of ICICI Bank Limited We have examined the compliance of conditions of corporate governance by ICICI Bank Limited ("the Bank") for the year ended on 31 March 2008, as stipulated in Clause 49 of the Listing Agreement of the said Company with stock exchanges. The... -

Page 36

... new economic drivers and holistic development of the agricultural sector and the rural economy are the key imperatives to realise India's full potential in the long run. FINANCIAL SECTOR OVERVIEW The financial sector mirrored the developments in the Indian economy. Credit growth during fiscal 2008... -

Page 37

...in the cash reserve ratio and the liquidity conditions, banks have increased their lending rates. The average yield on 10-year Government securities increased relatively moderately from 7.8% in fiscal 2007 to 7.9% in fiscal 2008, given the continued demand for government securities on account of the... -

Page 38

... demographic profile. At the same time, the retail credit business requires a high level of credit and analytical skills and strong operations processes backed by technology. Our retail strategy is centred around a wide distribution network, comprising our branches and offices, direct marketing... -

Page 39

... 19% of ICICI Prudential Life Insurance Company's new business was generated through ICICI Bank. We will continue to focus on cross-sell as a means to improve profitability and offer a complete suite of products to our customers. We continue to leverage our multi-channel network for distribution of... -

Page 40

... companies provide exciting opportunities for our corporate banking business. We believe that we are well-placed to capitalise on these opportunities by combining our domestic and international balance sheets, and our credit and structured financing expertise. Project Finance The Indian economy... -

Page 41

...international deposit base. Total deposits of ICICI Bank UK PLC and ICICI Bank Canada increased by 76.0% from Rs. 191.28 billion at March 31, 2007 to Rs. 335.86 billion at March 31, 2008. We also received approval for and commenced branch operations in the United States. We have established a strong... -

Page 42

...organisation's interest rate view and determines the strategy in light of the current and expected environment. These policies and processes are articulated in the ALM Policy. The Investment Policy addresses issues related to investments in various trading products. The Global Market Risk Management... -

Page 43

... given the volatile interest rate environment. The focus of our proprietary trading operations was to maximise profits from positions across key markets including corporate bonds, government securities, interest rate swap, equity and foreign exchange markets. While the adverse market conditions in... -

Page 44

... from across India through a rigorous process. This one-year programme strives to increase efficiency and improve customer experience by enabling first day employee productivity through knowledge, skills and grooming inputs. It aims at integrating students into the ICICI Group ethos and work ethics... -

Page 45

... fiscal 2007. ICICI Life's new business premium (on weighted received premium basis) grew by 68.3% from Rs. 39.71 billion in fiscal 2007 to Rs. 66.84 billion in fiscal 2008. Life insurance companies worldwide make losses in the initial years, in view of business set-up and customer acquisition costs... -

Page 46

... while total deposits grew by 84.2% from US$ 2,812 million at March 31, 2007 to US$ 5,180 million at March 31, 2008. ICICI Bank UK's profit after tax was US$ 38.4 million during fiscal 2008 after taking into account investment valuation charges. ICICI Bank Canada ICICI Bank Canada is a full-service... -

Page 47

... a business model that can provide financial services effectively across rural India and deliver value to this market at a low cost. The ICICI Group is working with key stakeholders including agri-based industries, government authorities and micro finance institutions in this direction. Technology... -

Page 48

... million lives for personal accident insurance and health insurance. The benefit for the government has been the transfer of risk to ICICI General, greater accountability and transparency and streamlined reporting. Innovative farmer finance: ICICI Bank has sought to introduce several new products to... -

Page 49

...CSOs and experienced service providers with whom it is in the process of building partnerships, in various areas, including fund-raising, financial management, volunteering, organisational governance, communications, accounting, human resources, legal aid and accounting. Its current partners include... -

Page 50

... of quality in business groups; Develop and implement quality practices for the Bank; Cross-pollinate best practices among group companies; and Remain at the cutting edge in our global search for quality practices. ICICI Bank was among the first services sector organisation to undertake enterprise... -

Page 51

... of equity shares in India and an issuance of American Depository Shares (ADSs) aggregating to Rs. 199.67 billion. The Sangli Bank Limited (Sangli Bank) was amalgamated with ICICI Bank with effect from April 19, 2007 in terms of the scheme of amalgamation approved by Reserve Bank of India (RBI) vide... -

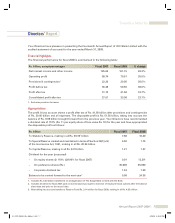

Page 52

...Fiscal 2007 Return on average equity (%) Return on average assets (%)2 Earnings per share (Rs.) Book value (Rs.) Fee to income (%) Cost to income (%)3 1 Fiscal 2008 11.14 1.1 39.4 4 417.54 41.6 40.4 13.4 1.1 34.8 269.8 40.5 40.2 1. Return on average equity is the ratio of the net profit after tax... -

Page 53

...the general increase in interest rates and increase in the volumes of certain high yielding loans. This was partly offset by increase in the cash reserve ratio (CRR) by RBI by 150 basis points during the year resulting in an adverse impact on yields. The yield on average interest-earning investments... -

Page 54

... mark-to-market losses/realised losses of Rs. 6.85 billion on the credit derivatives portfolio, offset, in part by higher gains from sale of equity and fixed income investments and proprietary trading. As at March 31, 2008, the Bank had a portfolio of Rs. 62.80 billion, including funded investments... -

