MetLife 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For purposes of this discussion, the terms ‘‘Company’’ or ‘‘MetLife’’ refer, at all times prior to the date of demutualization (as hereinafter defined), to

Metropolitan Life Insurance Company (‘‘Metropolitan Life’’), a mutual life insurance company organized under the laws of the State of New York, and its

subsidiaries, and at all times on and after the date of demutualization, to MetLife, Inc. (the ‘‘Holding Company’’), a Delaware corporation, and its

subsidiaries, including Metropolitan Life. Following this summary is a discussion addressing the consolidated results of operations and financial condition

of the Company for the periods indicated. This discussion should be read in conjunction with the Company’s consolidated financial statements included

elsewhere herein.

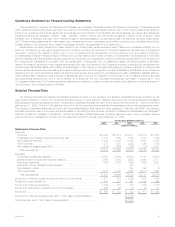

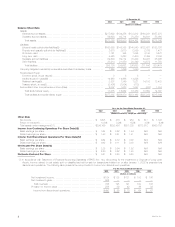

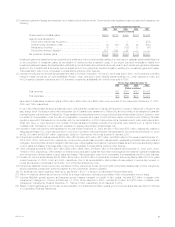

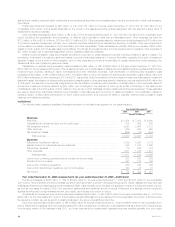

Business Realignment Initiatives

During the fourth quarter of 2001, the Company implemented several business realignment initiatives, which resulted from a strategic review of

operations and an ongoing commitment to reduce expenses. The following tables represent the original expenses recorded in the fourth quarter of 2001

and the remaining liability as of December 31, 2002:

Pre-tax Charges Recorded in the Fourth Quarter of 2001

Institutional Individual Auto & Home Total

(Dollars in millions)

Severance and severance-related costs ******************************** $9 $32 $3 $44

Facilities’ consolidation costs ****************************************** 365 — 68

Business exit costs ************************************************** 387 — — 387

Total ********************************************************** $399 $97 $ 3 $499

Remaining Liability as of December 31, 2002

Institutional Individual Auto & Home Total

(Dollars in millions)

Severance and severance-related costs ********************************* $— $ 1 $— $ 1

Facilities’ consolidation costs ******************************************* —17 —17

Business exit costs *************************************************** 40 — — 40

Total *********************************************************** $40 $18 $— $58

The business realignment initiatives resulted in savings of approximately $95 million, net of income tax, during 2002, comprised of approximately

$33 million, $57 million and $5 million in the Institutional, Individual and Auto & Home segments, respectively.

Institutional. The charges to this segment in the fourth quarter of 2001 include costs associated with exiting a business, including the write-off of

goodwill, severance and severance-related costs, and facilities’ consolidation costs. These expenses are the result of the discontinuance of certain

401(k) recordkeeping services and externally-managed guaranteed index separate accounts. These actions resulted in charges to policyholder benefits

and claims and other expenses of $215 million and $184 million, respectively. During the fourth quarter of 2002, approximately $30 million of the charges

recorded in 2001 were released into income primarily as a result of the accelerated implementation of the Company’s exit from the large market 401(k)

business. The business realignment initiatives will ultimately result in the elimination of approximately 930 positions. As of December 31, 2002, there were

approximately 340 terminations to be completed. The Company continues to carry a liability as of December 31, 2002 since the exit plan could not be

completed within one year due to circumstances outside the Company’s control and since certain of its contractual obligations extended beyond one

year.

Individual. The charges to this segment in the fourth quarter of 2001 include facilities’ consolidation costs, severance and severance-related costs,

which predominately stem from the elimination of approximately 560 non-sales positions and 190 operations and technology positions supporting this

segment. As of December 31, 2002, there were approximately 25 terminations to be completed. These costs were recorded in other expenses. The

remaining liability as of December 31, 2002 is due to certain contractual obligations that extended beyond one year.

Auto & Home. The charges to this segment in the fourth quarter of 2001 include severance and severance-related costs associated with the

elimination of approximately 200 positions. All terminations were completed as of December 31, 2002. The costs were recorded in other expenses.

September 11, 2001 Tragedies

On September 11, 2001 terrorist attacks occurred in New York, Washington, D.C. and Pennsylvania (the ‘‘tragedies’’) triggering a significant loss of

life and property which had an adverse impact on certain of the Company’s businesses. The Company has direct exposure to these events with claims

arising from its Individual, Institutional, Reinsurance and Auto & Home insurance coverages, and it believes the majority of such claims have been

reported or otherwise analyzed by the Company.

The Company’s original estimate of the total insurance losses related to the tragedies, which was recorded in the third quarter of 2001, was

$208 million, net of income taxes of $117 million. Net income for the year ended December 31, 2002 includes a $17 million, net of income taxes of

$9 million, benefit from the reduction of the liability associated with the tragedies. The revision to the liability is the result of an analysis completed during

the fourth quarter of 2002, which focused on the emerging incidence experienced over the past 12 months associated with certain disability products.

As of December 31, 2002, the Company’s remaining liability for unpaid and future claims associated with the tragedies was $47 million, principally related

to disability coverages. This estimate has been and will continue to be subject to revision in subsequent periods, as claims are received from insureds

and the claims to reinsurers are identified and processed. Any revision to the estimate of gross losses and reinsurance recoveries in subsequent periods

will affect net income in such periods. Reinsurance recoveries are dependent on the continued creditworthiness of the reinsurers, which may be

adversely affected by their other reinsured losses in connection with the tragedies.

The Company’s general account investment portfolios include investments, primarily comprised of fixed maturities, in industries that were affected by

the tragedies, including airline, other travel, lodging and insurance. Exposures to these industries also exist through mortgage loans and investments in

real estate. The carrying value of the Company’s investment portfolio exposed to industries affected by the tragedies was approximately $3.7 billion at

December 31, 2002.

MetLife, Inc.

4