Tyson Foods 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228

|

|

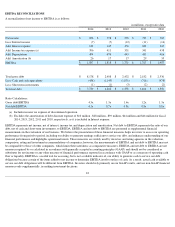

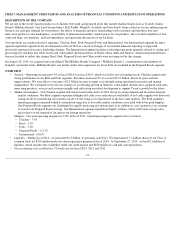

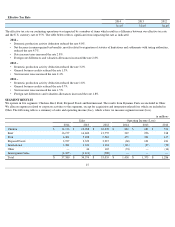

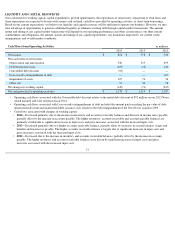

The effective tax rate on continuing operations was impacted by a number of items which result in a difference between our effective tax rate

and the U.S. statutory rate of 35%. The table below reflects significant items impacting the rate as indicated.

2014 –

2013 –

2012 –

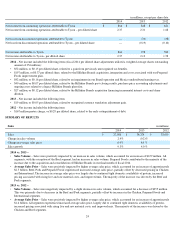

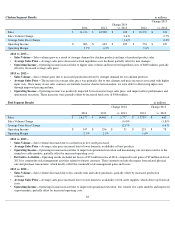

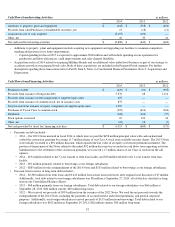

SEGMENT RESULTS

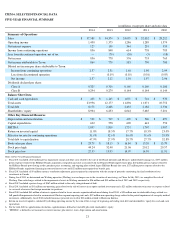

We operate in five segments: Chicken, Beef, Pork, Prepared Foods and International. The results from Dynamic Fuels are included in Other.

We allocate expenses related to corporate activities to the segments, except for acquisition and integration related fees which are included in

Other. The following table is a summary of sales and operating income (loss), which is how we measure segment income (loss).

27

Effective Tax Rate

2014

2013

2012

31.6

%

32.6

%

36.4

%

•

Domestic production activity deduction reduced the rate 4.0%.

•

Net decrease in unrecognized tax benefits, mostly related to expiration of statutes of limitations and settlements with taxing authorities,

reduced the rate 4.7%.

•

State income taxes increased the rate 2.8%.

•

Foreign rate differences and valuation allowances increased the rate 2.8%.

•

Domestic production activity deduction reduced the rate 3.2%.

•

General business credits reduced the rate 1.3%.

•

State income taxes increased the rate 2.4%.

•

Domestic production activity deduction reduced the rate 1.8%.

•

General business credits reduced the rate 0.7%.

•

State income taxes increased the rate 1.5%.

•

Foreign rate differences and valuation allowances increased the rate 1.8%.

in millions

Sales

Operating Income (Loss)

2014

2013

2012

2014

2013

2012

Chicken

$

11,116

$

10,988

$

10,270

$

883

$

683

$

554

Beef

16,177

14,400

13,755

347

296

218

Pork

6,304

5,408

5,510

455

332

417

Prepared Foods

3,927

3,322

3,237

(60

)

101

181

International

1,381

1,324

1,104

(121

)

(37

)

(70

)

Other

—

46

167

(74

)

—

(

14

)

Intersegment Sales

(1,325

)

(1,114

)

(988

)

—

—

—

Total

$

37,580

$

34,374

$

33,055

$

1,430

$

1,375

$

1,286