Page 55

... to retail business. The number of branches and extension counters in India increased to 1,262 at year-end fiscal 2008 from 755 at year-end fiscal 2007. ATMs increased to 3,881 at year-end fiscal 2008 from 3,271 at year-end fiscal 2007. We use marketing agents, called direct marketing agents or... -

Page 56

... funds. Our equity share capital and reserves at year-end fiscal 2008 increased to Rs. 464.71 billion as compared to Rs. 243.13 billion at year-end fiscal 2007 primarily due to the follow-on public offering and ADS offering aggregating Rs 199.67 billion during the year. Total deposits increased... -

Page 57

...exceeding 10 years. The credit risks associated with these products, as well as the operating risks, are similar to those relating to other types of financial instruments. We generally have collateral available to reimburse potential losses on the Annual Report 2007-2008 55 ICICI BANK_(Fin_Matter... -

Page 58

... billion at year-end fiscal 2007. Other property or security may also be available to us to cover losses under guarantees. We are obligated under a number of capital contracts. Capital contracts are job orders of a capital nature, which have been committed. As of the balance sheet date, work had not... -

Page 59

... segment by increasing new exposures to that segment, resulting in active portfolio management. The following tables set forth, at the dates indicated, the composition of our gross advances (net of write-offs). Rs. in billion, except percentages March 31, 2007 March 31, 2008 Total % of total Total... -

Page 60

...table sets forth, at March 31, 2008, the composition of our gross (net of write-offs) outstanding retail finance portfolio. Rs. in billion, except percentages Total retail advances Home loans1 Automobile loans Commercial business Two-wheeler loans Personal loans Credit cards Loans against securities... -

Page 61

... with government sponsored Indian development banks like the National Bank for Agriculture and Rural Development and the Small Industries Development Bank of India. These deposits have a maturity of up to seven years and carry interest rates lower than market rates. At year-end fiscal 2008, total... -

Page 62

... asset. In compliance with regulations governing the presentation of financial information by banks, we report non-performing assets net of cumulative write-offs in our financial statements. RBI has separate guidelines for restructured loans. A fully secured standard asset can be restructured by... -

Page 63

... (including trucks) Paper and paper products Cement Other Industries3 Total Interest suspense Gross NPAs 1. Includes home loans, automobile loans, commercial business loans, two wheeler loans, personal loans, credit cards, dealer funding and developer financing. 2. Includes sugar & tea. 3. Other... -

Page 64

... 2008 mainly due to higher business set-up costs in the initial years of rapid growth, non-amortisation of acquisition costs and reserving for actuarial liability in line with the insurance company accounting norms. These factors have resulted in statutory losses for the life insurance business... -

Page 65

... Primary Dealership Limited ICICI Prudential Life Insurance Company Limited ICICI Lombard General Insurance Company Limited ICICI Venture Funds Management Company Limited ICICI Home Finance Company Limited ICICI Prudential Asset Management Company Limited ICICI Bank UK PLC. ICICI Bank Canada ICICI... -

Page 66

... 13.4% 2007 1,958.66 2,305.10 3,446.58 243.13 11.7% 2008 2,256.16 2,444.31 3,997.95 464.71 14.0%2 1. Includes merchant foreign exchange income and margin on customer derivative transactions. 2. Capital adequacy ratio at year-end fiscal 2008 is calculated as per Basel II framework. 64 ICICI BANK_... -

Page 67

...Commissioned Officer, Indian Army Area Sales Manager, HDFC Bank - Dealer Business Manager, GE Countrywide Head of Fixed Income Fund, SBI Mutual Fund Stock Holding Corporation Manager, Birla Sunlife Country Head, Apna Loan (I) Private Limited - Project Officer, IFCI Managing Director, Sonnet Strategy... -

Page 68

... Manager, Gruh Finance Manager Construction, Shapoorji Pallonji & Company Assistant Manager, Standard Chartered Bank Associate Consultant, Price Waterhouse Coopers Officer, Canara Bank Branch Manager, Gmac-TCFC Finance Limited Senior Vice-President, ICICI Prudential Life Insurance Company Limited... -

Page 69

... E.C. Head-Business Development, Global Trade Finance Director-Operations, Asian Finance & Investment Corporation - Honda Siel Cars Senior Manager, National Bank of Oman - - Chief Manager, Global Trust Bank Senior Systems Analyst, Infosys Technologies - Assistant Manager, Nagarjuna Finance Limited... -

Page 70

... Operations, Capital One Service Inc. Sales Manager, Max New York Life Insurance Manager, Saraswat Bank Manager, HDFC Bank Assistant Manager, Ceat Financial Services Accounts / Credit Manager, Citicorp Maruti Finance Research Director, MARG Vice President, ABN Amro Bank Officer, Vysya Bank Limited... -

Page 71

... of India Regional Manager, Standard Chartered Bank Assistant Vice - President, Times Bank Senior Finance Officer, Indian Rayon & Ind. Limited Business Manager, ICI Paints Senior Manager, Bank of Maharashtra Senior Officer, HDFC Limited Head - Sales & Marketing, Bharti Airtel Limited Branch Manager... -

Page 72

... - Finance, United Overseas Bank Engineer, Engineers India Limited Territory Sales Manager, E-Funds Manager Sales & Credit, Standard Chartered Bank Head Corporate Banking, City Bank-Srilanka Branch Marketing Manager, TADFL Assistant Manager, State Bank of Travancore Manager Operations, Indusind Bank... -

