MetLife 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

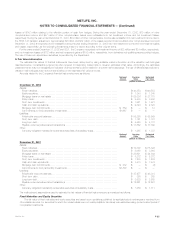

losses of $142 million relating to the effective portion of cash flow hedges. During the year ended December 31, 2002, $10 million of other

comprehensive income and $57 million of other comprehensive losses were reclassified into net investment income and net investment losses,

respectively. During the year ended December 31, 2001, $19 million of other comprehensive income was reclassified into net investment income due to

the SFAS 133 transition adjustment. Approximately $6 million and $12 million of the losses reported in accumulated other comprehensive income at

December 31, 2002 are expected to be reclassified during the year ending December 31, 2003 into net investment income and net investment gains

and losses, respectively, as the underlying investments mature or expire according to their original terms.

For the years ended December 31, 2002 and 2001, the Company recognized net investment income of $32 million and $24 million, respectively,

and net investment losses of $172 million and net investment gains of $100 million, respectively, from derivatives not qualifying as accounting hedges.

The use of these non-speculative derivatives is permitted by the Department.

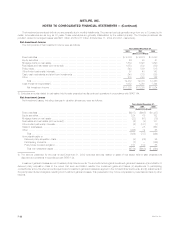

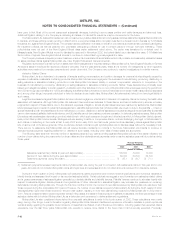

5. Fair Value Information

The estimated fair values of financial instruments have been determined by using available market information and the valuation methodologies

described below. Considerable judgment is often required in interpreting market data to develop estimates of fair value. Accordingly, the estimates

presented herein may not necessarily be indicative of amounts that could be realized in a current market exchange. The use of different assumptions or

valuation methodologies may have a material effect on the estimated fair value amounts.

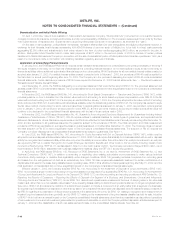

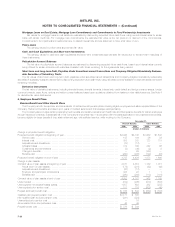

Amounts related to the Company’s financial instruments were as follows:

Notional Carrying Estimated

Amount Value Fair Value

(Dollars in millions)

December 31, 2002

Assets:

Fixed maturities********************************************************************** $140,553 $140,553

Equity securities ********************************************************************* $ 1,348 $ 1,348

Mortgage loans on real estate ********************************************************* $ 25,086 $ 27,778

Policy loans************************************************************************* $ 8,580 $ 8,580

Short-term investments *************************************************************** $ 1,921 $ 1,921

Cash and cash equivalents************************************************************ $ 2,323 $ 2,323

Mortgage loan commitments*********************************************************** $ 859 $ — $ 12

Commitments to fund partnership investments ******************************************** $1,667 $ — $ —

Liabilities:

Policyholder account balances ********************************************************* $ 55,285 $ 55,909

Short-term debt ********************************************************************* $ 1,161 $ 1,161

Long-term debt********************************************************************** $ 4,425 $ 4,731

Payable under securities loaned transactions ********************************************* $ 17,862 $ 17,862

Other:

Company-obligated mandatorily redeemable securities of subsidiary trusts********************* $ 1,265 $ 1,337

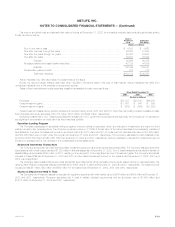

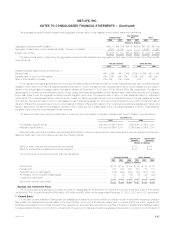

Notional Carrying Estimated

Amount Value Fair Value

(Dollars in millions)

December 31, 2001

Assets:

Fixed maturities********************************************************************** $115,398 $115,398

Equity securities ********************************************************************* $ 3,063 $ 3,063

Mortgage loans on real estate ********************************************************* $ 23,621 $ 24,844

Policy loans************************************************************************* $ 8,272 $ 8,272

Short-term investments *************************************************************** $ 1,203 $ 1,203

Cash and cash equivalents************************************************************ $ 7,473 $ 7,473

Mortgage loan commitments*********************************************************** $ 532 $ — $ (4)

Commitments to fund partnership investments ******************************************** $1,898 $ — $ —

Liabilities:

Policyholder account balances ********************************************************* $ 47,977 $ 48,318

Short-term debt ********************************************************************* $ 355 $ 355

Long-term debt********************************************************************** $ 3,628 $ 3,685

Payable under securities loaned transactions ********************************************* $ 12,661 $ 12,661

Other:

Company-obligated mandatorily redeemable securities of subsidiary trusts********************* $ 1,256 $ 1,311

The methods and assumptions used to estimate the fair values of financial instruments are summarized as follows:

Fixed Maturities and Equity Securities

The fair value of fixed maturities and equity securities are based upon quotations published by applicable stock exchanges or received from

other reliable sources. For securities for which the market values were not readily available, fair values were estimated using quoted market prices of

comparable investments.

MetLife, Inc. F-25