MetLife 2002 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

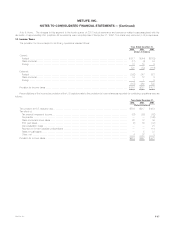

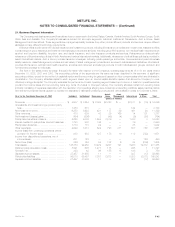

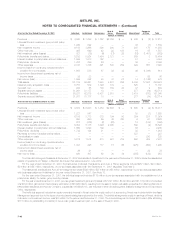

21. Business Segment Information

The Company provides insurance and financial services to customers in the United States, Canada, Central America, South America, Europe, South

Africa, Asia and Australia. The Company’s business is divided into six major segments: Individual, Institutional, Reinsurance, Auto & Home, Asset

Management and International. These segments are managed separately because they either provide different products and services, require different

strategies or have different technology requirements.

Individual offers a wide variety of individual insurance and investment products, including life insurance, annuities and mutual funds. Institutional offers

a broad range of group insurance and retirement and savings products and services, including group life insurance, non-medical health insurance such

as short and long-term disability, long-term care, and dental insurance, and other insurance products and services. Reinsurance provides primarily

reinsurance of life and annuity policies in North America and various international markets. Additionally, reinsurance of critical illness policies is provided in

select international markets. Auto & Home provides insurance coverages, including private passenger automobile, homeowners and personal excess

liability insurance. Asset Management provides a broad variety of asset management products and services to individuals and institutions. International

provides life insurance, accident and health insurance, annuities and retirement and savings products to both individuals and groups, and auto and

homeowners coverage to individuals.

Set forth in the tables below is certain financial information with respect to the Company’s operating segments as of or for the years ended

December 31, 2002, 2001 and 2000. The accounting policies of the segments are the same as those described in the summary of significant

accounting policies, except for the method of capital allocation and the accounting for gains and losses from inter-company sales which are eliminated in

consolidation. The Company allocates capital to each segment based upon an internal capital allocation system that allows the Company to more

effectively manage its capital. The Company evaluates the performance of each operating segment based upon income or loss from operations before

provision for income taxes and non-recurring items (e.g. items of unusual or infrequent nature). The Company allocates certain non-recurring items

(primarily consisting of expenses associated with the resolution of proceedings alleging race-conscious underwriting practices, sales practices claims

and claims for personal injuries caused by exposure to asbestos or asbestos-containing products and demutualization costs) to Corporate & Other.

Auto & Asset Corporate

At or for the Year Ended December 31, 2002 Individual Institutional Reinsurance Home Management International & Other Total

(Dollars in millions)

Premiums *********************************** $ 4,507 $ 8,254 $ 2,005 $2,828 $ — $1,511 $ (19) $ 19,086

Universal life and investment-type product policy

fees ************************************** 1,380 615 — — — 144 — 2,139

Net investment income ************************ 6,259 3,928 421 177 59 461 24 11,329

Other revenues******************************* 418 609 43 26 166 14 101 1,377

Net investment (losses) gains ******************* (164) (506) 2 (46) (4) (9) (57) (784)

Policyholder benefits and claims***************** 5,220 9,339 1,554 2,019 — 1,388 3 19,523

Interest credited to policyholder account balances** 1,793 932 146 — — 79 — 2,950

Policyholder dividends ************************* 1,770 115 22 — — 35 — 1,942

Other expenses ****************************** 2,629 1,531 622 793 211 507 768 7,061

Income (loss) from continuing operations before

provision for income taxes ******************* 988 983 127 173 10 112 (722) 1,671

Income from discontinued operations, net of

income taxes ****************************** 201 123 — — — — 126 450

Net income (loss) ***************************** 826 759 84 132 6 84 (286) 1,605

Total assets********************************** 138,783 94,950 10,229 4,957 191 8,963 19,312 277,385

Deferred policy acquisition costs **************** 8,521 608 1,477 175 — 945 1 11,727

Goodwill, net********************************* 223 62 96 155 18 193 3 750

Separate account assets ********************** 27,457 31,935 11 — — 307 (17) 59,693

Policyholder liabilities ************************** 95,813 55,497 7,387 2,673 — 5,883 (2,011) 165,242

Separate account liabilities ********************* 27,457 31,935 11 — — 307 (17) 59,693

MetLife, Inc. F-45