Page 73

...India Marketing Executive, Times Bank Limited Manager, HEG Limited Section Head Finance , RHB Bank Berhad Chief Dealer Fx Spot, Uob Singapore Global Treasury Manager, State Bank of India Senior Officer, HDFC Bank Limited Assistant Manager, India Mart-Intermesh Limited Sales Manager, Ashok Auto Sales... -

Page 74

financials ICICI_AR08_(Sec_217)1P-less.indd72 72 6/20/08 4:55:47 PM -

Page 75

...' report To the Members of ICICI Bank Limited 1. We have audited the attached Balance Sheet of ICICI Bank Limited ('the Bank') as at March 31, 2008 and also the Profit and Loss Account and the Cash Flow Statement for the year ended on that date, both annexed thereto. These financial statements are... -

Page 76

... Accountants AKEEL MASTER Partner Membership No.: 046768 For and on behalf of the Board of Directors N. VAGHUL Chairman CHANDA D. KOCHHAR Joint Managing Director & CFO MADHABI PURI BUCH Executive Director Place : Mumbai Date : April 26, 2008 F2 SANDEEP BATRA Group Compliance Officer & Company... -

Page 77

... Chartered Accountants AKEEL MASTER Partner Membership No.: 046768 For and on behalf of the Board of Directors N. VAGHUL Chairman CHANDA D. KOCHHAR Joint Managing Director & CFO MADHABI PURI BUCH Executive Director Place : Mumbai Date : April 26, 2008 SANDEEP BATRA Group Compliance Officer & Company... -

Page 78

...) ...Dividend and dividend tax paid ...Net cash generated from financing activities...Effect of exchange fluctuation on translation reserve ...Net cash and cash equivalents taken over from Sangli Bank Limited on amalgamation ...Net increase / (decrease) in cash and cash equivalents ...Cash and cash... -

Page 79

... Less : Calls unpaid ...Add : 111,603 equity shares forfeited (March 31, 2007: 111,603 equity shares) TOTAL EQUITY CAPITAL ...Preference share capital [Represents face value of 350 preference shares of Rs. 10 million each issued to preference shareholders of erstwhile ICICI Limited on amalgamation... -

Page 80

... paid-up value of the shares issued to the shareholders of The Sangli Bank Limited over the fair value of the net assets acquired on merger and amalgamation expenses as per scheme of amalgamation. b) Rs. 1,846.6 million being the share issue expenses, written-off from the securities premium account... -

Page 81

...176,374 TOTAL BORROWINGS IN INDIA...II. Borrowings outside India i) From multilateral/bilateral credit agencies guaranteed by the Government of India for the equivalent of Rs. 18,402.9 million at March 31, 2008 (March 31, 2007: Rs. 19,151.7 million) ...ii) From international banks, institutions and... -

Page 82

...8,992.7 million]. b) Corporate dividend tax payable of Rs. 1,490.3 million [March 31, 2007: Rs. 1,528.3 million]. SCHEDULE 6 - CASH AND BALANCES WITH RESERVE BANK OF INDIA I. II. Cash in hand (including foreign currency notes) ...Balances with Reserve Bank of India in current accounts ...28,478,239... -

Page 83

schedules forming part of the Balance Sheet (Contd.) As on 31.03.2008 SCHEDULE 8 - INVESTMENTS I. Investments in India [net of provisions] i) Government securities ...ii) Other approved securities...iii) Shares (includes equity and preference shares) ...iv) Debentures and bonds ...v) Subsidiaries ... -

Page 84

...process of being transferred in the Bank's name. SCHEDULE 12 - CONTINGENT LIABILITIES Claims against the Bank not acknowledged as debts...Liability for partly paid investments ...Liability on account of outstanding forward exchange contracts ...Guarantees given on behalf of constituents a) In India... -

Page 85

schedules forming part of the Profit and Loss Account Year ended 31.03.2008 SCHEDULE 13 - INTEREST EARNED I. Interest / discount on advances / bills ...II. Income on investments 1 ...III. Interest on balances with Reserve Bank of India and other inter-bank funds IV. Others 2 ...TOTAL INTEREST EARNED... -

Page 86

schedules forming part of the Accounts (Contd.) SCHEDULE 18 Significant accounting policies OVERVIEW ICICI Bank Limited ("ICICI Bank" or "the Bank"), incorporated in Vadodara, India is a publicly held banking company engaged in providing a wide range of banking and financial services including ... -

Page 87

...net asset value obtained from the asset reconstruction company from time to time, for valuation of such investments at each reporting year end. The Bank follows trade date method for accounting of its investments. d) e) f) g) h) i) j) 3. Provisions/Write-offs on loans and other credit facilities... -

Page 88

... branches and offshore banking units) are translated at quarterly average closing rates. Monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at closing exchange rates notified by Foreign Exchange Dealers' Association of India at the balance... -

Page 89

... Fund ICICI Bank contributes 15.0% of the total annual basic salary of each employee to a superannuation fund for ICICI Bank employees. The employee gets an option on retirement or resignation to commute one-third of the total credit balance in his/her account and receive a monthly pension... -

Page 90

... taken on operating lease are recognised as an expense in the profit and loss account over the lease term. 15. Cash and cash equivalents Cash and cash equivalents include cash in hand, balances with RBI, balances with other banks and money at call and short notice. SCHEDULE 19 NOTES FORMING PART OF... -

Page 91

... extraordinary expenses on integration and consolidation under the Scheme, to be incurred by the Bank and the balance in such account has been debited to the securities premium account. Accordingly, the excess of the paid-up value of the shares issued over the fair value of the net assets acquired... -

