Tyson Foods 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

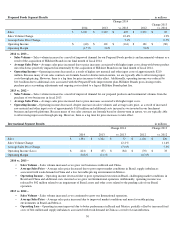

39

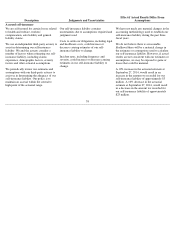

Description

Judgments and Uncertainties

Effect if Actual Results Differ From

Assumptions

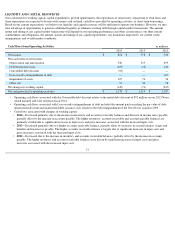

Defined benefit pension plans

We sponsor nine defined benefit pension

plans that provide retirement benefits to

certain employees. We also participate in a

multi-employer plan that provides defined

benefits to certain employees covered by

collective bargaining agreements. Such plans

are usually administered by a board of

trustees composed of the management of the

participating companies and labor

representatives.

We use independent third-party actuaries to

assist us in determining our pension

obligations and net periodic benefit cost. We

and the actuaries review assumptions that

include estimates of the present value of the

projected future pension payment to all plan

participants, taking into consideration the

likelihood of potential future events such as

salary increases and demographic

experience. We accumulate and amortize the

effect of actuarial gains and losses over

future periods.

Net periodic benefit costs for the defined

benefit pension plans were $14 million in

2014. The projected benefit obligation was

$2,031 million at the end of fiscal 2014.

Unrecognized actuarial losses were $75

million at the end of fiscal 2014. We

currently expect net periodic benefit cost for

fiscal 2015 to be approximately $8 million.

Plan assets are currently comprised of

approximately 81% fixed income securities

and 12% equity securities. Fixed income

securities can include, but are not limited to,

direct bond investments and pooled or

indirect bond investments. Other

investments may include, but are not limited

to, international and domestic equities, real

estate, commodities and private equity.

We expect to contribute approximately $14

million of cash to our pension plans in fiscal

2015. The exact amount of cash

contributions made to pension plans in any

year is dependent upon a number of factors,

including minimum funding requirements.

Our defined benefit pension plans contain

uncertainties due to assumptions required and

judgments used.

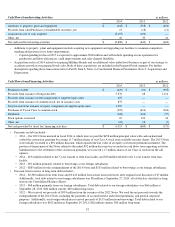

The key assumptions used in developing the

required estimates include such factors as

discount rates, expected returns on plan assets,

retirement rates, and mortality.

These assumptions can have a material impact

upon the funded status and the net periodic

benefit cost.

The discount rates were determined using a

cash flow matching technique whereby the

rates of a yield curve, developed from high-

quality debt securities, were applied to the

benefit obligations to determine the

appropriate discount rate. In determining the

long-term rate of return on plan assets, we

first examined historical rates of return for the

various asset classes within the plans. We then

determined a long-term projected rate-of-

return based on expected returns. Investment,

management and other fees paid out of plan

assets are factored into the determination of

asset return assumptions. Retirement rates are

based primarily on actual plan experience,

while standard actuarial tables are used to

estimate mortality.

It is reasonably likely that changes in external

factors will result in changes to the

assumptions used to measure pension

obligations and net periodic benefit cost in

future periods.

The risks of participating in multiemployer

plans are different from single-employer

plans. The net pension cost of the

multiemployer plans is equal to the annual

contribution determined in accordance with

the provisions of negotiated labor contracts.

Assets contributed to such plans are not

segregated or otherwise restricted to provide

benefits only to our employees. The future

cost of these plans is dependent on a number

of factors including the funded status of the

plans and the ability of the other participating

companies to meet ongoing funding

obligations.

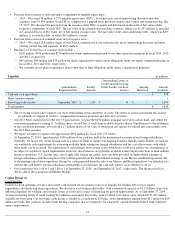

We have not made any material changes in the

accounting methodology used to establish our

pension obligations and net periodic benefit

cost during the past three fiscal years.

We do not believe there is a reasonable

likelihood there will be a material change in

the estimates or assumptions used to calculate

our pension obligations and net periodic

benefit cost. However, if actual results are not

consistent with our estimates or assumptions,

they are accumulated and amortized over

future periods and, therefore generally affect

the net periodic benefit cost in future periods.

A 1% increase in the discount rate at

September 27, 2014, would result in an

decrease in the projected benefit obligation

and net periodic benefit cost of approximately

$246 million and $2 million, respectively. A

1% decrease in the discount rate at September

27, 2014, would result in an increase in the

projected benefit obligation and decrease in

net periodic benefit cost of approximately

$283 million and $1 million, respectively.

A 1% change in the return on plan assets at

September 27, 2014, would impact the net

periodic benefit cost by approximately $16

million.

The sensitivities reflect the impact of

changing one assumption at a time and are

specific to based conditions at the end of

2014. Economic factors and conditions often

effect multiple assumption simultaneously and

that the effect of changes in assumptions are

not necessarily linear.