MetLife 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

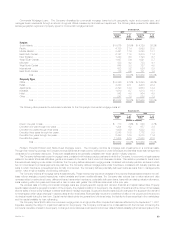

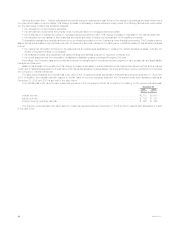

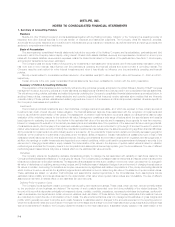

Earnings and cash flows. MetLife calculates the potential change in earnings and cash flows on the change in its earnings and cash flows over a

one-year period based on an immediate 10% change (increase or decrease) in market rates and equity prices. The following factors were incorporated

into the earnings and cash flows sensitivity analyses:

)the reinvestment of fixed maturity securities;

)the reinvestment of payments and prepayments of principal related to mortgage-backed securities;

)the re-estimation of prepayment rates on mortgage-backed securities for each 10% change (increase or decrease) in the interest rates; and

)the expected turnover (sales) of fixed maturities and equity securities, including the reinvestment of the resulting proceeds.

The sensitivity analysis is an estimate and should not be viewed as predictive of the Company’s future financial performance. The Company cannot

assure that its actual losses in any particular year will not exceed the amounts indicated in the table below. Limitations related to this sensitivity analysis

include:

)the market risk information is limited by the assumptions and parameters established in creating the related sensitivity analysis, including the

impact of prepayment rates on mortgages;

)the analysis excludes other significant real estate holdings and liabilities pursuant to insurance contracts; and

)the model assumes that the composition of assets and liabilities remains unchanged throughout the year.

Accordingly, the Company uses such models as tools and not substitutes for the experience and judgment of its corporate risk and asset/liability

management personnel.

Based on its analysis of the impact of a 10% change (increase or decrease) in market rates and prices, MetLife has determined that such a change

could have a material adverse effect on the fair value of its interest rate sensitive invested assets. The equity and foreign currency portfolios do not expose

the Company to material market risk.

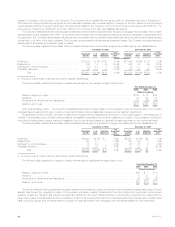

The table below illustrates the potential loss in fair value of the Company’s interest rate sensitive financial instruments at December 31, 2002 and

2001. In addition, the potential loss with respect to the fair value of currency exchange rates and the Company’s equity price sensitive positions at

December 31, 2002 and 2001 is set forth in the table below.

The potential loss in fair value for each market risk exposure of the Company’s portfolio, all of which is non-trading, for the periods indicated was:

December 31,

2002 2001

(Dollars in millions)

Interest rate risk *************************************************************************************** $2,710 $3,430

Equity price risk *************************************************************************************** $ 120 $ 228

Foreign currency exchange rate risk ********************************************************************** $ 529 $ 426

The change in potential loss in fair value related to market risk exposure between December 31, 2002 and 2001 was primarily attributable to a shift

in the yield curve.

MetLife, Inc.

40