MetLife 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fixed Maturities

Fixed maturities consist principally of publicly traded and privately placed debt securities, and represented 73.7% and 68.0% of total cash and

invested assets at December 31, 2002 and 2001, respectively. Based on estimated fair value, public fixed maturities represented $121,191 million, or

86.2%, and $96,579 million, or 83.7%, of total fixed maturities at December 31, 2002 and 2001, respectively. Based on estimated fair value, private fixed

maturities represented $19,362 million, or 13.8%, and $18,819 million, or 16.3%, of total fixed maturities at December 31, 2002 and 2001, respectively.

The Company invests in privately placed fixed maturities to (i) obtain higher yields than can ordinarily be obtained with comparable public market

securities, (ii) provide the Company with protective covenants, call protection features and, where applicable, a higher level of collateral, and (iii) increase

diversification. However, the Company may not freely trade its privately placed fixed maturities because of restrictions imposed by federal and state

securities laws and illiquid markets.

In cases where quoted market prices are not available, fair values are estimated using present value or valuation techniques. The fair value estimates

are made at a specific point in time, based on available market information and judgments about the financial instruments, including estimates of the

timing and amounts of expected future cash flows and the credit standing of the issuer or counter-party. Factors considered in estimating fair value

include: coupon rate, maturity, estimated duration, call provisions, sinking fund requirements, credit rating, industry sector of the issuer and quoted

market prices of comparable securities.

The Securities Valuation Office of the NAIC evaluates the fixed maturity investments of insurers for regulatory reporting purposes and assigns

securities to one of six investment categories called ‘‘NAIC designations.’’ The NAIC ratings are similar to the rating agency designations of the Nationally

Recognized Statistical Rating Organizations for marketable bonds. NAIC ratings 1 and 2 include bonds generally considered investment grade (rated

‘‘Baa3’’ or higher by Moody’s Investors Services (‘‘Moody’s’’), or rated ‘‘BBB–’’ or higher by Standard & Poor’s (‘‘S&P’’)) by such rating organizations. NAIC

ratings 3 through 6 include bonds generally considered below investment grade (rated ‘‘Ba1’’ or lower by Moody’s, or rated ‘‘BB+’’ or lower by S&P).

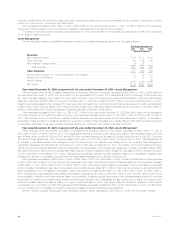

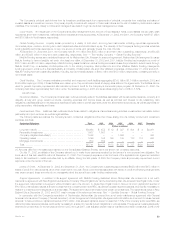

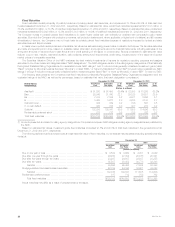

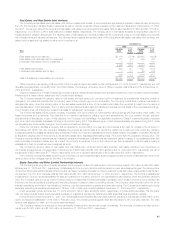

The following table presents the Company’s total fixed maturities by Nationally Recognized Statistical Rating Organizations designation and the

equivalent ratings of the NAIC, as well as the percentage, based on estimated fair value, that each designation comprises at:

December 31, 2002 December 31, 2001

Rating Agency Amortized Estimated % of Amortized Estimated % of

Designation(1) Cost Fair Value Total Cost Fair Value Total

(Dollars in millions)

Aaa/Aa/A ********************************************** $ 91,250 $ 97,495 69.4% $ 72,098 $ 75,265 65.2%

Baa *************************************************** 29,345 31,060 22.1 29,128 29,581 25.6

Ba **************************************************** 7,413 7,304 5.2 6,021 5,856 5.1

B***************************************************** 3,463 3,227 2.3 3,205 3,100 2.7

Caa and lower ****************************************** 434 339 0.2 726 597 0.5

In or near default **************************************** 430 416 0.3 327 237 0.2

Subtotal *********************************************** 132,335 139,841 99.5 111,505 114,636 99.3

Redeemable preferred stock ****************************** 817 712 0.5 783 762 0.7

Total fixed maturities ************************************* $133,152 $140,553 100.0% $112,288 $115,398 100.0%

(1) Amounts presented are based on rating agency designations. Comparisons between NAIC ratings and rating agency designations are published by

the NAIC.

Based on estimated fair values, investment grade fixed maturities comprised 91.5% and 90.8% of total fixed maturities in the general account at

December 31, 2002 and 2001, respectively.

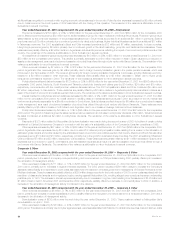

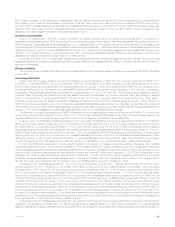

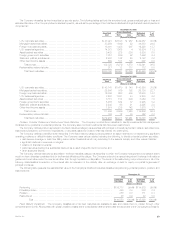

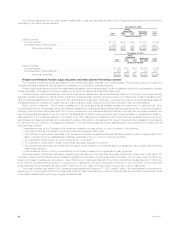

The following table shows the amortized cost and estimated fair value of fixed maturities, by contractual maturity dates (excluding scheduled sinking

funds) at:

December 31,

2002 2001

Amortized Estimated Amortized Estimated

Cost Fair Value Cost Fair Value

(Dollars in millions)

Due in one year or less ************************************************** $ 4,592 $ 4,662 $ 4,001 $ 4,049

Due after one year through five years *************************************** 26,200 27,354 20,168 20,841

Due after five years through ten years ************************************** 23,297 24,987 22,937 23,255

Due after ten years ****************************************************** 35,507 38,452 30,778 32,248

Subtotal *********************************************************** 89,596 95,455 77,884 80,393

Mortgage-backed and asset-backed securities ******************************* 42,739 44,386 33,621 34,243

Subtotal *********************************************************** 132,335 139,841 111,505 114,636

Redeemable preferred stock ********************************************** 817 712 783 762

Total fixed maturities ************************************************* $133,152 $140,553 $112,288 $115,398

Actual maturities may differ as a result of prepayments by the issuer.

MetLife, Inc.

28