MetLife 2002 Annual Report Download - page 19

Download and view the complete annual report

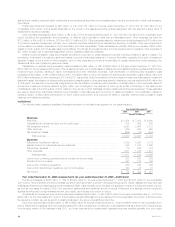

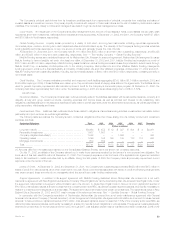

Please find page 19 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.market performance. This decrease is partially offset by a $33 million increase in group insurance due to growth in the administrative service businesses

and a settlement received in 2002 related to the Company’s former medical business.

Policyholder benefits and claims increased by $415 million, or 5%, to $9,339 million for the year ended December 31, 2002 from $8,924 million for

the comparable 2001 period. This variance is attributable to increases of $238 million and $177 million in group insurance and retirement and savings,

respectively. Excluding $291 million of 2001 claims related to the September 11, 2001 tragedies, group insurance policyholder benefits and claims

increased by $529 million commensurate with the aforementioned premium growth in this segment’s group life, dental, disability, and long-term care

businesses. Excluding $215 million of 2001 policyholder benefits related to the fourth quarter 2001 business realignment initiatives, retirement and

savings policyholder benefits increased $392 million, commensurate with the aforementioned premium growth.

Interest credited to policyholders decreased by $81 million, or 8%, to $932 million for the year ended December 31, 2002 from $1,013 million for

the comparable 2001 period. Decreases of $42 million and $39 million in retirement and savings and group insurance, respectively, are primarily

attributable to declines in the average crediting rates in 2002 as a result of the current low interest rate environment.

Policyholder dividends decreased by $144 million, or 56%, to $115 million for the year ended December 31, 2002 from $259 million for the

comparable 2001 period. This decline is largely attributable to unfavorable mortality experience of several large group clients. Policyholder dividends vary

from period to period based on participating contract experience, which are generally recorded in policyholder benefits and claims.

Other expenses decreased by $215 million, or 12%, to $1,531 million for the year ended December 31, 2002 from $1,746 million in the

comparable 2001 period. Retirement and savings decreased by $293 million, primarily attributable to $184 million of accrued expenses related to

business realignment initiatives recorded in the fourth quarter of 2001 (predominantly related to the Company’s exit from the large market 401(k)

business), $30 million of which was released into income in the fourth quarter of 2002. In addition, ongoing expenses for the defined contribution product

have steadily decreased throughout 2002. The net reduction in retirement and savings is partially offset by an increase in pension and post-retirement

costs. Group insurance other expenses increased by $78 million. This increase is mainly attributable to growth in operational expenses for the dental and

disability products, as well as group insurance’s non-deferrable expenses, including a certain portion of premium taxes and commissions. These

variances are commensurate with the aforementioned premium growth. In addition, an increase in pension and post-retirement costs contributed to the

variance.

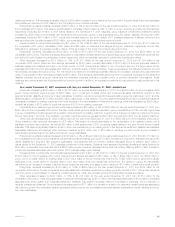

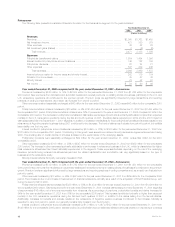

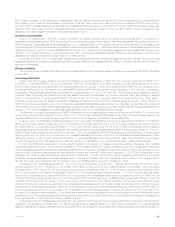

Year ended December 31, 2001 compared with the year ended December 31, 2000—Institutional

Premiums increased by $388 million, or 6%, to $7,288 million for the year ended December 31, 2001 from $6,900 million for the comparable 2000

period. Group insurance premiums grew by $680 million, due, in most part, to sales growth and continued favorable policyholder retention in this

segment’s dental, disability and long-term care businesses. In addition, premiums received from several existing group life customers in 2001 and the

BMA acquisition contributed $173 million and $29 million, respectively, to this variance. The 2000 balance includes $124 million in additional insurance

coverages purchased by existing customers with funds received in the demutualization. Retirement and savings premiums decreased by $292 million,

primarily as a result of $270 million in premiums received in 2000 from existing customers.

Universal life and investment-type product policy fees increased by $45 million, or 8%, to $592 million for the year ended December 31, 2001 from

$547 million for the comparable 2000 period. The rise in fees reflects growth in sales and deposits in group universal life and COLI products. Higher fees

in group universal life products represent an increase in insured lives for an existing customer, coupled with a change in a customer preference for group

life over optional term products. The increase in corporate-owned life insurance represents a $27 million fee received in 2001 from an existing customer.

Other revenues decreased by $1 million to $649 million for the year ended December 31, 2001 from $650 million for the comparable 2000 period.

Group insurance other revenues decreased by $19 million. This decline is primarily attributable to the renegotiation of an existing contract with a

significant long-term care customer, as well as $20 million in final settlements in 2000 on several cases relating to the term life and former medical

business. This variance is partially offset by a rise in other revenues stemming from sales growth in this segment’s dental and disability administrative

businesses. Retirement and savings’ other revenues increased by $18 million, due to $12 million in earnings on seed money and an increase in

administrative services fees for the defined contribution group businesses.

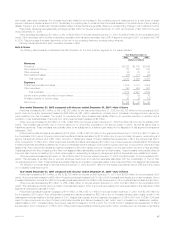

Policyholder benefits and claims increased by $746 million, or 9%, to $8,924 million for the year ended December 31, 2001 from $8,178 million for

the comparable 2000 period. Group insurance policyholder benefits and claims grew by $778 million, primarily due to growth in this segment’s group life,

dental, disability and long-term care insurance businesses, commensurate with the premium variance discussed above. In addition, $291 million in

claims related to the September 11, 2001 tragedies contributed to this variance. Retirement and savings policyholder benefits and claims declined by

$32 million. A decrease commensurate with the $292 million premium variance discussed above is almost entirely offset by a $215 million increase in

policyholder benefits associated with fourth quarter 2001 business realignment initiatives.

Interest credited to policyholder account balances decreased by $77 million, or 7%, to $1,013 million for the year ended December 31, 2001 from

$1,090 million for the comparable 2000 period. Retirement and savings decreased by $53 million, or 9%, to $549 million in 2001 from $602 million in

2000, due to a overall decline in crediting rates in 2001 as a result of the low interest rate environment. A $24 million drop in group life is largely

attributable to an overall decline in crediting rates in 2001 as a result of the low interest rate environment. The variance in group life was partially

dampened by an increase in average customer account balances stemming from asset growth, resulting in $12 million in additional interest credited.

Policyholder dividends increased by $135 million, or 109%, to $259 million for the year ended December 31, 2001 from $124 million for the

comparable 2000 period. The rise in dividends is primarily attributed to favorable experience on a large group life contract in 2001. Policyholder dividends

vary from period to period based on insurance contract experience, which are generally recorded in policyholder benefits and claims.

Other expenses increased by $232 million, or 15%, to $1,746 million for the year ended December 31, 2001 from $1,514 million for the

comparable 2000 period. Other expenses related to retirement and savings rose by $121 million, which is largely attributable to $184 million in expenses

associated with fourth quarter 2001 business realignment initiatives. This variance is partially offset by a decrease in expenses, due in most part, to

expense management initiatives. Group insurance expenses grew by $111 million due primarily to a rise in non-deferrable variable expenses associated

with premium growth. Non-deferrable variable expenses include premium tax, commissions and administrative expenses for dental, disability and long-

term care businesses.

MetLife, Inc. 15