Tyson Foods 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

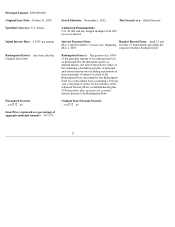

SARA LEE CORPORATION

SARA LEE CORPORATION, a Maryland corporation (herein called the “Company,” which term includes any successor

corporation under the Indenture referred to below), for value received, hereby promises to pay to Cede & Co., as nominee for The

Depository Trust Company, or registered assigns, the principal amount stated above at Stated Maturity, and to pay interest thereon

from the Original Issue Date shown above or, in the case of a Security issued upon registration of transfer or exchange, from and

including the most recent Interest Payment Date to which interest has been paid or duly provided for to, but not including, the

applicable Interest Payment Date or the Stated Maturity or any Redemption Date (each such Stated Maturity or Redemption Date

is referred to hereinafter as a “Maturity” with respect to principal repayable on such date), as the case may be, provided that if the

Original Issue Date is after a Regular Record Date and before the Interest Payment Date immediately following such Regular

Record Date, interest payments will commence on the second Interest Payment Date following the Original Issue Date, at the rate

per annum set forth above, until the principal hereof is paid or made available for payment. The interest so payable, and

punctually paid or duly provided for, on any Interest Payment Date will, as provided in such Indenture, be paid to the Person in

whose name this Security (or one or more Predecessor Securities) is registered at the close of business on the Regular Record Date

for such interest; provided , however , that interest payable at Maturity will be payable to the Person to whom principal shall be

payable. Any such interest not so punctually paid or duly provided for will forthwith cease to be payable to the Holder on such

Regular Record Date and shall be paid to the Person in whose name this Security (or one or more Predecessor Securities) is

registered at the close of business on a special record date (which shall be not less than five Business Days prior to the date of

payment of such defaulted interest) established by notice given by mail by or on behalf of the Company to the Holder of this

Security (or one or more Predecessor Securities) not less than 15 calendar days preceding such special record date (the “Special

Record Date”).

This Security is one of a duly authorized issue of securities of the Company (herein called the “Securities”), issued and to

be issued in one or more series under an Indenture dated as of October 2, 1990, as supplemented from time to time (herein called

the “Indenture”), among the Company and The Bank of New York, as successor to Continental Bank, N.A., as Trustee (herein

called the “Trustee,” which term includes any successor trustee under the Indenture), to which Indenture and all indentures

supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities

thereunder of the Company, the Trustee and the Holders of the Securities and of the terms upon which the Securities are, and are

to be, authenticated and delivered. This Security is one of the series designated on the face hereof. The Securities of this series

may be denominated in different currencies, bear different dates, mature at different times and bear interest at different rates.

Subject to being increased by the Company pursuant to an Officer’s Certificate, the aggregate principal amount of the Securities

of this series which may be authenticated and delivered pursuant to the Indenture (except as provided therein) is $500,000,000.00.

The Company will appoint and at all times maintain a Paying Agent (which may be the Trustee) authorized by the

Company to pay the principal of (and premium, if any) and interest on any Securities of this series on behalf of the Company and

having an office or agency in The City of New York, New York or The City of Chicago, Illinois where Securities of this series

may be presented or surrendered for payment and where notices, designations or requests in respect of payments with respect to

Securities of this series may be served. The Company has initially appointed The Bank of New York as such Paying Agent, with

its Corporate Trust Office currently at 101 Barclay Street, New York, New York 10286. The Company will give prompt written

notice to the Trustee of any change in such appointment.

3