Page 92

schedules forming part of the Accounts (Contd.) 3. Capital adequacy ratio The Bank is subject to the capital adequacy norms stipulated by the Reserve Bank of India ('RBI'). As per the earlier applicable capital adequacy guidelines (Basel I), the Bank was required to maintain a minimum ratio of total... -

Page 93

schedules forming part of the Accounts (Contd.) 5. Information about business and geographical segments Business segments for the year ended March 31, 2008 Pursuant to the guidelines issued by RBI on Accounting Standard - 17 (Segment Reporting) - Enhancement of Disclosures dated April 18, 2007, ... -

Page 94

... in India. l Foreign operations comprises branches having operations outside India and offshore banking unit having operations in India. Geographical segment results are given below: Rupees in million Revenue1 Domestic Operation ...Foreign Operation ...Total ...1. For the year ended March 31, 2008... -

Page 95

schedules forming part of the Accounts (Contd.) 6. Earnings per share Basic and diluted earnings per equity share are computed in accordance with Accounting Standard 20, "Earnings per Share". Basic earnings per share is computed by dividing net profit after tax by the weighted average number of ... -

Page 96

... Securities Limited, ICICI International Limited, ICICI Trusteeship Services Limited, ICICI Home Finance Company Limited, ICICI Investment Management Company Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Bank UK PLC, ICICI Bank Canada, ICICI Prudential Life Insurance Company... -

Page 97

.../buyback and conversion of investments During the year ended March 31, 2008, the Bank received a consideration of Rs. 1.2 million (March 31, 2007: Rs. 663.9 million) on account of buyback/capital reduction of equity shares by subsidiaries. Units in associates/joint ventures/other related entities... -

Page 98

... payable to/receivable from subsidiaries/joint ventures/associates/other related entities/key management personnel included in the balance sheet as on March 31, 2008 are given below: Rupees in million Items/Related party Deposits with ICICI Bank ...Deposits of ICICI Bank ...Call/term money lent... -

Page 99

...the financial year. The balances payable to/receivable from subsidiaries/joint ventures/associates/key management personnel included in the balance sheet as on March 31, 2007 are given below: Rupees in million Items/Related party Deposits with ICICI Bank ...Deposits of ICICI Bank ...Call/term money... -

Page 100

... maximum balance payable to/receivable from subsidiaries/joint ventures/associates/key management personnel during the year ended March 31, 2007 is given below: Rupees in million Subsidiaries/ joint ventures Deposits with ICICI Bank ...16,238.9 Items/Related party Deposits of ICICI Bank ...Call/term... -

Page 101

... March 31, 2007 is given in the table below: Rupees in million, except number of loans securitised Year ended March 31, 2008 Total number of loan assets securitised...Total book value of loan assets securitised...Sale consideration received for the securitised assets ...Net gain/(loss) on account of... -

Page 102

schedules forming part of the Accounts (Contd.) Particulars Opening plan assets, at fair value ...Add: Addition due to amalgamation ...Expected return on plan assets ...Actuarial gain/(loss) ...Assets distributed on settlement ...Contributions ...Benefits paid ...Closing plan assets, at fair value... -

Page 103

... 31, 2008. As per the scheme, the exercise price of ICICI Bank's options is the last closing price on the stock exchange, which recorded highest trading volume preceding the date of grant of options. Hence, there is no compensation cost in the year ended March 31, 2008 based on intrinsic value of... -

Page 104

... Finance Act 2007 introduced Fringe Benefit Tax ("FBT") on employee stock options. The FBT liability crystallises on the date of exercise of stock options by employees and is computed based on the difference between fair market value on date of vesting and the exercise price. As per the ESOS scheme... -

Page 105

...coupon rate of 10.15% i.e. 10.65% payable annually for the balance years, if the call option is not exercised by the Bank. Call option exercisable on April 30, 2018 and on every interest payment date thereafter (exercisable with RBI approval). Rupees in million Particulars Tranche 1 Option II Total... -

Page 106

... excluded from the capital adequacy ratio (CRAR) computation, pending clarification required by Reserve Bank of India regarding certain terms of these bonds. Rupees in million Particulars Option I Total (Upper Tier II) Date of Issue December 27, 2006 Coupon Rate (%) six-monthly libor + 1.40% (semi... -

Page 107

... India ...b) Outside India ...Movement of provisions held towards depreciation on investments (i) Opening balance ...(ii) Add: Provisions made during the year ...(iii) Less: Write-off/write back of excess provisions during the year ...(iv) Closing balance ...As on March 31, 2008 As on March 31, 2007... -

Page 108

... shares of subsidiaries, namely ICICI Bank UK PLC and ICICI Bank Canada. This also excludes investments in government securities (Rs. 1,402.5 million) of non-Indian origin made by overseas branches. 3. Includes Rs. 1,770.0 million of application money towards bonds issued by banks, which were listed... -

Page 109

... government and other approved securities for the year ended March 31, 2008 and March 31, 2007 is given below: Rupees in million Particulars Opening balance ...Additions during the year ...Reduction during the year...Closing balance ...Total provisions held ...16. Repurchase transactions The details... -

Page 110

... the Bank in respect of primary issue of shares or convertible bonds or convertible debentures or units of equity oriented mutual funds. Financing to stockbrokers for margin trading. All exposures to Venture Capital Funds (both registered and unregistered). Total 423.2 As on March 31, 2007 N.A. iv... -

Page 111

...closing balances of NPAs in retail loans is included in additions during the year. 3. Includes non-performing loans acquired on merger of Sangli Bank. 4. Includes suspended interest and claims received from ECGC/DICGC of Rs. 1,457.2 million (March 31, 2007: Rs. 504.3 million) on working capital loan... -

