Tyson Foods 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

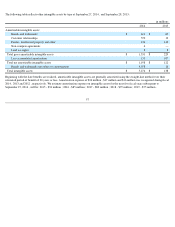

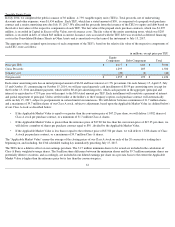

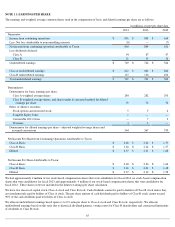

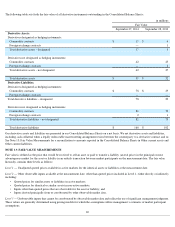

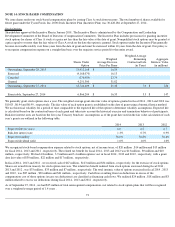

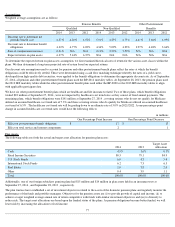

The following table sets forth the pretax impact of cash flow hedge derivative instruments in the Consolidated Statements of Income:

Fair value hedges

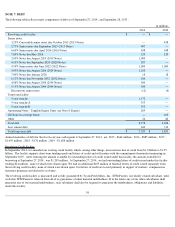

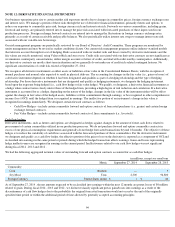

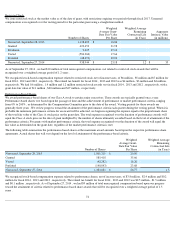

We designate certain futures contracts as fair value hedges of firm commitments to purchase livestock for slaughter. Our objective of these

hedges is to minimize the risk of changes in fair value created by fluctuations in commodity prices associated with fixed price livestock firm

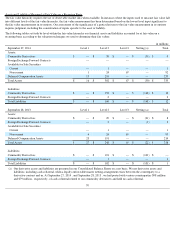

commitments. We had the following aggregated notional values of outstanding forward contracts entered into to hedge firm commitments

which are accounted for as a fair value hedge:

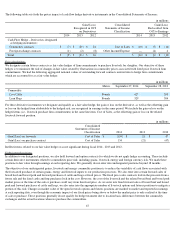

For these derivative instruments we designate and qualify as a fair value hedge, the gain or loss on the derivative, as well as the offsetting gain

or loss on the hedged item attributable to the hedged risk, are recognized in earnings in the same period. We include the gain or loss on the

hedged items (i.e., livestock purchase firm commitments) in the same line item, Cost of Sales, as the offsetting gain or loss on the related

livestock forward position.

Ineffectiveness related to our fair value hedges was not significant during fiscal 2014 , 2013 and 2012 .

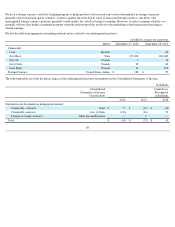

Undesignated positions

In addition to our designated positions, we also hold forward and option contracts for which we do not apply hedge accounting. These include

certain derivative instruments related to commodities price risk, including grains, livestock, energy and foreign currency risk. We mark these

positions to fair value through earnings at each reporting date. We generally do not enter into undesignated positions beyond 18 months .

The objective of our undesignated grains, livestock and energy commodity positions is to reduce the variability of cash flows associated with

the forecasted purchase of certain grains, energy and livestock inputs to our production processes. We also enter into certain forward sales of

boxed beef and boxed pork and forward purchases of cattle and hogs at fixed prices. The fixed price sales contracts lock in the proceeds from a

future sale and the fixed cattle and hog purchases lock in the cost. However, the cost of the livestock and the related boxed beef and boxed pork

market prices at the time of the sale or purchase could vary from this fixed price. As we enter into fixed forward sales of boxed beef and boxed

pork and forward purchases of cattle and hogs, we also enter into the appropriate number of livestock options and futures positions to mitigate a

portion of this risk. Changes in market value of the open livestock options and futures positions are marked to market and reported in earnings

at each reporting date, even though the economic impact of our fixed prices being above or below the market price is only realized at the time

of sale or purchase. These positions generally do not qualify for hedge treatment due to location basis differences between the commodity

exchanges and the actual locations when we purchase the commodities.

