MetLife 2002 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

chairman’s letter

To MetLife Shareholders:

A few years ago, MetLife stood before the investment community and made some powerful promises.

We laid out specific financial and operational objectives that we would work to achieve over the next

several years. We said we would achieve increasing profitability across the enterprise and efficiently

utilize excess capital while improving returns to shareholders. And we said our newly instituted perform-

ance management culture would drive MetLife to higher levels of performance.

This December, as the MetLife senior management team and I stood before 200 members of the

investment community during our annual Investor Day, the message was clear and unequivocal. We are

delivering on our promises. We are doing what we said we would do and are well on the way

to achieving our ambitious goals, despite the hurdles that we and others in the industry have faced.

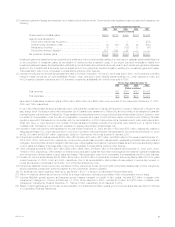

The year 2002 was good for MetLife in terms of financial performance. We delivered to our shareholders results consistent with

investment community expectations and, in fact, exceeded our target of 11.5% operating return on equity, ending the year at 11.7%. We

delivered to our customers the continued pledge to build financial freedom for everyone. This is what it’s all about—earning the trust of

our various constituencies as we have done for the past 135 years.

Particularly today, in light of stock market volatility, the recent spate of corporate scandals, and the uncertain geopolitical landscape,

customers want to deal with a company they can trust. They want a financially strong company that will be there for them, in good times

and bad, to deliver on its guarantees and provide the products they need to feel secure and confident. They want to deal with employees

they can trust to offer the highest level of objective advice and counsel. And they want to do business with a company which has

integrity as one of its core values.

Customers want to do business with a company like MetLife, and this year we benefited from this flight to quality. Through disciplined

and strategic financial management and solid business growth, we are increasingly well positioned in the marketplace. Our earnings,

despite some significant market hurdles and a difficult operating environment, continue to reflect the diversity, strength and financial

flexibility of MetLife’s businesses.

In 2002, we continued to focus on our capital management. As volatile equity markets in 2002 caused rating agencies to take a more

cautious view of the insurance industry, we worked quickly to defend our ratings by increasing capital in our primary insurance operating

entity, Metropolitan Life Insurance Company. We did so, in part, from the sale of 17 real estate properties during the fourth quarter that

had a carrying value of approximately $840 million. This special initiative, which is a portion of the company’s total real estate sales

program, provided us in excess of $500 million in statutory gains. Capital was also raised through a $1 billion debt offering in December,

the proceeds of which were used to increase capital in Metropolitan Life Insurance Company and for other general corporate purposes.

The combination of these and other actions enhanced Metropolitan Life Insurance Company’s risk based capital ratio, a measure of

financial strength and security used by regulators, rating agencies and investors.

HBusiness Growth Outpaces the Market

Throughout our lines of business, we surpassed a number of goals this year as we continued to grow and enhance our operations.

The exceptional results of Institutional Business resulted in an operating return on allocated equity of 23.0%, as the business exper-

ienced strong top line sales growth and continued expense efficiencies. In fact, our business growth in many cases outpaced the

market, a clear sign that we are improving our competitive positioning.

In 2002, we set out to reduce expenses in our Individual Business operation by $200 million, before income taxes. We exceeded our

goal and delivered expense savings of $220 million, before income taxes. We realized these savings through rigorous expense

discipline, aggressive utilization of technology and development of common platforms to support many of our functional operations.

In addition to the expense savings in Individual Business, our distribution channels in this operation nimbly shifted gears to

accommodate market demands through their broad array of fixed offerings to compensate for the lower demand for variable products.

Increases in whole life, universal life and term life insurance sales offset declines in equity-linked insurance products, while the launch of

a new line of annuity products created new market opportunities in the agent and broker-dealer channels.