Tyson Foods 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 vs. 2013 –

2013 vs. 2012 –

2014 vs. 2013 –

2013 vs. 2012 –

28

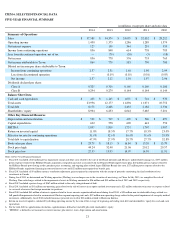

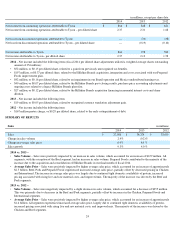

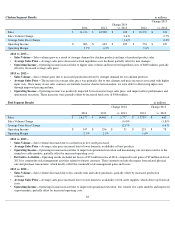

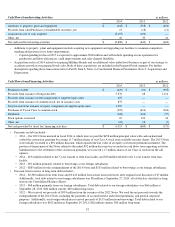

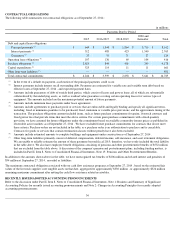

Chicken Segment Results

in millions

2014

2013

Change 2014

vs. 2013

2012

Change 2013

vs. 2012

Sales

$

11,116

$

10,988

$

128

$

10,270

$

718

Sales Volume Change

2.6

%

0.7

%

Average Sales Price Change

(1.4

)%

6.2

%

Operating Income

$

883

$

683

$

200

$

554

$

129

Operating Margin

7.9

%

6.2

%

5.4

%

• Sales Volume –

Sales volume grew as a result of stronger demand for chicken products and mix of rendered product sales.

• Average Sales Price –

Average sales price decreased as feed ingredient costs declined, partially offset by mix changes.

• Operating Income – Operating income increased due to higher sales volume and lower feed ingredient costs of $600 million, partially

offset by decreased average sales price.

• Sales Volume –

Sales volume grew due to increased production driven by stronger demand for our chicken products.

• Average Sales Price – The increase in average sales price was primarily due to mix changes and price increases associated with higher

input costs. Since many of our sales contracts are formula based or shorter-term in nature, we were able to offset rising input costs

through improved pricing and mix.

• Operating Income – Operating income was positively impacted by increased average sales price, and improved live performance and

operational execution. These increases were partially offset by increased feed costs of $406 million.

