Tyson Foods 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

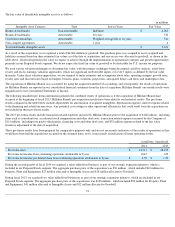

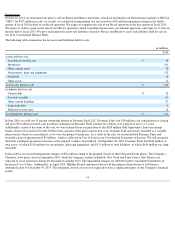

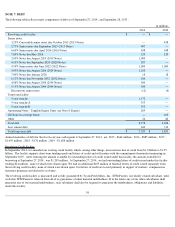

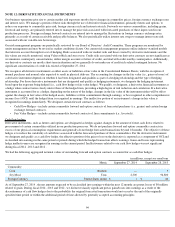

2013 Notes

In September 2008, we issued $458 million principal amount 3.25% convertible senior unsecured notes due October 15, 2013 . In connection

with the issuance of the 2013 Notes, we entered into separate call option and warrant transactions with respect to our Class A stock to minimize

the potential economic dilution upon conversion of the 2013 Notes. The call options contractually expired upon the maturity of the 2013 Notes.

The 2013 Notes matured on October 15, 2013 at which time we paid the $458 million principal value with cash on hand and settled the

conversion premium by issuing 11.7 million shares of our Class A stock from available treasury shares. Simultaneously with the settlement of

the conversion premium, we received 11.7 million shares of our Class A stock from the call options.

The warrants were settled on various dates in fiscal 2014 resulting in the issuance of 11.7 million shares of Class A stock.

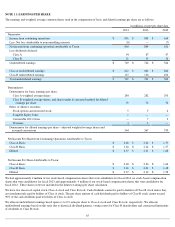

2016 Notes

The 2016 Notes carry an interest rate at issuance of 6.60% , with an interest step up feature dependent on their credit rating. On June 7, 2012,

Moody's upgraded the credit rating of these notes from "Ba1" to "Baa3." This upgrade decreased the interest rate on the 2016 Notes from

6.85% to 6.60% , effective beginning with the six-month interest payment due October 1, 2012.

On February 11, 2013, S&P upgraded the credit rating of the 2016 Notes from "BBB-" to "BBB." This upgrade did not impact the interest rate

on the 2016 Notes.

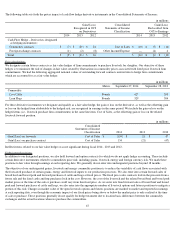

2019 / 2024 / 2034 / 2044 Notes

In August 2014, we issued senior unsecured notes with an aggregate principal amount of $3,250 million , consisting of $1,000 million due

August 2019, $1,250 million due August 2024, $500 million due August 2034, and $500 million due August 2044. The 2019 Notes, 2024

Notes, 2034 Notes, and 2044 Notes carry interest rates of

2.65% , 3.95% , 4.88% and 5.15% , respectively, with interest payments due semi-

annually on August 15 and February 15. After the original issue discounts of $7 million , we received net proceeds of $3,243 million . In

addition, we incurred offering expenses of $27 million .

2022 Notes

In June 2012, we issued $1.0 billion of senior unsecured notes, which will mature in June 2022. The 2022 Notes carry a 4.50% interest rate,

with interest payments due semi-annually on June 15 and December 15. After the original issue discount of $5 million , based on an issue price

of 99.458% , we received net proceeds of $995 million . In addition, we incurred offering expenses of $9 million .

Term Loan Facility

In August 2014, we borrowed under our unsecured term loan facility, which provided for total term loans in an aggregate principal amount of

$2,300 million , consisting of a $1,202 million 3 -year tranche facility, a $546 million 5 -year tranche A facility, and a $552 million 5 -year

tranche B facility. The principal of the 3 -year tranche facility and the 5 -year tranche A facility each amortize at 2.5% per quarter. In addition,

we incurred term loan issuance costs of approximately $11 million .

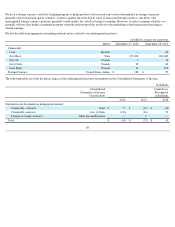

2015 / 2020 / 2032 Notes

In August 2014 and in connection with our acquisition of Hillshire Brands, we assumed $840 million of Hillshire Brands' debt, which had an

estimated fair value of approximately $868 million as of the acquisition date. We recorded the assumed debt at fair value. This fair value

adjustment will be amortized as a reduction of interest expense in future periods. The debt assumed is mainly comprised of senior unsecured

notes which consist of $400 million due September 2015, $278 million due September 2020, and $152 million due November 2032. The 2015

Notes, 2020 Notes, and the 2032 Notes carry interest rates of

2.75% , 4.10% , and 6.13% , respectively.

GO Zone Tax-Exempt Bonds

In October 2008, Dynamic Fuels received $100 million in proceeds from the sale of Gulf Opportunity Zone tax-exempt bonds made available

by the federal government to the regions affected by Hurricanes Katrina and Rita in 2005. As further described in Note 3: Acquisitions and

Dispositions, we sold our interest in Dynamic Fuels in fiscal 2014, which resulted in the deconsolidation of its assets and liabilities, including

these bonds.

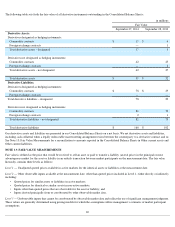

Debt Covenants

Our revolving credit facility contains affirmative and negative covenants that, among other things, may limit or restrict our ability to: create

liens and encumbrances; incur debt; merge, dissolve, liquidate or consolidate; make acquisitions and investments; dispose of or transfer assets;

change the nature of our business; engage in certain transactions with affiliates; and enter into hedging transactions, in each case, subject to

certain qualifications and exceptions. In addition, we are required to maintain minimum interest expense coverage and maximum debt to

capitalization ratios.

Our senior notes and term loans also contain affirmative and negative covenants that, among other things, may limit or restrict our ability to:

create liens; engage in certain sale/leaseback transactions; and engage in certain consolidations, mergers and sales of assets.

We were in compliance with all debt covenants at September 27, 2014 .

59