Tyson Foods 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

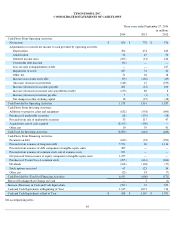

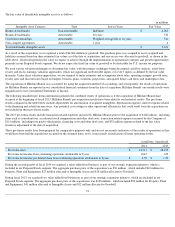

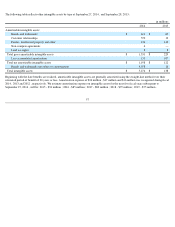

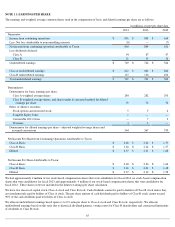

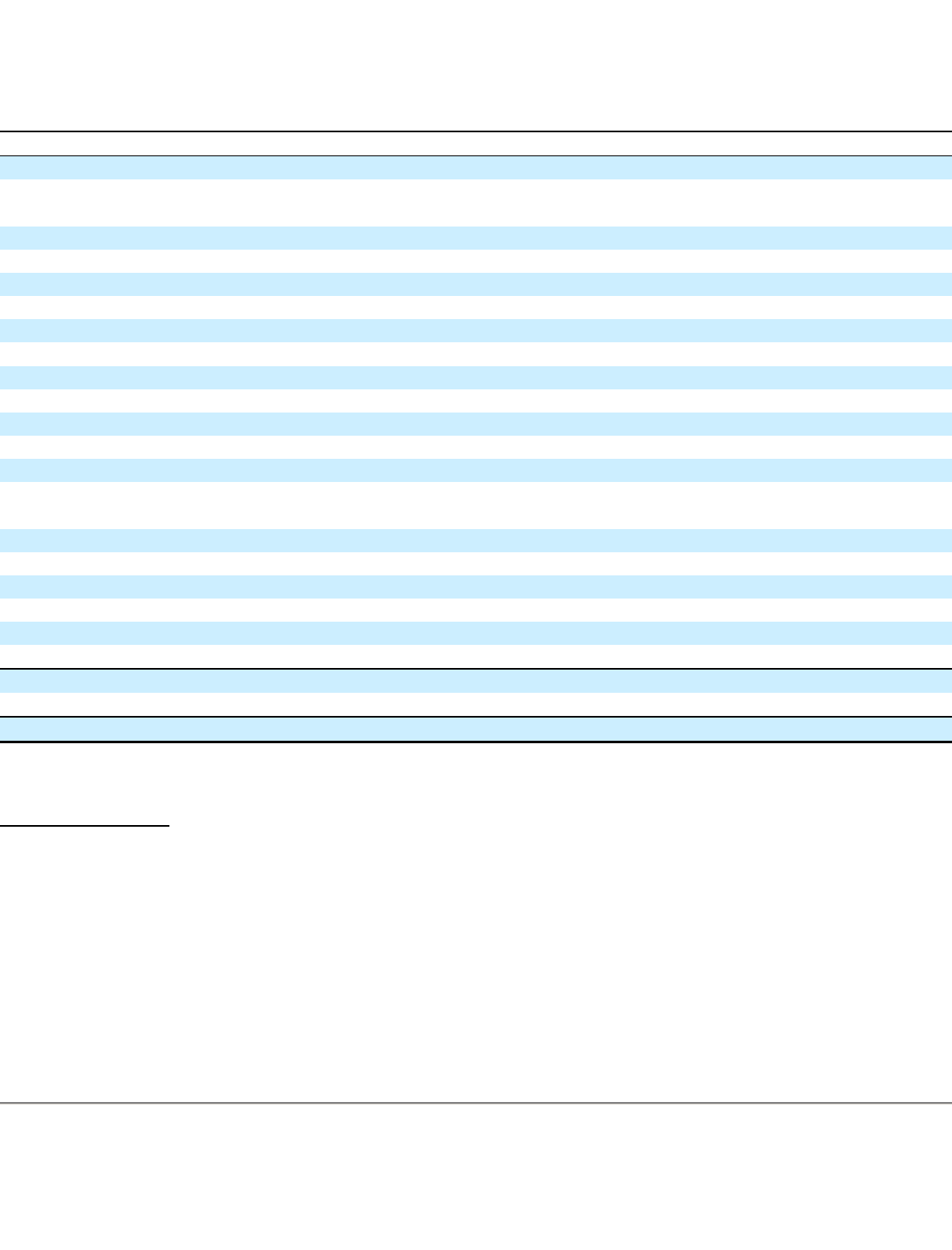

NOTE 7: DEBT

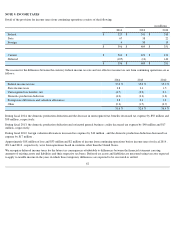

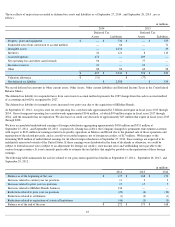

The following table reflects major components of debt as of September 27, 2014 , and September 28, 2013 :

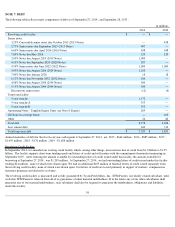

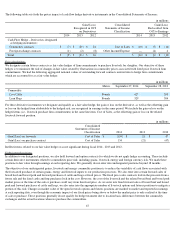

Annual maturities of debt for the five fiscal years subsequent to September 27, 2014 , are: 2015 - $644 million ; 2016 - $885 million ; 2017 -

$1,059 million ; 2018 - $176 million ; 2019 - $1,688 million .

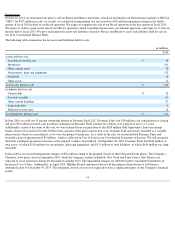

Revolving Credit Facility

In September 2014, we amended our existing credit facility which, among other things, increased our line of credit from $1.0 billion to $1.25

billion . The facility supports short-term funding needs and letters of credit and will mature with the commitments thereunder terminating in

September 2019 . After reducing the amount available by outstanding letters of credit issued under this facility, the amount available for

borrowing at September 27, 2014 , was $1,209 million . At September 27, 2014 , we had outstanding letters of credit issued under this facility

totaling $41 million , none of which were drawn upon. We had an additional $105 million of bilateral letters of credit issued separately from

the revolving credit facility, none of which were drawn upon. Our letters of credit are issued primarily in support of workers’ compensation