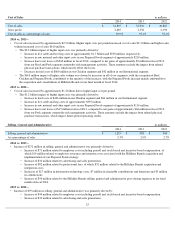

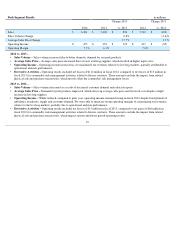

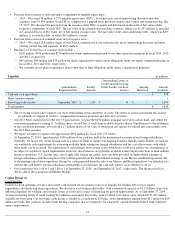

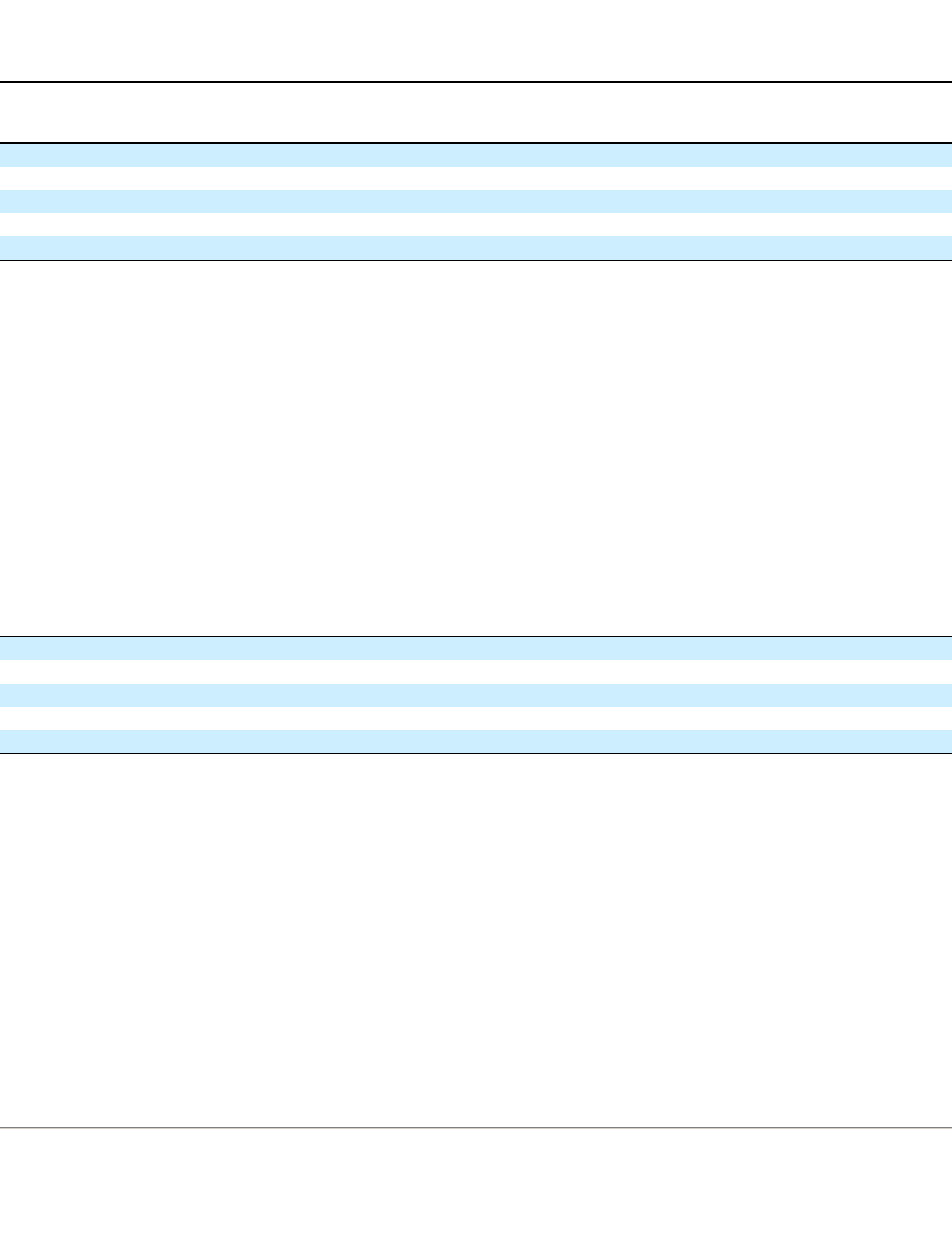

Beef Segment Results

in millions

2014

2013

Change 2014

vs. 2013

2012

Change 2013

vs. 2012

Sales

$

16,177

$

14,400

$

1,777

$

13,755

$

645

Sales Volume Change

(0.4

)%

(1.8

)%

Average Sales Price Change

12.8

%

6.6

%

Operating Income

$

347

$

296

$

51

$

218

$

78

Operating Margin

2.1

%

2.1

%

1.6

%

• Sales Volume –

Sales volume decreased due to a reduction in live cattle processed.

• Average Sales Price –

Average sales price increased due to lower domestic availability of beef products.

• Operating Income – Operating income increased due to improved operational execution and maximizing our revenues relative to the

rising live cattle markets, partially offset by increased operating costs.

• Derivative Activities –

Operating results included net losses of $72 million in fiscal 2014, compared to net gains of $9 million in fiscal

2013 for commodity risk management activities related to futures contracts. These amounts exclude the impact from related physical

sale and purchase transactions, which mostly offset the commodity risk management gains and losses.

• Sales Volume – Sales volume decreased due to less outside trim and tallow purchases, partially offset by increased production

volumes.

• Average Sales Price –

Average sales price increased due to lower domestic availability of fed cattle supplies, which drove up livestock

costs.

• Operating Income –

Operating income increased due to improved operational execution, less volatile live cattle markets and improved

export markets, partially offset by increased operating costs.