MetLife 2002 Annual Report Download - page 29

Download and view the complete annual report

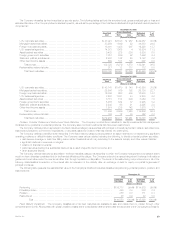

Please find page 29 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$3,514 million increase in policyholder account balances primarily from sales of annuity products, $2,550 million of cash payments to policyholders in

2000 related to the Company’s demutualization, the paydown of $2,365 million of short-term debt in 2000 and the issuance of $1,393 million in long-

term debt in 2001. Partially offsetting these activities were the issuance of $4,009 million in common stock in connection with the Company’s initial public

offering in 2000, $708 million in higher costs associated with the stock repurchase program in 2001 and $772 million in lower proceeds from the

issuance of company-obligated mandatorily redeemable securities in 2001.

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require life insurers doing business within the jurisdiction to

participate in guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies issued by impaired, insolvent or

failed life insurers. These associations levy assessments, up to prescribed limits, on all member insurers in a particular state on the basis of the

proportionate share of the premiums written by member insurers in the lines of business in which the impaired, insolvent or failed insurer engaged. Some

states permit member insurers to recover assessments paid through full or partial premium tax offsets. Assessments levied against the Company from

January 1, 2000 through December 31, 2002 aggregated $2 million. The Company maintained a liability of $62 million at December 31, 2002 for future

assessments in respect of currently impaired, insolvent or failed insurers.

In the past five years, none of the aggregate assessments levied against MetLife’s insurance subsidiaries has been material. The Company has

established liabilities for guaranty fund assessments that it considers adequate for assessments with respect to insurers that are currently subject to

insolvency proceedings.

Effects of Inflation

The Company does not believe that inflation has had a material effect on its consolidated results of operations, except insofar as inflation may affect

interest rates.

Accounting Standards

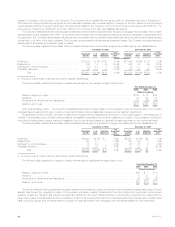

During 2002, the Company adopted or applied the following accounting standards: (i) SFAS No. 141, Business Combinations (‘‘SFAS 141’’),

(ii) SFAS No. 142 and (iii) SFAS No. 144. In accordance with SFAS 141, the elimination of $5 million of negative goodwill was reported in net income in

the first quarter of 2002 as a cumulative effect of a change in accounting. On January 1, 2002, the Company adopted SFAS 142. The Company did not

amortize goodwill during 2002. Amortization of goodwill was $47 million and $50 million for the years ended December 31, 2001 and 2000, respectively.

Amortization of other intangible assets was not material for the years December 31, 2002, 2001 and 2000. The Company has completed the required

impairment tests of goodwill and indefinite-lived intangible assets. As a result of these tests, the Company recorded a $5 million charge to earnings

relating to the impairment of certain goodwill assets in the third quarter of 2002 as a cumulative effect of a change in accounting. There was no

impairment of identified intangible assets or significant reclassifications between goodwill and other intangible assets at January 1, 2002. Adoption of

SFAS 144 did not have a material impact on the Company’s consolidated financial statements other than the presentation as discontinued operations of

net investment income and net investment gains related to operations of real estate on which the Company initiated disposition activities subsequent to

January 1, 2002 and the classification of such real estate as held-for-sale on the consolidated balance sheets.

The Financial Accounting Standards Board (‘‘FASB’’) is deliberating on a proposed statement that would further amend SFAS No. 133, Accounting

for Derivative Instruments and Hedging Activities (‘‘SFAS 133’’). The proposed statement will address certain SFAS 133 Implementation Issues. The

proposed statement is not expected to have a significant impact on the Company’s consolidated financial statements.

In January 2003, the FASB issued FASB Interpretation No. 46, Consolidation of Variable Interest Entities, an Interpretation of APB No. 51 (‘‘FIN 46’’).

FIN 46 requires certain variable interest entities to be consolidated by the primary beneficiary of the entity if the equity investors in the entity do not have

the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional

subordinated financial support from other parties. FIN 46 is effective for all new variable interest entities created or acquired after January 31, 2003. For

variable interest entities created or acquired prior to February 1, 2003, the provisions of FIN 46 must be applied for the first interim or annual period

beginning after June 15, 2003. The Company is in the process of assessing the impact of FIN 46 on its consolidated financial statements. Certain

disclosure provisions of FIN 46 were required for December 31, 2002 financial statements. Such provisions, which were adopted by the Company,

required the disclosure of the total assets and the maximum exposure to loss relating to the Company’s interests in variable interest entities.

In 2003, the FASB staff is expected to provide transition guidance with respect to the issue of whether embedded derivatives within modified

coinsurance agreements need to be accounted for separately. The Company enters into modified coinsurance and certain coinsurance agreements

under which assets equal to the net statutory reserves are withheld from the Company and legally owned by the ceding company. The withheld funds are

reflected on the Company’s balance sheet as funds withheld at interest and totaled $2.1 billion as of December 31, 2002. The Company also cedes

business under certain modified coinsurance agreements. As of December 31, 2002, the Company has not separately accounted for any potential

embedded derivatives associated with these contracts, which it believes is consistent with GAAP, as well as industry practice. The Company cannot

estimate the impact, if any, associated with the adoption of any new FASB guidance expected to be issued in 2003.

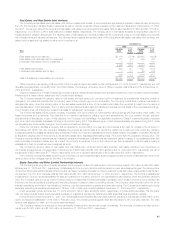

In December 2002, the FASB issued SFAS No. 148, Accounting for Stock-Based Compensation — Transition and Disclosure (‘‘SFAS 148’’), which

provides guidance on how to transition from the intrinsic value method of accounting for stock-based employee compensation under Accounting

Principles Board (‘‘APB’’) Opinion No. 25 Accounting for Stock-Issued to Employees (‘‘APB 25’’) to the fair value method of accounting from SFAS

No. 123 Accounting for Stock-Based Compensation (‘‘SFAS 123’’), if a company so elects. Effective January 1, 2003, the Company adopted the fair

value method of recording stock options under SFAS 123. In accordance with alternatives available under the transitional guidance of SFAS 148, the

Company has elected to apply the fair value method of accounting for stock options prospectively to awards granted subsequent to January 1, 2003. As

permitted, options granted prior to January 1, 2003, will continue to be accounted for under APB 25, and the pro forma impact of accounting for these

options at fair value will continue to be disclosed in the consolidated financial statements until the last of those options vest in 2005. Had the Company

expensed stock options beginning January 1, 2002, the income statement impact would have been approximately $23 million pretax, and $15 million, or

$0.02 per diluted share, after tax, in 2002. As the cost of anticipated future option awards is phased in over a three-year period, the annual impact in the

third year (2005) will rise to approximately $0.07 per diluted share, assuming options are granted in future years at a similar level and under similar market

conditions to 2002. The actual impact per diluted share may vary in the event the fair value or the number of options granted increases or decreases from

the current estimate, or if the current accounting guidance changes.

In November 2002, the FASB issued Interpretation No. 45, Guarantor’s Accounting and Disclosure Requirements for Guarantees Including Indirect

Guarantees of Indebtedness of Others (‘‘FIN 45’’). FIN 45 requires entities to establish liabilities for certain types of guarantees, and expands financial

statement disclosures for others. Disclosure requirements under FIN 45 are effective for financial statements of annual periods ending after December 15,

MetLife, Inc. 25