Page 112

... the year ended March 31, 2007, RBI increased the requirement of general provisioning to 2% on standard loans relating to personal loans, loans and advances qualifying as capital market exposure, credit card receivables, advances to non-deposit taking systemically important non-banking financial... -

Page 113

.../2005-06 dated July 13, 2005 on such sale. Rupees in million Particulars A. B. C. D. No. of accounts ...Aggregate value (net of provisions) of accounts sold, excluding those sold to SC/RC ...Aggregate consideration...Aggregate gain/(loss) over net book value ...Year ended March 31, 2008 12,545 515... -

Page 114

... under operating lease as at March 31, 2008 and March 31, 2007. 27.1 Assets under finance lease The details of finance leases are given below: Rupees in million Particulars Total of future minimum lease receipts ...Present value of lease receipts ...Unmatured finance charges...Maturity profile of... -

Page 115

.... The marked to market position and VAR on the credit derivatives portfolio is reported on a monthly basis. The use of derivatives for hedging purposes is governed by the hedge policy approved by Asset Liability Management Committee ("ALCO"). Subject to prevailing RBI guidelines, the Bank deals in... -

Page 116

... interest rate swaps, forward rate agreements and swaptions are included in interest rate derivatives. Excludes notional amount of options sold for Rs. 444,221.2 million. For trading portfolio excluding accrued interest. Represents net positions. Amounts given are absolute values. The swap contracts... -

Page 117

...-parties and FIMMDA. The Bank offers deposits to customers of its offshore branches with structured returns linked to interest, forex or equity benchmarks. The Bank covers these exposures in the inter-bank market. As on March 31, 2008, the net open position on this portfolio was Rs. 4.0 million with... -

Page 118

...in such payments. 38. Farm loan waiver The Union Finance Minister, in his budget proposal for Financial Year 2008-09, announced a debt relief scheme for farmers, which would cover agricultural loans disbursed by scheduled commercial banks, regional rural banks and co-operative credit institutions up... -

Page 119

... the current year's presentation. Signatures to Schedules 1 to 19 For and on behalf of the Board of Directors N. VAGHUL Chairman CHANDA D. KOCHHAR Joint Managing Director & CFO MADHABI PURI BUCH Executive Director Place : Mumbai Date : April 26, 2008 SANDEEP BATRA Group Compliance Officer & Company... -

Page 120

... of ICICI Securities Limited, ICICI Securities Inc. is a wholly-owned subsidiary of ICICI Securities Holdings Inc. 6. The profits/(losses) of ICICI Bank UK PLC. and ICICI International Limited for the year ended March 31, 2008 have been translated into Indian Rupees at the rate of 1 USD = Rs... -

Page 121

Consolidated financial statements of ICICI Bank Limited and its subsidiaries ICICI_BK_AR_2008_(F47_F92).indd 47 6/20/08 3:31:15 PM -

Page 122

... and joint ventures for the year ended March 31, 2008. These unaudited financial statements as approved by the respective Board of Directors of these companies have been furnished to us by the management of the Bank. The attached annual consolidated financial results include assets of Rs 111... -

Page 123

... in India: a) b) c) in the case of the consolidated Balance Sheet, of the state of affairs of the Group as at March 31, 2008; in the case of the consolidated Profit and Loss Account, of the profit of the Group for the year ended on that date; and in the case of the consolidated Cash Flow Statement... -

Page 124

... Executive Director CHARANJIT ATTRA General Manager & Chief Accountant CHANDA D. KOCHHAR Joint Managing Director & CFO MADHABI PURI BUCH Executive Director SANDEEP BATRA Group Compliance Officer & Company Secretary RAKESH JHA Deputy Chief Financial Officer Place : Mumbai Date : April 26, 2008 F50... -

Page 125

... BATRA Group Compliance Officer & Company Secretary RAKESH JHA Deputy Chief Financial Officer K. V. KAMATH Managing Director & CEO V. VAIDYANATHAN Executive Director SONJOY CHATTERJEE Executive Director CHARANJIT ATTRA General Manager & Chief Accountant F51 Place : Mumbai Date : April 26, 2008... -

Page 126

... debts) ...Dividend and dividend tax paid ...Net cash generated from financing activities...(C) Effect of exchange fluctuation on translation reserve...(D) Net cash and cash equivalents received from The Sangli Bank Limited on amalgamation ...(E) Net increase/(decrease) in cash and cash equivalents... -

Page 127

...Less: Calls unpaid ...Add: 111,603 equity shares forfeited (March 31, 2007: 111,603 equity shares) ... TOTAL EQUITY CAPITAL ...Preference Share Capital (Represents face value of 350 preference shares of Rs. 10 million each issued to preference shareholders of erstwhile ICICI Limited on amalgamation... -

Page 128

... on account of first time adoption of Financial Reporting Standard ("FRS") 26 by ICICI Bank UK PLC for the year ended March 31, 2007. 6. Includes restricted reserve of Rs. 5,423.2 million (March 31, 2007: Rs. 2,541.9 million) relating to life insurance subsidiary. 7. Includes unrealised losses, net... -

Page 129

schedules forming part of the Consolidated Balance Sheet (Contd.) As on 31.03.2008 SCHEDULE 2A - MINORITY INTEREST Opening minority interest ...Subsequent increase/decrease...CLOSING MINORITY INTEREST ...SCHEDULE 3 - DEPOSITS A. I. Demand deposits i) From banks...ii) From others ...II. III. Savings ... -