insurance programs and derivative activities.

The revolving credit facility is unsecured and is fully guaranteed by Tyson Fresh Meats, Inc. (TFM Parent), our wholly owned subsidiary, until

such date TFM Parent is released from all of its guarantees of other material indebtedness. If in the future any of our other subsidiaries shall

guarantee any of our material indebtedness, such subsidiary shall also be required to guarantee the indebtedness, obligations and liabilities

under this facility.

58

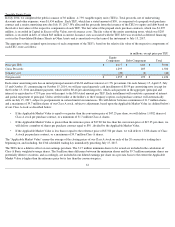

in millions

2014

2013

Revolving credit facility

$

—

$

—

Senior notes:

3.25% Convertible senior notes due October 2013 (2013 Notes)

—

458

2.75% Senior notes due September 2015 (2015 Notes)

407

—

6.60% Senior notes due April 2016 (2016 Notes)

638

638

7.00% Notes due May 2018

120

120

2.65% Notes due August 2019 (2019 Notes)

1,000

—

4.10% Notes due September 2020 (2020 Notes)

287

—

4.50% Senior notes due June 2022 (2022 Notes)

1,000

1,000

3.95% Notes due August 2024 (2024 Notes)

1,250

—

7.00% Notes due January 2028

18

18

6.13% Notes due November 2032 (2032 Notes)

164

—

4.88% Notes due August 2034 (2034 Notes)

500

—

5.15% Notes due August 2044 (2044 Notes)

500

—

Discount on senior notes

(12

)

(6

)

Term loan facility:

3-year tranche

1,172

—

5-year tranche A

353

—

5-year tranche B

552

—

Amortizing Notes - Tangible Equity Units (see Note 8: Equity)

205

—

GO Zone tax-exempt bonds

—

100

Other

24

80

Total debt

8,178

2,408

Less current debt

643

513

Total long-term debt

$

7,535

$

1,895