Tyson Foods 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

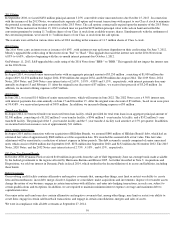

Recently Issued Accounting Pronouncements: In May 2014, the Financial Accounting Standards Board (FASB) issued guidance changing

the criteria for recognizing revenue. The guidance also modifies the related disclosure requirements, clarifies guidance for multiple-element

arrangements and provides guidance for transactions that were not addressed fully in previous guidance. The guidance is effective for annual

reporting periods and interim periods within those annual reporting periods beginning after December 15, 2016, our fiscal 2018. Early adoption

is not permitted. The Company is currently evaluating the impact this guidance will have on our consolidated financial statements.

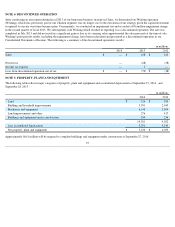

NOTE 2: CHANGES IN ACCOUNTING PRINCIPLES

In December 2011 and February 2013, the FASB issued guidance enhancing disclosures related to offsetting of certain assets and liabilities.

This guidance is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods.

We adopted this guidance in the first quarter of fiscal 2014. The adoption did not have a significant impact on our consolidated financial

statements.

In April 2014, the FASB issued guidance changing the criteria for reporting discontinued operations. The guidance also modifies the related

disclosure requirements. The guidance is effective on a prospective basis for annual reporting periods beginning after December 15, 2014, and

interim periods within annual periods beginning on or after December 15, 2015. Early adoption is permitted and we adopted it in the third

quarter of fiscal 2014. The adoption did not have a significant impact on our consolidated financial statements.

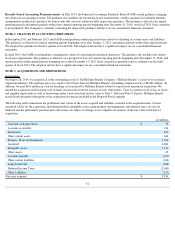

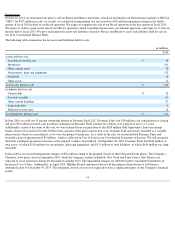

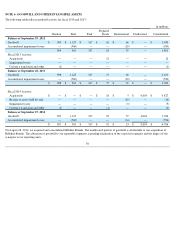

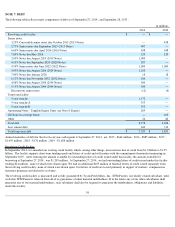

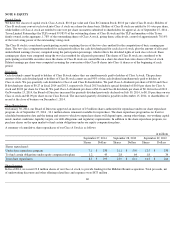

NOTE 3: ACQUISITIONS AND DISPOSITIONS

Acquisitions

On August 28, 2014, we acquired all of the outstanding stock of The Hillshire Brands Company ("Hillshire Brands") as part of our strategic

expansion initiative. The purchase price was equal to $63.00 per share for Hillshire Brands' outstanding common stock, or $8,081 million . In

addition, we paid $163 million in cash for breakage costs incurred by Hillshire Brands related to a previously announced acquisition. We

funded the acquisition with existing cash on hand, net proceeds from the issuance of new senior notes, Class A common stock (Class A stock),

and tangible equity units as well as borrowings under a new term loan facility (refer to Note 7: Debt and Note 8: Equity). Hillshire Brands'

results from operations subsequent to the acquisition closing are included in the Prepared Foods segment.

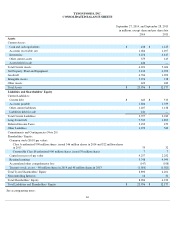

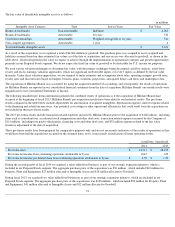

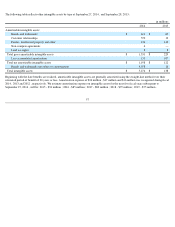

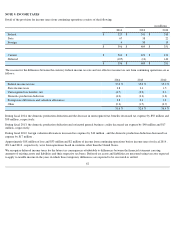

The following table summarizes the preliminary fair values of the assets acquired and liabilities assumed at the acquisition date. Certain

estimated values for the acquisition, including goodwill, intangible assets, plant property and equipment, and deferred taxes, are not yet

finalized and the preliminary purchase price allocations are subject to change as we complete our analysis of the fair value at the date of

acquisition.

52

in millions

Cash and cash equivalents

$

72

Accounts receivable

236

Inventories

421

Other current assets

344

Property, Plant and Equipment

1,306

Goodwill

4,804

Intangible Assets

5,141

Other Assets

45

Accounts payable

(347

)

Other current liabilities

(324

)

Long-Term Debt

(868

)

Deferred Income Taxes

(2,069

)

Other Liabilities

(517

)

Net asset acquired

$

8,244