Tyson Foods 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

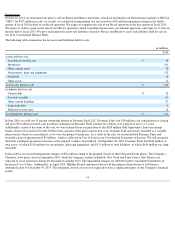

NOTE 8: EQUITY

Capital Stock

We have two classes of capital stock, Class A stock, $0.10 par value and Class B Common Stock, $0.10 par value (Class B stock). Holders of

Class B stock may convert such stock into Class A stock on a share-for-share basis. Holders of Class B stock are entitled to 10 votes per share,

while holders of Class A stock are entitled to one vote per share on matters submitted to shareholders for approval. As of September 27, 2014 ,

Tyson Limited Partnership (the TLP) owned 99.985% of the outstanding shares of Class B stock and the TLP and members of the Tyson

family owned, in the aggregate, 1.78% of the outstanding shares of Class A stock, giving them, collectively, control of approximately 70.14%

of the total voting power of the outstanding voting stock.

The Class B stock is considered a participating security requiring the use of the two-class method for the computation of basic earnings per

share. The two-class computation method for each period reflects the cash dividends paid for each class of stock, plus the amount of allocated

undistributed earnings (losses) computed using the participation percentage, which reflects the dividend rights of each class of stock. Basic

earnings per share were computed using the two-class method for all periods presented. The shares of Class B stock are considered to be

participating convertible securities since the shares of Class B stock are convertible on a share-for-share basis into shares of Class A stock.

Diluted earnings per share were computed assuming the conversion of the Class B shares into Class A shares as of the beginning of each

period.

Dividends

Cash dividends cannot be paid to holders of Class B stock unless they are simultaneously paid to holders of Class A stock. The per share

amount of the cash dividend paid to holders of Class B stock cannot exceed 90% of the cash dividend simultaneously paid to holders of

Class A stock. We pay quarterly cash dividends to Class A and Class B shareholders. We paid Class A dividends per share of $0.30 and Class

B dividends per share of $0.27 in fiscal 2014 and 2013, respectively. Fiscal 2013 included a special dividend of $0.10 per share for Class A

stock and $0.09 per share for Class B. We paid Class A dividends per share of $0.16 and Class B dividends per share of $0.144 in fiscal 2012 .

On November 13, 2014, the Board of Directors increased the quarterly dividend previously declared on July 30, 2014, to $0.10

per share on our

Class A stock and $0.09 per share on our Class B stock. The increased quarterly dividend is payable on December 15, 2014, to shareholders of

record at the close of business on December 1, 2014.

Share Repurchases

On January 30, 2014, our Board of Directors approved an increase of 25 million shares authorized for repurchase under our share repurchase

program. As of September 27, 2014 , 32.1 million shares remained available for repurchase. The share repurchase program has no fixed or

scheduled termination date and the timing and extent to which we repurchase shares will depend upon, among other things, our working capital

needs, market conditions, liquidity targets, our debt obligations and regulatory requirements. In addition to the share repurchase program, we

purchase shares on the open market to fund certain obligations under our equity compensation plans.

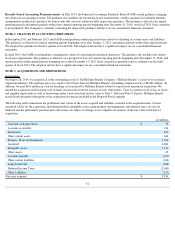

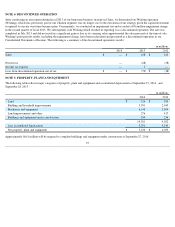

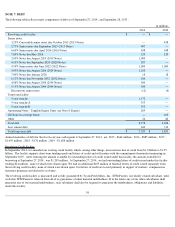

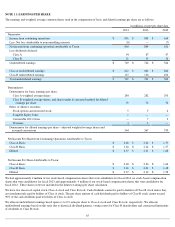

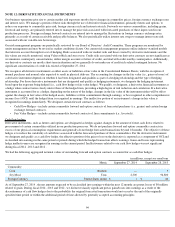

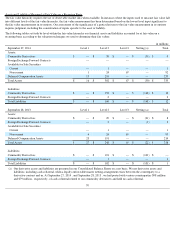

A summary of cumulative share repurchases of our Class A Stock is as follows:

Share Issuance

In fiscal 2014, we issued 23.8 million shares of our Class A stock, to provide funding for the Hillshire Brands acquisition. Total proceeds, net

of underwriting discounts and other offering related fees and expenses were $873 million .

60

in millions

September 27, 2014

September 28, 2013

September 29, 2012

Shares

Dollars

Shares

Dollars

Shares

Dollars

Shares repurchased:

Under share repurchase program

7.1

$

250

21.1

$

550

12.5

$

230

To fund certain obligations under equity compensation plans

1.2

45

2.8

64

1.8

34

Total share repurchases

8.3

$

295

23.9

$

614

14.3

$

264