MetLife 2002 Annual Report Download - page 25

Download and view the complete annual report

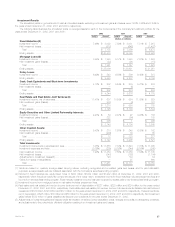

Please find page 25 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.relating to MetLife’s banking initiatives, as well as a decrease in the elimination of intersegment activity. Legal expenses of $250 million were recorded in

the fourth quarter of 2001 to cover costs associated with the anticipated resolution of class action lawsuits and a regulatory inquiry pending against

Metropolitan Life, involving alleged race-conscious insurance underwriting practices prior to 1973. These increases are partially offset by a reduction in

interest expenses due to reduced average levels in borrowing and a lower rate environment in 2001.

Liquidity and Capital Resources

The Holding Company

Capital

Restrictions and Limitations on Bank Holding Companies and Financial Holding Companies — Capital. MetLife, Inc. and its insured depository

institution subsidiary are subject to risk-based and leverage capital guidelines issued by the federal banking regulatory agencies for banks and financial

holding companies. The federal banking regulatory agencies are required by law to take specific prompt corrective actions with respect to institutions that

do not meet minimum capital standards. At December 31, 2002, MetLife and its insured depository institution subsidiary were in compliance with the

aforementioned guidelines.

Liquidity

Liquidity refers to a company’s ability to generate adequate amounts of cash to meet its needs. Liquidity is managed to preserve stable, reliable and

cost-effective sources of cash to meet all current and future financial obligations. Liquidity is provided by a variety of sources, including a portfolio of liquid

assets, a diversified mix of short- and long-term funding sources from the wholesale financial markets and the ability to borrow through committed credit

facilities. The Holding Company is an active participant in the global financial markets through which it obtains a significant amount of funding. These

markets, which serve as cost-effective sources of funds, are critical components of the Holding Company’s liquidity management. Decisions to access

these markets are based upon relative costs, prospective views of balance sheet growth, and a targeted liquidity profile. A disruption in the financial

markets could limit access to liquidity for the Holding Company.

The Holding Company’s ability to maintain regular access to competitively priced wholesale funds is fostered by its current debt ratings from the

major credit rating agencies. Management views its capital ratios, credit quality, stable and diverse earnings streams, diversity of liquidity sources and its

liquidity monitoring procedures as critical to retaining high credit ratings.

Liquidity is monitored through the use of internal liquidity risk metrics, including the composition and level of the liquid asset portfolio, timing

differences in short-term cash flow obligations, access to the financial markets for capital and term-debt transactions, and exposure to contingent draws

on the Holding Company’s liquidity.

Liquidity Sources

Dividends. The primary source of the Holding Company’s liquidity is dividends it receives from Metropolitan Life. Under the New York Insurance

Law, Metropolitan Life is permitted without prior insurance regulatory clearance to pay a stockholder dividend to the Holding Company as long as the

aggregate amount of all such dividends in any calendar year does not exceed the lesser of (i) 10% of its statutory surplus as of the immediately preceding

calendar year, and (ii) its statutory net gain from operations for the immediately preceding calendar year (excluding realized capital gains). Metropolitan Life

will be permitted to pay a stockholder dividend to the Holding Company in excess of the lesser of such two amounts only if it files notice of its intention to

declare such a dividend and the amount thereof with the Superintendent and the Superintendent does not disapprove the distribution. Under the New

York Insurance Law, the Superintendent has broad discretion in determining whether the financial condition of a stock life insurance company would

support the payment of such dividends to its stockholders. The New York Insurance Department (the ‘‘Department’’) has established informal guidelines

for such determinations. The guidelines, among other things, focus on the insurer’s overall financial condition and profitability under statutory accounting

practices. Management of the Holding Company cannot provide assurance that Metropolitan Life will have statutory earnings to support payment of

dividends to the Holding Company in an amount sufficient to fund its cash requirements and pay cash dividends or that the Superintendent will not

disapprove any dividends that Metropolitan Life must submit for the Superintendent’s consideration. In addition, the Holding Company also receives

dividends from its other subsidiaries. The Holding Company’s other insurance subsidiaries are also subject to restrictions on the payment of dividends to

their respective parent companies.

The dividend limitation is based on statutory financial results. Statutory accounting practices, as prescribed by the Department, differ in certain

respects from accounting principles used in financial statements prepared in conformity with GAAP. The significant differences relate to deferred policy

acquisition costs, certain deferred income taxes, required investment reserves, reserve calculation assumptions, goodwill and surplus notes.

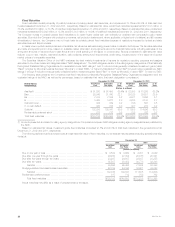

Liquid Assets. An integral part of the Holding Company’s liquidity management is the amount of liquid assets that it holds. Liquid assets include

cash, cash equivalents, short-term investments and marketable fixed maturities. At December 31, 2002 and 2001, the Holding Company had

$1,343 million and $2,981 million in liquid assets, respectively.

Global Funding Sources. Liquidity is also provided by a variety of both short- and long-term instruments, including repurchase agreements,

commercial paper, medium-and long-term debt, capital securities and stockholders’ equity. The diversity of the Holding Company’s funding sources

enhances funding flexibility and limits dependence on any one source of funds, and generally lowers the cost of funds.

At December 31, 2002, the Holding Company had $249 million in short-term debt outstanding. At December 31, 2001, the Holding Company had

no short-term debt outstanding. At December 31, 2002 and 2001, the Holding Company had $3.3 billion and $2.3 billion in long-term debt outstanding,

respectively.

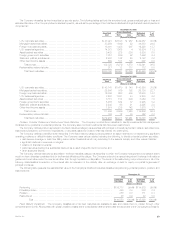

The Holding Company filed a $4.0 billion shelf registration statement, effective June 1, 2001, with the U.S. Securities and Exchange Commission

(‘‘SEC’’) which permits the registration and issuance of debt and equity securities as described more fully therein. The Holding Company has issued

senior debt in the amount of $2.25 billion under this registration statement. In December 2002, the Holding Company issued $400 million 5.375% senior

notes due 2012 and $600 million 6.50% senior notes due 2032 and in November 2001, the Holding Company issued $500 million 5.25% senior notes

due 2006 and $750 million 6.125% senior notes due 2011. In addition, in February 2003, the Holding Company remarketed under the shelf registration

statement $1,006 million aggregate principal amount of debentures previously issued in connection with the issuance of equity security units as part of

MetLife, Inc.’s initial public offering in April 2000.

MetLife, Inc. 21