MetLife 2002 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

be reasonably estimated. Liabilities related to certain lawsuits, including the Company’s asbestos-related liability, are especially difficult to estimate due to

the limitation of available data and uncertainty regarding numerous variables used to determine amounts recorded. The data and variables that impact the

assumption used to estimate the Company’s asbestos-related liability include the number of future claims, the cost to resolve claims, the disease mix

and severity of disease, the jurisdiction of claims filed, tort reform efforts and the impact of any possible future adverse verdicts and their amounts. It is

possible that an adverse outcome in certain of the Company’s litigation, including asbestos-related cases, or the use of different assumptions in the

determination of amounts recorded could have a material effect upon the Company’s consolidated net income or cash flows in particular quarterly or

annual periods.

Employee Benefit Plans

The Company sponsors pension and other retirement plans in various forms covering employees who meet specified eligibility requirements. The

reported expense and liability associated with these plans requires an extensive use of assumptions which include the discount rate, expected return on

plan assets and rate of future compensation increases as determined by the Company. Management determines these assumptions based upon

currently available market and industry data, historical performance of the plan and its assets, and consultation with an independent consulting actuarial

firm to aid it in selecting appropriate assumptions and valuing its related liabilities. The actuarial assumptions used by the Company may differ materially

from actual results due to changing market and economic conditions, higher or lower withdrawal rates or longer or shorter life spans of the participants.

These differences may have a significant effect on the Company’s consolidated financial statements and liquidity.

The actuarial assumptions used in the calculation of the Company’s aggregate projected benefit obligation may vary and include an expectation of

long-term market appreciation in equity markets which is not changed by minor short-term market fluctuations, but does change when large interim

deviations occur. For the largest of the plans sponsored by the Company (the Metropolitan Life Retirement Plan for United States Employees, with a

projected benefit obligation of $4.3 billion or 98.6% of all qualified plans at December 31, 2002), the discount rate, expected rate of return on plan assets,

and the range of rates of future compensation increases used in that plan’s valuation at December 31, 2002 were 6.75%, 9% and 4% to 8%,

respectively. The expected rate of return on plan assets for use in that plan’s valuation in 2003 is currently anticipated to be 8.5%.

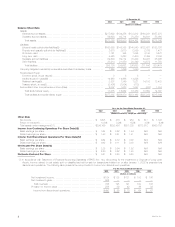

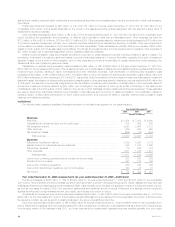

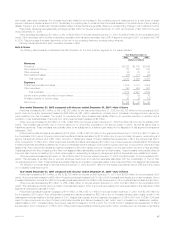

Results of Operations

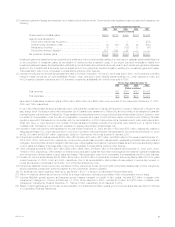

The following table presents consolidated financial information for the years indicated:

Year Ended December 31,

2002 2001 2000

(Dollars in millions)

Revenues

Premiums*********************************************************************** $19,086 $17,212 $16,317

Universal life and investment-type product policy fees ********************************** 2,139 1,889 1,820

Net investment income *********************************************************** 11,329 11,255 11,024

Other revenues ****************************************************************** 1,377 1,507 2,229

Net investment losses (net of amounts allocable to other accounts

of ($145), ($134) and ($54), respectively) ****************************************** (784) (603) (390)

Total revenues*************************************************************** 33,147 31,260 31,000

Expenses

Policyholder benefits and claims (excludes amounts directly related

to net investment losses of ($150), ($159) and $41, respectively) ********************** 19,523 18,454 16,893

Interest credited to policyholder account balances ************************************* 2,950 3,084 2,935

Policyholder dividends ************************************************************ 1,942 2,086 1,919

Payments to former Canadian policyholders ****************************************** — — 327

Demutualization costs************************************************************* — — 230

Other expenses (excludes amounts directly related to net investment

losses of $5, $25 and ($95), respectively) ***************************************** 7,061 7,022 7,401

Total expenses ************************************************************** 31,476 30,646 29,705

Income from continuing operations before provision for income taxes ********************* 1,671 614 1,295

Provision for income taxes********************************************************* 516 227 421

Income from continuing operations************************************************** 1,155 387 874

Income from discontinued operations, net of income taxes****************************** 450 86 79

Net income ********************************************************************* $ 1,605 $ 473 $ 953

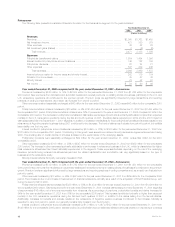

Year ended December 31, 2002 compared with the year ended December 31, 2001 — The Company

Premiums increased by $1,874 million, or 11%, to $19,086 million for the year ended December 31, 2002 from $17,212 million for the comparable

2001 period. This variance is primarily attributable to increases in the Institutional, International and Reinsurance segments. A $966 million increase in

Institutional is largely due to sales growth in its group life, dental, disability and long-term care businesses, a sale of a significant retirement and savings

contract in the second quarter of 2002, as well as new sales throughout 2002 in this segment’s structured settlements and traditional annuity products.

The June 2002 acquisition of Hidalgo, the 2001 acquisitions in Chile and Brazil and the sale of an annuity contract in the first quarter of 2002 to a

Canadian trust company are the primary drivers of a $665 million increase in International. A portion of the increase in International is also attributable to

business growth in South Korea, Mexico (excluding Hidalgo), Spain and Taiwan. In addition, an increase in Canada due to the restructuring of a pension

contract from an investment-type product to a long-term annuity contributed to this variance. New premiums from facultative and automatic treaties, and

renewal premiums on existing blocks of business contributed to a $243 million increase in the Reinsurance segment.

Universal life and investment-type product policy fees increased by $250 million, or 13%, to $2,139 million for the year ended December 31, 2002

from $1,889 million for the comparable 2001 period. This variance is primarily attributable to the Individual, International and Institutional segments. A

$120 million favorable variance in Individual is due to an increase in policy fees from insurance products, primarily due to higher revenue from insurance

MetLife, Inc. 7