Tyson Foods 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

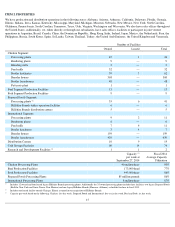

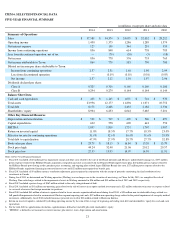

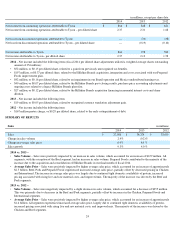

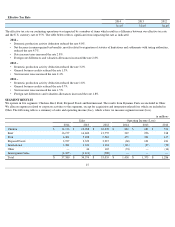

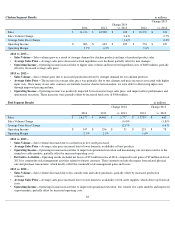

ITEM 6. SELECTED FINANCIAL DATA

FIVE-YEAR FINANCIAL SUMMARY

Notes to Five

-Year Financial Summary

21

in millions, except per share and ratio data

2014

2013

2012

2011

2010

Summary of Operations

Sales

$

37,580

$

34,374

$

33,055

$

32,032

$

28,212

Operating income

1,430

1,375

1,286

1,289

1,574

Net interest expense

125

138

344

231

333

Income from continuing operations

856

848

614

738

783

Loss from discontinued operation, net of tax

—

(

70

)

(38

)

(5

)

(18

)

Net income

856

778

576

733

765

Net income attributable to Tyson

864

778

583

750

780

Diluted net income per share attributable to Tyson:

Income from continuing operations

2.37

2.31

1.68

1.98

2.09

Loss from discontinued operation

—

(

0.19

)

(0.10

)

(0.01

)

(0.03

)

Net income

2.37

2.12

1.58

1.97

2.06

Dividends declared per share:

Class A

0.325

0.310

0.160

0.160

0.160

Class B

0.294

0.279

0.144

0.144

0.144

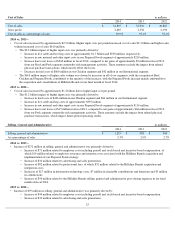

Balance Sheet Data

Cash and cash equivalents

$

438

$

1,145

$

1,071

$

716

$

978

Total assets

23,956

12,177

11,896

11,071

10,752

Total debt

8,178

2,408

2,432

2,182

2,536

Shareholders’ equity

8,904

6,233

6,042

5,685

5,201

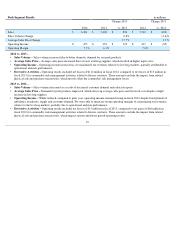

Other Key Financial Measures

Depreciation and amortization

$

530

$

519

$

499

$

506

$

497

Capital expenditures

632

558

690

643

550

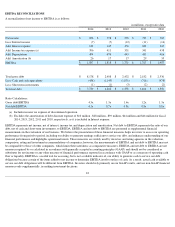

EBITDA

1,897

1,818

1,731

1,767

1,987

Return on invested capital

11.8

%

18.5

%

17.7

%

18.5

%

23.0

%

Effective tax rate for continuing operations

31.6

%

32.6

%

36.4

%

31.6

%

35.9

%

Total debt to capitalization

47.9

%

27.9

%

28.7

%

27.7

%

32.8

%

Book value per share

$

23.70

$

18.13

$

16.84

$

15.38

$

13.78

Stock price high

44.24

32.40

21.06

20.12

20.57

Stock price low

27.33

15.93

14.07

14.59

11.91

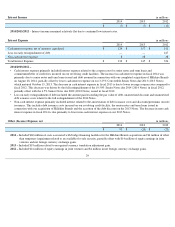

a. Fiscal 2014 included a $42 million pretax impairment charge and other costs related to the sale of our Brazil operation and Mexico's undistributed earnings tax, $197 million

pretax expense related to the Hillshire Brands acquisition, integration and costs associated with our Prepared Foods improvement plan, $40 million pretax expense related to

the Hillshire Brands post-closing results, purchase price accounting, and ongoing plant related legacy Hillshire Brands fire costs, $27 million pretax expense related to the

Hillshire Brands acquisition financing incremental interest cost and $52 million unrecognized tax benefit gain.

b. Fiscal 2013 included a $19 million currency translation adjustment gain recognized in conjunction with the receipt of proceeds constituting the final resolution of our

investment in Canada.

c. During fiscal 2013 we determined our Weifang operation (Weifang) was no longer core to the execution of our strategy in China. In July 2013, we completed the sale of

Weifang. Non-cash charges related to the impairment of assets in Weifang amounted to $56 million and $15 million in fiscal 2013 and 2012, respectively.

d.

Fiscal 2012 included a pretax charge of $167 million related to the early extinguishment of debt.

e. Fiscal 2011 included an $11 million non-

operating gain related to the sale of interest in an equity method investment and a $21 million reduction to income tax expense related

to a reversal of reserves for foreign uncertain tax positions.

f. Fiscal 2010 included $61 million of interest expense related to losses on notes repurchased/redeemed during fiscal 2010, a $29 million non-tax deductible charge related to a

full goodwill impairment related to an immaterial Chicken segment reporting unit and a $12 million non-

operating charge related to the partial impairment of an equity method

investment. Additionally, fiscal 2010 included insurance proceeds received of $38 million related to Hurricane Katrina.

g. Return on invested capital is calculated by dividing operating income by the sum of the average of beginning and ending total debt and shareholders’ equity less cash and cash

equivalents.

h. For the total debt to capitalization calculation, capitalization is defined as total debt plus total shareholders’

equity.

i.

"EBITDA" is defined as net income less interest income, plus interest, taxes, depreciation and amortization.