Page 130

...9,036.2 million). b) Corporate dividend tax payable of Rs. 1,596.0 million (March 31, 2007: Rs. 1,591.8 million). SCHEDULE 6 - CASH AND BALANCES WITH RESERVE BANK OF INDIA I. II. Cash in hand (including foreign currency notes) ...Balances with Reserve Bank of India in current accounts ...32,653,915... -

Page 131

schedules forming part of the Consolidated Balance Sheet (Contd.) As on 31.03.2008 SCHEDULE 8 - INVESTMENTS I. Investments in India (net of provisions) i) Government securities ...ii) Other approved securities...iii) Shares (includes equity and preference shares)1 ...iv) Debentures and bonds ...v) ... -

Page 132

...process of being transferred in the Bank's name. 2. Includes debit balance in profit and loss account of Rs. Nil (March 31, 2007: Rs. 73.7 million) net of credit balance in profit and loss account of Rs. Nil (March 31, 2007: Rs. 88.7 million) for joint ventures. 3. Includes goodwill on consolidation... -

Page 133

schedules forming part of the Consolidated Profit and Loss Account Year ended 31.03.2008 SCHEDULE 13 - INTEREST EARNED I. Interest/discount on advances/bills ...II. Income on investments1 ...III. Interest on balances with Reserve Bank of India and other inter-bank funds ...IV. Others2 ...TOTAL ... -

Page 134

.... ICICI Securities Holdings Inc. ICICI Securities Primary Dealership Limited ICICI Venture Funds Management Company Limited ICICI Home Finance Company Limited ICICI Trusteeship Services Limited ICICI Investment Management Company Limited ICICI International Limited Country of incorporation India USA... -

Page 135

... Development Corporation Limited Financial Information Network and Operations Limited3 I-Process Services (India) Private Limited3 I-Solutions Providers (India) Private Limited3 NIIT Institute of Finance, Banking and Insurance Training Limited3 ICICI Venture Value Fund3 India Mauritius India India... -

Page 136

... mobilisation and terms of agreement with the client. The Group follows trade date method for accounting of its investments. l Life insurance premium is recognised as income when due. Premium on lapsed policies is recognised as income when such policies are reinstated. Top-up premiums are considered... -

Page 137

... trading volume on the said date shall be considered. In case of ICICI Prudential Life Insurance Company Limited, ICICI Lombard General Insurance Company Limited and ICICI Securities Limited, the fair value of the shares is determined based on an external valuation report. Since the exercise price... -

Page 138

...and one year renewable group term insurance. The unit liability in respect of linked business has been taken as the value of the units standing to the credit of policyholders, using the net asset value (NAV) prevailing at the valuation date. The adequacy of charges under unit-linked policies to meet... -

Page 139

... Fund ICICI Bank contributes 15.0% of the total annual basic salary of each employee to a superannuation fund for ICICI Bank employees. The employee gets an option on retirement or resignation to commute one-third of the total credit balance in his/her account and receive a monthly pension... -

Page 140

... at each reporting year end. i) The Bank follows trade date method for accounting of its investments. The Bank's venture capital funds carry investments at fair values, with unrealised gains and temporary losses on investments recognised as components of investors' equity and accounted for in... -

Page 141

..., taking into account management's perception of the higher risk associated with the business of the company. Certain NPAs are considered as loss assets and full provision has been made against such assets. In case of the Bank's housing finance subsidiary, loans and other credit facilities are... -

Page 142

... period of four years from the date they are put to use, being management's estimate of the useful life of such intangibles. Depreciation on furniture and fixtures is charged @ 15% per annum. In case of the Bank's general insurance and housing finance subsidiary, computer software are stated at cost... -

Page 143

... Bank. As a result, the balances in Statutory Reserve is higher to the extent of Rs. 206.5 million and the excess of the paid-up value of the share issued over the fair value of the net assets acquired is lower to that extent. 2. Equity issue of ICICI Bank Limited The Bank made a follow on public... -

Page 144

... Information Network & Operations Limited, I-Process Services (India) Private Limited, I-Solutions Providers (India) Private Limited, NIIT Institute of Finance, Banking and Insurance Training Limited, ICICI Venture Value Fund, Comm Trade Services Limited, Loyalty Solutions & Research Limited... -

Page 145

schedules forming part of the Consolidated Accounts (Contd.) Insurance services During the year ended March 31, 2008, the Group received insurance premium from associates/other related entities of Rs. 116.8 million. During the year ended March 31, 2008, the Group paid claims to its associates/other ... -

Page 146

... March 31, 2008 22.5 1.6 Year ended March 31, 2007 59.3 0.1 Employee stock option scheme ("ESOS") In terms of the ESOS, as amended, the maximum number of options granted to any eligible employee in a financial year shall not exceed 0.05% of the issued equity shares of the Bank at the time of grant... -

Page 147

... fair market value of the equity shares on the date of vesting and the exercise price. As per the ESOS scheme, FBT of Rs. 226.7 million has been recovered from the employees on 1,468,713 stock options exercised during the year ended March 31, 2008. ICICI Prudential Life Insurance Company Limited has... -

Page 148

schedules forming part of the Consolidated Accounts (Contd.) A summary of the status of the stock option plan of ICICI Prudential Life Insurance Company Limited is given below. Rupees, except number of options Stock options outstanding Year ended March 31, 2008 Particulars Outstanding at the ... -

