Tyson Foods 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

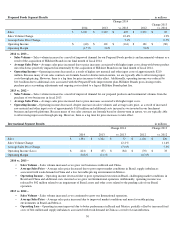

2014/2013/2012 – Interest income remained relatively flat due to continued low interest rates.

2014/2013/2012 –

2014 – Included $60 million of costs associated with bridge financing facilities for the Hillshire Brands acquisition and $6 million of other

than temporary impairment related to an available-for-sale security, partially offset with $14 million of equity earnings in joint

ventures and net foreign currency exchange gains.

2013 – Included $19 million related to recognized currency translation adjustment gain.

2012 – Included $16 million of equity earnings in joint ventures and $4 million in net foreign currency exchange gains.

26

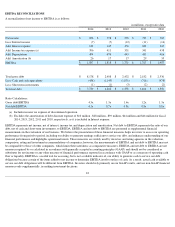

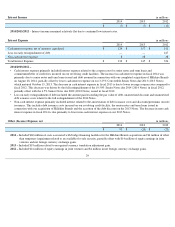

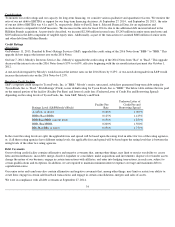

Interest Income

in millions

2014

2013

2012

$

(7

)

$

(7

)

$

(12

)

Interest Expense

in millions

2014

2013

2012

Cash interest expense, net of amounts capitalized

$

124

$

117

$

151

Loss on early extinguishment of debt

—

—

167

Non-cash interest expense

8

28

38

Total Interest Expense

$

132

$

145

$

356

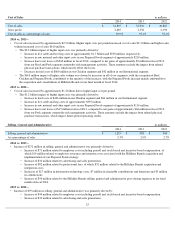

• Cash interest expense primarily included interest expense related to the coupon rates for senior notes and term loans and

commitment/letter of credit fees incurred on our revolving credit facilities. The increase in cash interest expense in fiscal 2014 was

primarily due to senior notes and term loans issued and debt assumed in connection with our completed acquisition of Hillshire Brands

on August 28, 2014, partially offset by lower cash interest expense on our 3.25% Convertible Senior Notes due 2013 (2013 Notes)

which matured October 15, 2013. The decrease in cash interest expense in fiscal 2013 is due to lower average coupon rates compared to

fiscal 2012. This decrease was driven by the full extinguishment of the 10.50% Senior Notes due 2014 (2014 Notes) in fiscal 2012,

partially offset with the 4.5% Senior Notes due 2022 (2022 Notes) issued in fiscal 2012.

• Loss on early extinguishment of debt included the amount paid exceeding the par value of debt, unamortized discount and unamortized

debt issuance costs related to the full extinguishment of the 2014 Notes.

•

Non

-

cash interest expense primarily included interest related to the amortization of debt issuance costs and discounts/premiums on note

issuances. This includes debt issuance costs incurred on our revolving credit facility, the senior notes and term loans issued in

connection with our acquisition of Hillshire Brands and the accretion of the debt discount on the 2013 Notes. The decrease in non-cash

interest expense in fiscal 2014 is due primarily to lower non-cash interest expense on our 2013 Notes.

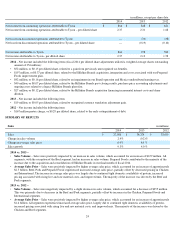

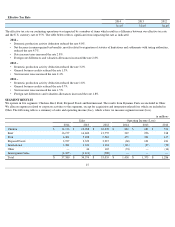

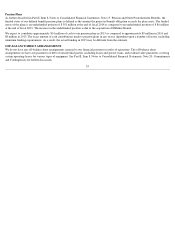

Other (Income) Expense, net

in millions

2014

2013

2012

$

53

$

(20

)

$

(23

)