Tyson Foods 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

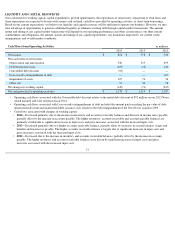

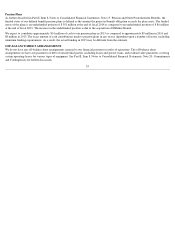

Capital Resources

Credit Facility

Cash flows from operating activities and current cash on hand are our primary sources of liquidity for funding debt service, capital

expenditures, dividends and share repurchases. We also have a revolving credit facility, with a committed capacity of $1.25 billion, to provide

additional liquidity for working capital needs, letters of credit and a source of financing for growth opportunities. As of September 27, 2014 ,

we had outstanding letters of credit totaling $41 million issued under this facility, none of which were drawn upon, which left $1,209 million

available for borrowing. Our revolving credit facility is funded by a syndicate of 42 banks, with commitments ranging from $0.3 million to $85

million per bank. The syndicate includes bank holding companies that are required to be adequately capitalized under federal bank regulatory

agency requirements.

33

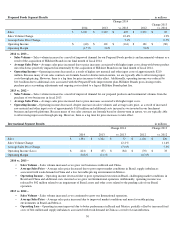

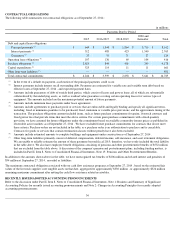

• Proceeds from issuance of debt and equity components of tangible equity units

–

• 2014 – We issued 30 million, 4.75% tangible equity units (TEUs). Total proceeds, net of underwriting discounts and other

expenses, were $1,454 million. Each TEU is comprised of a prepaid stock purchase contract and a senior amortizing note due July

15, 2017. We allocated the proceeds from the issuance of the TEUs to equity and debt based on the relative fair values of the

respective components of each TEU. The fair value of the prepaid stock purchase contracts, which was $1,295 million, is recorded

in Capital in Excess of Par Value, net of $40 million issuance costs. The fair value of the senior amortizing notes, which was $205

million, is recorded in debt, of which $65 million is current.

• Proceeds from issuance of common stock, net of issuance costs

–

• 2014 – We issued 23.8 million shares of our Class A common stock, for total proceeds, net of underwriting discounts and other

offering related fees and expenses, of $873 million.

• Purchases of Tyson Class A common stock include

–

• $250 million, $550 million and $230 million for shares repurchased pursuant to our share repurchase program in fiscal 2014, 2013

and 2012, respectively.

• $

45 million, $64 million and $34 million for shares repurchased to fund certain obligations under our equity compensation plans in

fiscal 2014, 2013 and 2012, respectively.

•

We currently do not plan to repurchase shares other than to fund obligations under equity compensation programs.