Page 149

... average exercise price (Rupees) 48 Weighted average remaining contractual life (Number of years) 8.23 As per the ESOS scheme, FBT of Rs. 0.8 million has been recovered from the employees on 150,240 stock options exercised during the year ended March 31, 2008. If the Group had used the fair value... -

Page 150

...original issue terms. 9. 10. Staff retirement benefits Reconciliation of opening and closing balance of the present value of the defined benefit obligation for pension and gratuity benefits of the Group is given below. Rupees in million Particulars Year ended March 31, 2008 Pension Defined benefit... -

Page 151

... Accounts (Contd.) Particulars Year ended March 31, 2008 Pension Opening plans assets, at fair value Add: Addition due to amalgamation ...Expected return on plan assets ...Actuarial gain/(loss) ...Assets distributed on settlement ...Contributions ...Benefits paid ...Closing plan assets at fair value... -

Page 152

... Infrastructure Development Corporation Limited, Financial Information Network and Operations Limited (FINO), I-Process Services (India) Private Limited, I-Solutions Providers (India) Private Limited, NIIT Institute of Finance, Banking and Insurance Training Limited and ICICI Venture Value Fund... -

Page 153

...,061.9 Life insurance General insurance 244,185.4 10,838.4 36,240.6 249,493.5 Wholesale banking Other banking business Intersegment adjustments Sr. Particulars no. ICICI_BK_AR_2008_(F47_F92).indd 79 1 Revenue 2 Segment results schedules 3 Unallocated expenses 4 5 Income tax expenses (net... -

Page 154

... Canada and ICICI Bank Eurasia LLC., ICICI Securities Primary Dealership Limited (formerly ICICI Securities Limited), ICICI Securities Limited (formerly ICICI Brokerage Services Limited), ICICI Securities Inc., and ICICI Securities Holdings Inc., ICICI Venture Funds Management Company Limited, ICICI... -

Page 155

... segment results are given below. Rupees in million Revenue1 Domestic operations ...Foreign operations ...Total For the year ended March 31, 2008 572,499.1 28,031.7 600,530.8 For the year ended March 31, 2007 399,509.0 14,128.9 413,637.9 1. Gains and losses on offsetting transactions are accounted... -

Page 156

... Consolidated Accounts (Contd.) 18. Farm loan waiver The Union Finance Minister, in his budget proposal for Financial Year 2008-09, announced a debt relief scheme for farmers, which would cover agricultural loans disbursed by scheduled commercial banks, regional rural banks and co-operative credit... -

Page 157

... in trade. 5. Dividend paid includes proposed dividend. 6. The financials of ICICI Bank UK PLC. and ICICI International Limited have been translated into Indian Rupees at the closing rate on March 31, 2008 of 1 USD = Rs. 40.1200. 7. The financials of ICICI Bank Canada and ICICI Wealth Management Inc... -

Page 158

Reconciliation to US GAAP and related notes for the year ended March 31, 2008 ICICI_BK_AR_2008_(F47_F92).indd 84 6/20/08 3:33:16 PM -

Page 159

... income reconciliation Rupees in million Note Consolidated profit after tax as per Indian GAAP ...Adjustments on account of: Allowance for loan losses ...Business combinations ...Consolidation ...Valuation of debt and equity securities ...Amortisation of fees and costs ...Accounting for derivatives... -

Page 160

...personal loans, credit card receivables, loans and advances qualifying as capital market exposure, commercial real estate and advances to non-deposit taking systematically important non-banking financial companies (NBFCs) was increased to 2%. A loan is classified as sub-standard if interest payments... -

Page 161

... is established via a process that includes an estimate of probable losses inherent in the portfolio, based upon various statistical analysis. Under US GAAP, the allowance for loan losses for restructured loans is created by discounting expected cash flows at contracted interest rates, unlike Indian... -

Page 162

... and total assets of the acquired group is immaterial to the consolidated results of operations and financial position of the Group. The fair values of the net assets of The Sangli Bank as on the date of merger are as follows: Rs. in million Particulars Assets Cash and balances with RBI ...Balances... -

Page 163

... the year ended March 31, 2008 Under Indian GAAP, the insurance subsidiaries (ICICI Prudential Life Insurance Company Limited and ICICI Lombard General Insurance Company Limited) are fully consolidated whereas under US GAAP, these subsidiaries are accounted for by the equity method of accounting as... -

Page 164

... US GAAP and related notes for the year ended March 31, 2008 v) Un-realised loss/(gain) on trading portfolio of participating funds Under Indian GAAP, accounting for investments is in accordance with the guidelines issued by the Insurance Regulatory and Development Authority, which do not allow the... -

Page 165

... paid to direct marketing agents are expensed in the year in which they are incurred. Costs ICICI Bank Limited had implemented an Early Retirement Option Scheme 2003 ('ERO') for its employees in July 2003. All employees who had completed 40 years of age and seven years of service with the Bank... -

Page 166

...gain or loss on the sale of the financial asset is accounted for in the income statement at the time of the sale. Under Indian GAAP, with effect from February 1, 2007, net income arising from securitisation of loan assets is accounted for over the life of the securities issued or to be issued by the... -

Page 167

...Securities Holdings Inc. Holding company of ICICI Securities Inc. - fully consolidated ICICI Venture Funds Private equity/venture capital fund management Management Company Limited - fully consolidated ICICI Home Finance Company Limited Housing finance - fully consolidated ICICI Trusteeship Services... -

Page 168

... in banking and finance - consolidated by equity method for financial reporting but not consolidated for capital adequacy 26 ICICI West Bengal Infrastructure Development Corporation Limited 27 Financial Information Network and Operations Limited 28 I-Process Services (India) Private Limited 29... -

