MetLife 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

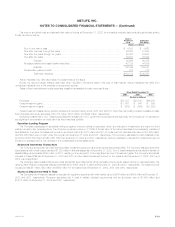

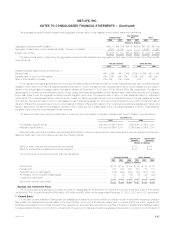

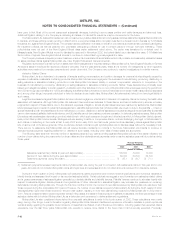

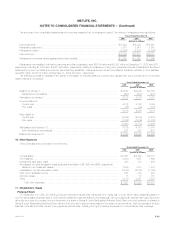

Information regarding the policyholder dividend obligation is as follows:

For the Period

April 7, 2000

Years Ended through

December 31, December 31,

2002 2001 2000

(Dollars in millions)

Balance at beginning of period ****************************************************** $ 708 $ 385 $ —

Impact on net income before amounts allocable to policyholder dividend obligation ********** 157 159 85

Net investment losses ************************************************************* (157) (159) (85)

Change in unrealized investment and derivative gains *********************************** 1,174 323 385

Balance at end of period *********************************************************** $1,882 $ 708 $385

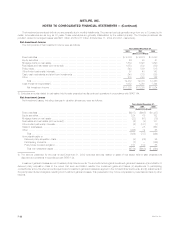

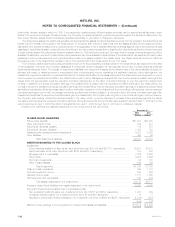

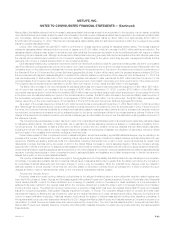

Closed block revenues and expenses were as follows:

For the Period

April 7, 2000

Years Ended through

December 31, December 31,

2002 2001 2000

(Dollars in millions)

REVENUES

Premiums *************************************************************************** $3,551 $3,658 $2,900

Net investment income and other revenues *********************************************** 2,568 2,555 1,789

Net investment gains (losses) (net of amounts allocable to the policyholder dividend obligation of

($157), ($159) and ($85), respectively) ************************************************* 168 (20) (150)

Total revenues *************************************************************** 6,287 6,193 4,539

EXPENSES

Policyholder benefits and claims ******************************************************** 3,770 3,862 2,874

Policyholder dividends ***************************************************************** 1,573 1,544 1,132

Change in policyholder dividend obligation (excludes amounts directly related to net investment

losses of ($157), ($159) and ($85), respectively)***************************************** 157 159 85

Other expenses ********************************************************************** 310 352 265

Total expenses *************************************************************** 5,810 5,917 4,356

Revenues net of expenses before income taxes ******************************************* 477 276 183

Income taxes ************************************************************************ 173 97 67

Revenues net of expenses and income taxes ********************************************* $ 304 $ 179 $ 116

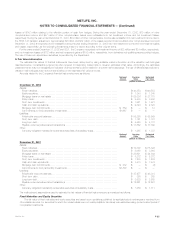

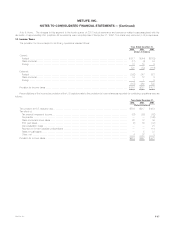

The change in maximum future earnings of the closed block was as follows:

For the Period

April 7, 2000

Years Ended through

December 31, December 31,

2002 2001 2000

(Dollars in millions)

Balance at the end of period *********************************************************** $5,114 $5,333 $5,512

Less:

Reallocation of assets *************************************************************** 85 — —

Balance at beginning of period******************************************************** 5,333 5,512 5,628

Change during period ***************************************************************** $ (304) $ (179) $ (116)

During the year ended December 31, 2002, the allocation of assets to the closed block was revised to appropriately classify assets in accordance

with the plan of demutualization. The reallocation of assets had no impact on consolidated assets or liabilities.

Metropolitan Life charges the closed block with federal income taxes, state and local premium taxes, and other additive state or local taxes, as well

as investment management expenses relating to the closed block as provided in the plan of demutualization. Metropolitan Life also charges the closed

block for expenses of maintaining the policies included in the closed block.

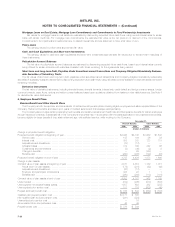

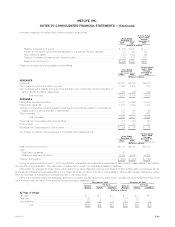

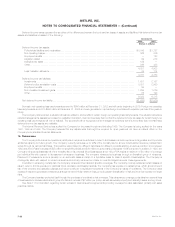

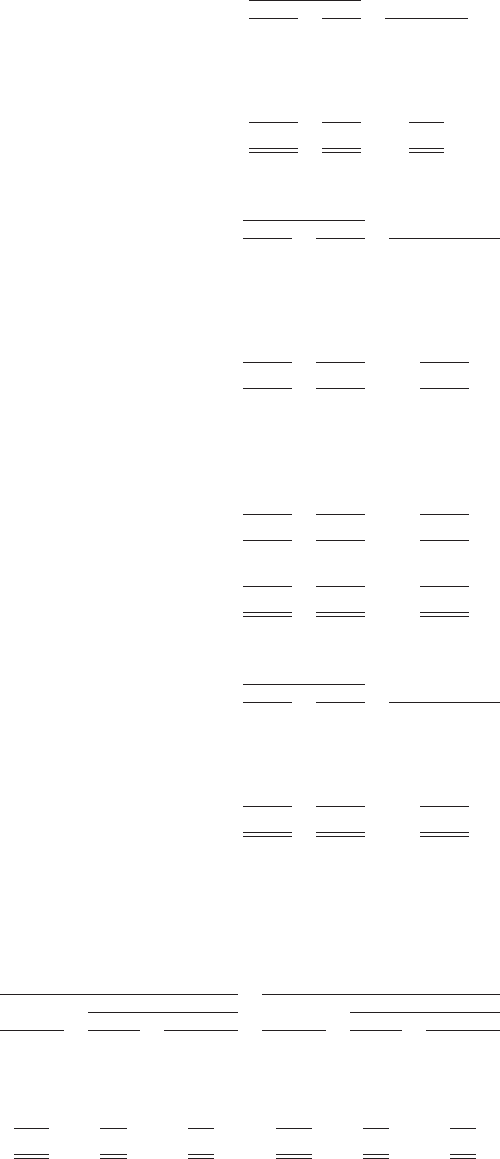

Many of the derivative instrument strategies used by the Company are also used for the closed block. The table below provides a summary of the

notional amount and fair value of derivatives by hedge accounting classification at:

December 31, 2002 December 31, 2001

Fair Value Fair Value

Notional Notional

Amount Assets Liabilities Amount Assets Liabilities

(Dollars in millions)

By Type of Hedge

Fair value ********************************************* $ — $— $— $ — $— $—

Cash flow********************************************* 128 2 11 171 22 —

Non-qualifying ***************************************** 258 32 2 112 13 5

Total ***************************************** $386 $34 $13 $283 $35 $ 5

MetLife, Inc. F-29