67

in millions

Gain/(Loss)

Recognized in OCI

on Derivatives

Consolidated

Statements of Income

Classification

Gain/(Loss)

Reclassified from

OCI to Earnings

2014

2013

2012

2014

2013

2012

Cash Flow Hedge – Derivatives designated

as hedging instruments:

Commodity contracts

$

(7

)

$

(29

)

$

24

Cost of Sales

$

(10

)

$

(5

)

$

(16

)

Foreign exchange contracts

(1

)

(2

)

(8

)

Other Income/Expense

—

(

4

)

4

Total

$

(8

)

$

(31

)

$

16

$

(10

)

$

(9

)

$

(12

)

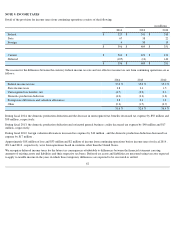

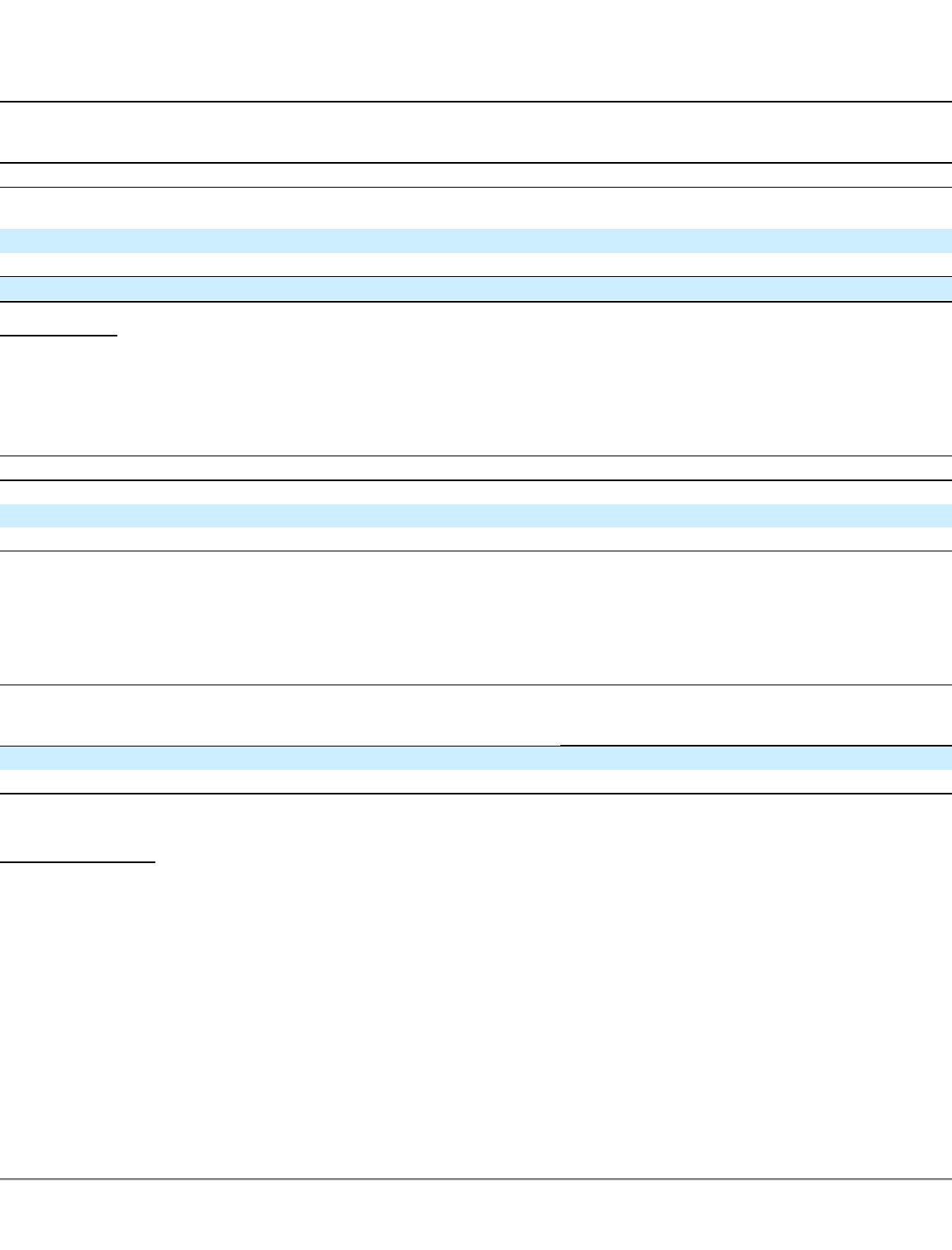

in millions

Metric

September 27, 2014

September 28, 2013

Commodity:

Live Cattle

Pounds

427

209

Lean Hogs

Pounds

329

384

in millions

Consolidated

Statements of Income

Classification

2014

2013

2012

Gain/(Loss) on forwards

Cost of Sales

$

(154

)

$

21

$

47

Gain/(Loss) on purchase contract

Cost of Sales

154

(21

)

(47

)