Page 169

... and loss reserve, upper Tier-2 instruments (upper Tier-2 bonds) and subordinate debt instruments (lower Tier-2 bonds) eligible for inclusion in Tier-2 capital. ICICI Bank and its subsidiaries have issued debt instruments that form a part of Tier-1 and Tier-2 capital. The terms and conditions that... -

Page 170

... during current financial year Amount eligible to be reckoned as capital funds e. Total eligible capital (March 31, 2008) Rupees in billion Eligible Tier-1 capital Eligible Tier-2 capital Total eligible capital 3. CAPITAL ADEQUACY a. Capital assessment ICICI Bank is subjected to the capital adequacy... -

Page 171

... (Consolidated) Risk area Market risk Capital required - for interest rate risk - for foreign exchange (including gold) risk - for equity position risk Operational risk Capital required Total capital requirement at 9% Total capital funds of the Bank Total risk weighted assets Capital adequacy ratio... -

Page 172

... management of key risks such as credit, market, liquidity and operational risks are addressed in the Bank's policies, procedures and operating instructions and has separate focussed groups to carry out credit, market and operational risk analysis of each portfolio within various business groups... -

Page 173

... statements that are more than three months old even though the unit may be working or the borrower's financial position is satisfactory e. the regular/ad hoc credit limits have not been reviewed/ renewed within 180 days from the due date/ date of ad hoc sanction. iii) a bill purchased/discounted... -

Page 174

...101,340.0 1,217,318.0 1. Includes home loans, automobile loans, commercial business loans, two wheeler loans, personal loans, credit cards, dealer funding and developer financing. 2. Includes all entities considered for Basel II capital adequacy computation. e. Residual contractual maturity break... -

Page 175

... 225,397.9 4,659,691.8 1. Consolidated figures for ICICI Bank Limited, ICICI Bank UK PLC, ICICI Bank Canada, ICICI Bank Eurasia LLC, ICICI Home Finance Company and ICICI Securities and its subsidiaries. f. Amount of non-performing loans (NPL) (March 31, 2008) Rupees in million NPL Classification... -

Page 176

...31, 2008 1. Consolidated figures for ICICI Bank Limited, banking subsidiaries and ICICI Home Finance Company. 7,058.5 (3,660.6) 3,397.9 j. Movement of provisions for depreciation on investments Rupees in million Amount Opening balance as on April 1, 2007 Provisions made during the year (Write-off... -

Page 177

... loans and current assets for working capital finance. For project finance, security of the assets of the borrower and assignment of the underlying project contracts is generally taken. In addition, in some cases, additional security such as pledge of shares, cash collateral, charge on receivables... -

Page 178

..., life insurance policies with a declared surrender value issued by an insurance company which is regulated by the insurance sector regulator, certain debt securities rated by a recognized credit rating agency, mutual fund units where daily Net Asset Value (NAV) is available in public domain... -

Page 179

.... In accordance with the RBI guidelines, with effect from February 1, 2006, the Bank accounts for any loss arising from securitisation immediately at the time of sale and the profit/premium arising from securitisation is amortised over the life of the securities issued or to be issued by the special... -

Page 180

...- Pillar 3 Disclosures (Consolidated) d. Break-up of total outstanding exposures securitized by exposure type (March 31, 2008) Rupees in million Exposure type Vehicle / equipment loans Home & home equity loans Personal loans Corporate loans a. Deals originated in current year where the Bank does not... -

Page 181

...type Vehicle / equipment loans Home & home equity loans Personal loans Corporate loans Mixed assets Total 1. This includes gain on sale of assets. 2. Includes subordinate contribution amount deducted from capital. 3. Includes credit enhancements and capital deducted on PTCs originated by ICICI Bank... -

Page 182

... rates, exchange rates, credit spreads and other asset prices. The market risk for the Bank and each of its banking subsidiaries is managed in accordance with the investment policies, which are approved by the respective Boards. These policies ensure that operations in securities, foreign exchange... -

Page 183

...relevant policies. All business groups are required to operate within these limits. Hedge transactions for banking book transactions are periodically assessed for hedge effectiveness as per home and host country financial guidelines. b. Capital requirements for market risk (March 31, 2008) Rupees in... -

Page 184

...Risk Management Framework for IRRBB Interest rate risk is the risk of potential variability in earnings and capital value resulting from changes in market interest rates. The Bank holds assets, liabilities and off balance sheet items across various markets with different maturity or re-pricing dates... -

Page 185

... points increase on the MTM book. The MTM book, including securities held for statutory liquidity ratio requirements of RBI, comprises all fixed income securities in available for sale and held for trading books, interest rate swaps, and any other derivatives, which have to be marked to market. The... -

Page 186

...455.3 Currency INR USD JPY GBP EURO CHF Others Total1 1. Consolidated figures for ICICI Bank Limited, ICICI Bank UK PLC, ICICI Bank Canada, ICICI Bank Eurasia LLC, ICICI Home Finance Company and ICICI Securities and its subsidiaries. As on March 31, 2008, impact on economic value of equity is as... -

Page 187

Global Reach ICICI Bank's global network, today, spans 18 countries. Canada UK Russia Belgium Germany China USA Bahrain Bangladesh Dubai HongKong Qatar Abu Dhabi India Thailand Malaysia Sri Lanka Indonesia Singapore South Africa Graphical Representation. Not to scale. Cover2008.indd 3 6/23/... -

Page 188

Cover2008.indd 4 6/23/08 10:30:54 AM