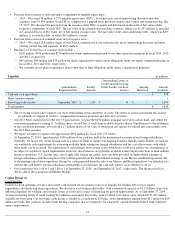

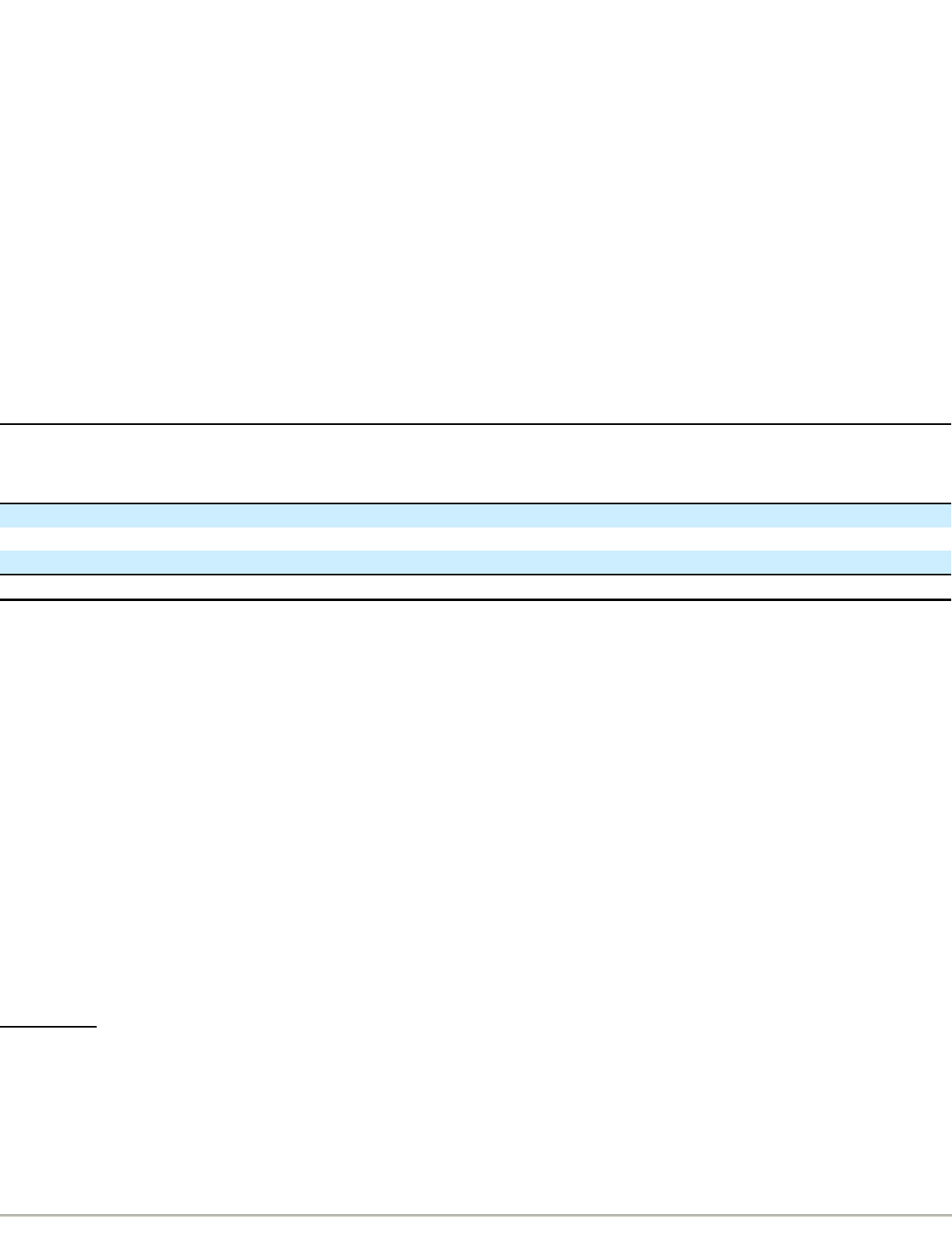

Liquidity

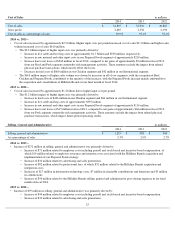

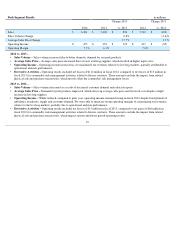

in millions

Commitments

Expiration Date

Facility

Amount

Outstanding Letters of

Credit under Revolving

Credit Facility (no draw

downs)

Amount

Borrowed

Amount

Available

Cash and cash equivalents

$

438

Short-term investments

1

Revolving credit facility

September 2019

$

1,250

$

41

$

—

1,209

Total liquidity

$

1,648

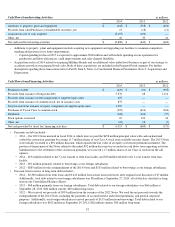

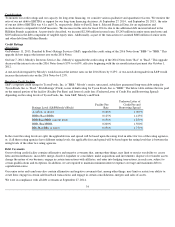

• The revolving credit facility supports our short-term funding needs and letters of credit. The letters of credit issued under this facility

are primarily in support of workers’ compensation insurance programs and derivative activities.

• Our 2013 Notes matured in October 2013. Upon maturity, we paid the $458 million principal value with cash on hand, and settled the

conversion premium by issuing 11.7 million shares of our Class A stock from available treasury shares. Simultaneous to the settlement

of the conversion premium, we received 11.7 million shares of our Class A stock from call options we entered into concurrently with

the 2013 Note issuance.

• We expect net interest expense will approximate $290 million for fiscal 2015 (53-

weeks).

• At September 27, 2014 , approximately $380 million of our cash was held in the international accounts of our foreign subsidiaries.

Generally, we do not rely on the foreign cash as a source of funds to support our ongoing domestic liquidity needs. Rather, we manage

our worldwide cash requirements by reviewing available funds among our foreign subsidiaries and the cost effectiveness with which

those funds can be accessed. The repatriation of cash balances from certain of our subsidiaries could have adverse tax consequences or

be subject to regulatory capital requirements; however, those balances are generally available without legal restrictions to fund ordinary

business operations. U.S. income taxes, net of applicable foreign tax credits, have not been provided on undistributed earnings of

foreign subsidiaries with the exception of $17 million provided on the undistributed earnings of our Mexico and Brazil operations due

to the pending sale of those operations. Except for cash generated from the sale of our Mexico and Brazil operations, our intention is to

reinvest the cash held by foreign subsidiaries permanently or to repatriate the cash only when it is tax effective to do so.

• Our current ratio was 1.64 to 1 and 1.86 to 1 at September 27, 2014 , and September 28, 2013 , respectively. The decrease in fiscal

2014 is due to the acquisition of Hillshire Brands.