Tyson Foods 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

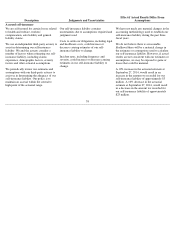

Description

Judgments and Uncertainties

Effect if Actual Results Differ From

Assumptions

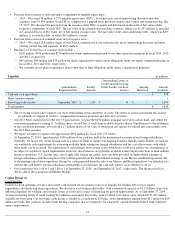

Income taxes

We estimate total income tax expense based

on statutory tax rates and tax planning

opportunities available to us in various

jurisdictions in which we earn income.

Federal income tax includes an estimate for

taxes on earnings of foreign subsidiaries

expected to be taxable upon remittance to

the United States, except for earnings

considered to be indefinitely invested in the

foreign subsidiary.

Deferred income taxes are recognized for the

future tax effects of temporary differences

between financial and income tax reporting

using tax rates in effect for the years in

which the differences are expected to

reverse.

Valuation allowances are recorded when it is

likely a tax benefit will not be realized for a

deferred tax asset.

We record unrecognized tax benefit

liabilities for known or anticipated tax issues

based on our analysis of whether, and the

extent to which, additional taxes will be due.

Changes in tax laws and rates could affect

recorded deferred tax assets and liabilities in

the future.

Changes in projected future earnings could

affect the recorded valuation allowances in the

future.

Our calculations related to income taxes

contain uncertainties due to judgment used to

calculate tax liabilities in the application of

complex tax regulations across the tax

jurisdictions where we operate.

Our analysis of unrecognized tax benefits

contains uncertainties based on judgment used

to apply the more likely than not recognition

and measurement thresholds.

We do not believe there is a reasonable

likelihood there will be a material change in

the tax related balances or valuation

allowances. However, due to the complexity

of some of these uncertainties, the ultimate

resolution may result in a payment that is

materially different from the current estimate

of the tax liabilities.

To the extent we prevail in matters for which

unrecognized tax benefit liabilities have been

established, or are required to pay amounts in

excess of our recorded unrecognized tax

benefit liabilities, our effective tax rate in a

given financial statement period could be

materially affected. An unfavorable tax

settlement would require use of our cash and

generally result in an increase in our effective

tax rate in the period of resolution. A

favorable tax settlement would generally be

recognized as a reduction in our effective tax

rate in the period of resolution.

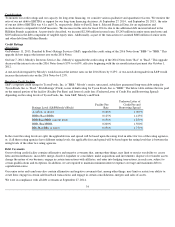

Impairment of long-lived assets

Long-lived assets are evaluated for

impairment whenever events or changes in

circumstances indicate the carrying value

may not be recoverable. Examples include a

significant adverse change in the extent or

manner in which we use a long-

lived asset or

a change in its physical condition.

When evaluating long-lived assets for

impairment, we compare the carrying value

of the asset to the asset’s estimated

undiscounted future cash flows. An

impairment is indicated if the estimated

future cash flows are less than the carrying

value of the asset. For long-lived assets held

for sale, we compare the carrying value of

the disposal group to fair value. The

impairment is the excess of the carrying

value over the fair value of the long-lived

asset.

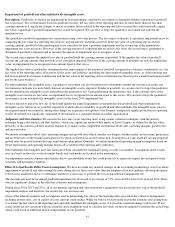

We recorded impairment charges related to

long-lived assets of $107 million, $74

million and $29 million, in fiscal 2014, 2013

and 2012, respectively.

Our impairment analysis contains

uncertainties due to judgment in assumptions

and estimates surrounding undiscounted

future cash flows of the long-lived asset,

including forecasting useful lives of assets and

selecting the discount rate that reflects the risk

inherent in future cash flows to determine fair

value.

We have not made any material changes in the

accounting methodology used to evaluate the

impairment of long-

lived assets during the last

three fiscal years.

We do not believe there is a reasonable

likelihood there will be a material change in

the estimates or assumptions used to calculate

impairments of long-lived assets. However, if

actual results are not consistent with our

estimates and assumptions used to calculate

estimated future cash flows, we may be

exposed to impairment losses that could be

material.

Additionally, we continue to evaluate our

domestic and international operations and

strategies, which may expose us to future

impairment losses.