Tyson Foods 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

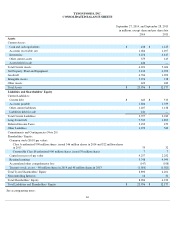

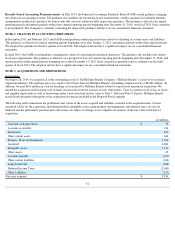

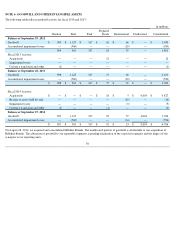

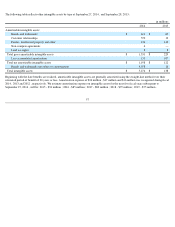

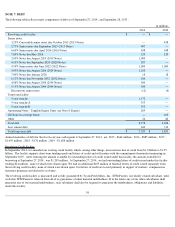

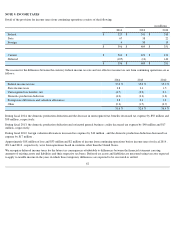

The fair value of identifiable intangible assets is as follows:

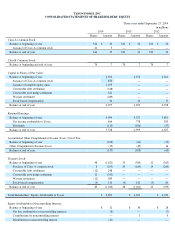

As a result of the acquisition, we recognized a total of $4,804 million of goodwill. The purchase price was assigned to assets acquired and

liabilities assumed based on their estimated fair values as of the date of acquisition, and any excess was allocated to goodwill, as shown in the

table above. Goodwill represents the value we expect to achieve through the implementation of operational synergies and growth opportunities

primarily in our Prepared Foods segment. We do not expect the final fair value of goodwill to be deductible for U.S. income tax purposes.

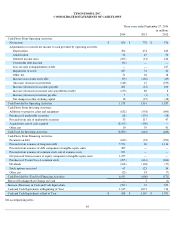

We used various valuation techniques to determine fair value, with the primary techniques being discounted cash flow analysis, relief-from-

royalty and excess earnings valuation approaches, which use significant unobservable inputs, or Level 3 inputs, as defined by the fair value

hierarchy. Under these valuation approaches, we are required to make estimates and assumptions about sales, operating margins, growth rates,

royalty rates and discount rates based on budgets, business plans, economic projections, anticipated future cash flows and marketplace data.

The acquisition of Hillshire Brands was accounted for using the acquisition method of accounting, and consequently, the results of operations

for Hillshire Brands are reported in our consolidated financial statements from the date of acquisition. Hillshire Brands' one month results were

insignificant to our Consolidated Statements of Income.

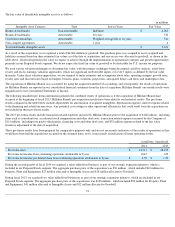

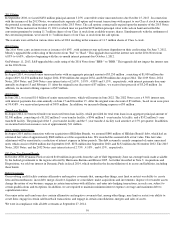

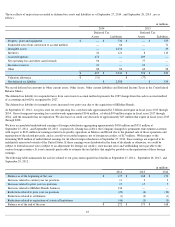

The following unaudited pro forma information presents the combined results of operations as if the acquisition of Hillshire Brands had

occurred at the beginning of fiscal 2013. Hillshire Brands' pre-acquisition results have been added to our historical results. The pro forma

results contained in the table below include adjustments for amortization of acquired intangibles, depreciation expense, interest expense related

to the financing and related income taxes. Any potential cost savings or other operational efficiencies that could result from the acquisition are

not included in these pro forma results.

The 2013 pro forma results include transaction related expenses incurred by Hillshire Brands prior to the acquisition of $168 million

, including

items such as consultant fees, accelerated stock compensation and other deal costs; transaction related expenses incurred by the Company of

$115 million , including fees paid to third parties, financing costs and other deal costs; and $32 million expense related to the fair value

inventory adjustment at the date of acquisition.

These pro forma results have been prepared for comparative purposes only and are not necessarily indicative of the results of operations as they

would have been had the acquisitions occurred on the assumed dates, nor is it necessarily an indication of future operating results.

During the second quarter of fiscal 2014 we acquired a value-added food business as part of our strategic expansion initiative, which is

included in our Prepared Foods segment. The aggregate purchase price of the acquisition was $56 million , which included $12 million for

Property, Plant and Equipment, $27 million allocated to Intangible Assets and $18 million allocated to Goodwill.

During fiscal 2013, we acquired two value-added food businesses as part of our strategic expansion initiative, which are included in our

Prepared Foods segment. The aggregate purchase price of the acquisitions was $106 million , which included $50 million for Property, Plant

and Equipment, $41 million allocated to Intangible Assets and $12 million allocated to Goodwill.

53

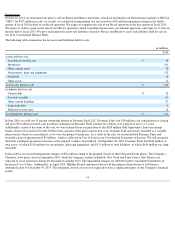

in millions

Intangible Asset Category

Type

Life in Years

Fair Value

Brands & trademarks

Non-amortizable

Indefinite

$

4,062

Brands & trademarks

Amortizable

20 years

532

Customer relationships

Amortizable

Weighted average life of 16 years

541

Non-compete agreements

Amortizable

1 year

6

Total identifiable intangible assets

$

5,141

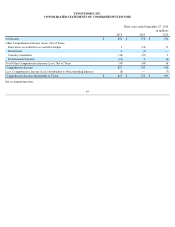

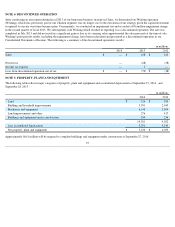

in millions (unaudited)

2014

2013

Pro forma sales

$

41,311

$

38,195

Pro forma net income from continuing operations attributable to Tyson

1,047

655

Pro forma net income per diluted share from continuing operations attributable to Tyson

$

2.50

$

1.52