MetLife 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The long-term effects of the tragedies on the Company’s businesses cannot be assessed at this time. The tragedies have had significant adverse

effects on the general economic, market and political conditions, increasing many of the Company’s business risks. This may have a negative effect on

MetLife’s businesses and results of operations over time. In particular, the declines in share prices experienced after the reopening of the U.S. equity

markets following the tragedies have contributed, and may continue to contribute, to a decline in separate account assets, which in turn may have an

adverse effect on fees earned in the Company’s businesses. In addition, the Company has received and expects to continue to receive disability claims

from individuals resulting from the tragedies.

The Demutualization

On April 7, 2000 (the ‘‘date of demutualization’’), pursuant to an order by the New York Superintendent of Insurance (the ‘‘Superintendent’’) approving

its plan of reorganization, as amended (the ‘‘plan’’), Metropolitan Life converted from a mutual life insurance company to a stock life insurance company

and became a wholly-owned subsidiary of the Holding Company. In conjunction therewith, each policyholder’s membership interest was extinguished

and each eligible policyholder received, in exchange for that interest, trust interests representing shares of Common Stock held in the MetLife

Policyholder Trust, cash or an adjustment to their policy values in the form of policy credits, as provided in the plan. In addition, Metropolitan Life’s

Canadian branch made cash payments to holders of certain policies transferred to Clarica Life Insurance Company in connection with the sale of a

substantial portion of Metropolitan Life’s Canadian operations in 1998, as a result of a commitment made in connection with obtaining Canadian

regulatory approval of that sale. The payments, which were recorded in the second quarter of 2000, were determined in a manner that was consistent

with the treatment of, and fair and equitable to, eligible policyholders of Metropolitan Life.

On the date of demutualization, the Holding Company conducted an initial public offering of 202,000,000 shares of its Common Stock and

concurrent private placements of an aggregate of 60,000,000 shares of its Common Stock at an offering price of $14.25 per share. The shares of

Common Stock issued in the offerings are in addition to 494,466,664 shares of Common Stock of the Holding Company distributed to the Metropolitan

Life Policyholder Trust for the benefit of policyholders of Metropolitan Life in connection with the demutualization. On April 10, 2000, the Holding Company

issued 30,300,000 additional shares of its Common Stock as a result of the exercise of over-allotment options granted to underwriters in the initial public

offering.

Concurrently with these offerings, MetLife, Inc. and MetLife Capital Trust I, a Delaware statutory business trust wholly-owned by MetLife, Inc. (the

‘‘Trust’’), issued 20,125,000 8.00% equity security units (‘‘units’’) for an aggregate offering price of $1,006 million. Each unit originally consisted of (i) a

contract to purchase, for $50, shares of Common Stock on May 15, 2003, and (ii) a capital security of the Trust, with a stated liquidation amount of $50.

In accordance with the terms of the units, the Trust was dissolved on February 5, 2003 and $1,006 million aggregate principal amount of 8% debentures

of the Holding Company (the ‘‘MetLife debentures’’), the sole asset of the Trust, were distributed to the unit holders. As required by the terms of the units,

the MetLife debentures were remarketed on behalf of the debenture holders on February 12, 2003 and the interest rate on the MetLife debentures was

reset as of February 15, 2003 to 3.911% per annum for a yield to maturity of 2.876%.

On the date of demutualization, Metropolitan Life established a closed block for the benefit of holders of certain individual life insurance policies of

Metropolitan Life.

Acquisitions and Dispositions

In June 2002, the Company acquired Aseguradora Hidalgo S.A. (‘‘Hidalgo’’), an insurance company based in Mexico with approximately $2.5 billion

in assets as of the date of acquisition. The purchase price is subject to adjustment under certain provisions of the purchase agreement. The Company

does not expect that any purchase price adjustment will have an impact on its consolidated statements of income. The Company is in the process of

integrating Hidalgo and Seguros Genesis, S.A., (‘‘Genesis’’), MetLife’s wholly-owned Mexican subsidiary headquartered in Mexico City, to operate as a

combined entity under the name MetLife Mexico.

In November 2001, the Company acquired Compania de Seguros de Vida Santander S.A. and Compania de Reaseguros de Vida Soince Re S.A.,

wholly-owned subsidiaries of Santander Central Hispano in Chile. These acquisitions marked MetLife’s entrance into the Chilean insurance market.

In July 2001, the Company completed its sale of Conning Corporation (‘‘Conning’’), an affiliate acquired in the acquisition of GenAmerica Financial

Corporation (‘‘GenAmerica’’) in 2000. Conning specialized in asset management for insurance company investment portfolios and investment research.

In May 2001, the Company acquired Seguradora America Do Sul S.A., a life and pension company in Brazil. Seasul has been integrated into

MetLife’s wholly-owned Brazilian subsidiary, Metropolitan Life Seguros e Previdencia Privada S.A.

In February 2001, the Holding Company consummated the purchase of Grand Bank, N.A., which was renamed MetLife Bank, N.A. (‘‘MetLife

Bank’’). MetLife Bank provides banking services to individuals and small businesses in the Princeton, New Jersey area. On February 12, 2001, the

Federal Reserve Board approved the Holding Company’s application for bank holding company status and to become a financial holding company upon

its acquisition of Grand Bank, N.A.

During the second half of 2000, Reinsurance Group of America, Incorporated (‘‘RGA’’) acquired the interest in RGA Financial Group, LLC it did not

already own.

In October 2000, the Company completed the sale of its 48% ownership interest in its affiliates, Nvest, L.P. and Nvest Companies L.P.

In July 2000, the Company acquired the workplace benefits division of Business Men’s Assurance Company (‘‘BMA’’), a Kansas City, Missouri-

based insurer.

In April 2000, Metropolitan Life acquired the outstanding shares of Conning common stock not already owned by Metropolitan Life.

In January 2000, Metropolitan Life completed its acquisition of GenAmerica, a holding company which included General American Life Insurance

Company (‘‘General American’’), approximately 49% of the outstanding shares of RGA common stock, and 61% of the outstanding shares of Conning

common stock, which was subsequently sold in 2001. Metropolitan Life owned 9% of the outstanding shares of RGA common stock prior to the

completion of the GenAmerica acquisition. During 2002, the Company purchased an additional 327,600 shares of RGA’s outstanding common stock at

an aggregate price of $9.5 million to offset potential future dilution of the Company’s holding of RGA’s common stock arising from the issuance by RGA of

company-obligated mandatorily redeemable securities of a subsidiary trust in December 2001. These purchases increased the Company’s ownership

percentage of outstanding shares of RGA common stock from approximately 58% at December 31, 2001 to approximately 59% at December 31, 2002.

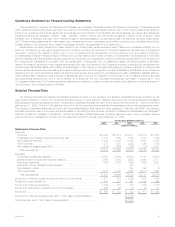

Summary of Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (‘‘GAAP’’) requires

management to adopt accounting policies and make estimates and assumptions that affect amounts reported in the consolidated financial statements.

The critical accounting policies, estimates and related judgments underlying the Company’s consolidated financial statements are summarized below. In

applying these accounting policies, management makes subjective and complex judgments that frequently require estimates about matters that are

MetLife, Inc. 5