MetLife 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

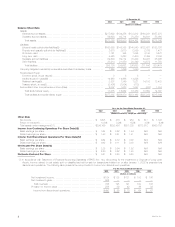

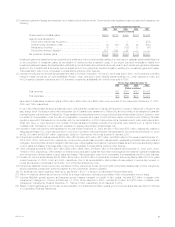

Through improved operating fundamentals, including rate increases, Auto & Home exceeded its goal of $155 million in operating

earnings and achieved a combined ratio under 100%. And, through strategic and accretive acquisitions in Mexico and Chile, our

International business nearly tripled its operating earnings while continuing to plant seeds for future growth.

HLeveraging the Power of the Enterprise

To broaden our services and capitalize on a trend in our business over the past several years—the increasing popularity of voluntary

benefits in the workplace, such as life insurance, long-term care, auto and home insurance, and financial advice—we placed our

Individual and Institutional Businesses under a shared services umbrella in 2002. The U.S. Insurance and Financial Services businesses,

while distinct, leverage the strengths of our Individual Business and Institutional Business by creating a common administrative platform

which will bring to bear the company’s full resources to enhance top-line growth, create greater efficiencies, increase expense savings,

bolster product development and accelerate the pace of technology enhancements. More importantly, we will be better positioned to

serve our customers.

HAchieving Milestones

We made a number of business inroads in 2002, including continued success with eBusiness initiatives such as MyBenefits,

MetDental.com and MetLink. By year-end, group life premiums, fees and other revenues were $5.16 billion, voluntary benefit premiums

topped $3 billion, and retirement and savings entered the market with its new fully bundled 401(k) product. Annuity deposits were

$7.89 billion, driven by increases in production by: MetLife Investors Group, up 98%; New England Financial, up 32%; MetLife

Resources, up 16%; and, MetLife Financial Services, up 6%. Fixed annuity deposits were $1.47 billion and variable annuity deposits

were $6.42 billion.

In the international arena, MetLife’s acquisition of Mexico’s Aseguradora Hidalgo S.A., vaulted us to the #1 spot in life insurance in

that country. This acquisition enabled MetLife to further expand its presence in Mexico, a country in which we’ve had very good

experience through MetLife Genesis, a wholly-owned subsidiary since 1992.

International is a growth area for MetLife as we continue to tap opportunities in underserved, yet growing markets worldwide. In fact,

we are challenging International to grow operating earnings by 30% to 40% and operating revenues by 15% to 20% each year, obtaining

leadership positions in three or four countries by 2005, and to contribute 7%-9% of the company’s total operating revenues and

operating earnings by that year.

HMetLife and Snoopy

Part of our strength as a company comes from our brand, one of the most widely recognized and trusted in the world. Snoopy is our

corporate ambassador and has been an important part of our advertising campaigns for more than 17 years. In December 2002, we

signed a new 10-year contract with United Media to continue the inclusion of Snoopy and the PEANUTS characters in MetLife’s

domestic and certain international advertising.

HSetting Higher Standards for Performance

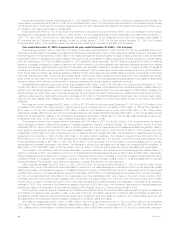

MetLife’s relentless focus on performance management continues to produce tangible results. Consider that six years ago, when we

implemented performance management, our adjusted operating return on equity was 7%. As of December 31, 2002, our operating return

on equity was 11.7%. What this tells me, and the broader investment community, is that we are driving results by rewarding perform-

ance. Within this culture, we continue to attract and retain top achievers. People are recognizing that MetLife is an exciting place to be.

With solid business strategies, capital strength and continued discipline around operational excellence, MetLife is very well posi-

tioned. Our tradition of trust and integrity has become a vital point of differentiation that has enabled MetLife to benefit from the flight to

quality evidenced in today’s marketplace. This is something we’re proud of, and which is reaffirmed day-to-day as an integral part of how

we manage our business.

MetLife’s leadership in the world’s financial service arena carries with it responsibilities as large as they are exciting. To me, there can

be no doubt about our ability to deliver on our promises. There can be no question as to our honor. Earning marketplace respect, and

your respect as our shareholders, is a priority for me, and for all employees of MetLife. Thank you for your continued commitment to

MetLife’s success.

Sincerely,

Robert H. Benmosche

Chairman of the Board and Chief Executive Officer

March 27, 2003

* Operating return on equity is defined as operating earnings divided by average equity (excluding unrealized investment gains and losses). Operating earnings is defined as

net income excluding net investment gains or losses, net of income taxes. Operating earnings is a non-GAAP financial measure that management uses in managing the

company’s business and evaluating its results.

Adjusted operating return on equity also excludes $190 million, net of income taxes, of certain litigation-related charges.