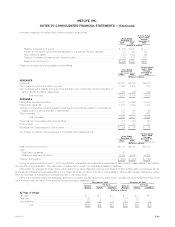

MetLife 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

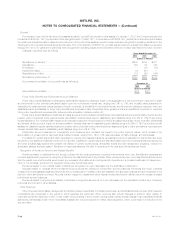

The investment amounts set forth above are generally due in monthly installments. The payment periods generally range from two to 15 years, but in

certain circumstances are as long as 30 years. These receivables are generally collateralized by the related property. The Company’s deferred tax

provision related to leveraged leases was $981 million and $1,077 million at December 31, 2002 and 2001, respectively.

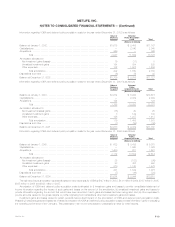

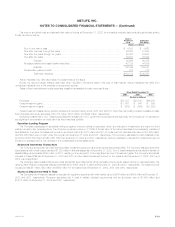

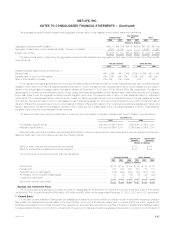

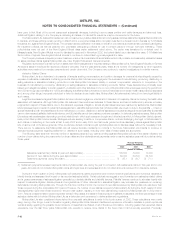

Net Investment Income

The components of net investment income were as follows:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Fixed maturities ************************************************************************* $ 8,384 $ 8,574 $ 8,538

Equity securities ************************************************************************ 26 49 41

Mortgage loans on real estate************************************************************* 1,883 1,848 1,693

Real estate and real estate joint ventures(1) ************************************************* 1,053 932 989

Policy loans **************************************************************************** 543 536 515

Other limited partnership interests********************************************************** 57 48 142

Cash, cash equivalents and short-term investments ****************************************** 248 279 288

Other ********************************************************************************* 218 249 162

Total ****************************************************************************** 12,412 12,515 12,368

Less: Investment expenses(1) ************************************************************* 1,083 1,260 1,344

Net investment income ************************************************************** $11,329 $11,255 $11,024

(1) Excludes amounts related to real estate held-for-sale presented as discontinued operations in accordance with SFAS 144.

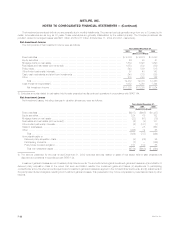

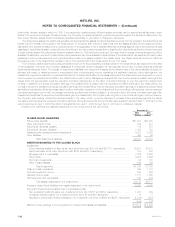

Net Investment Losses

Net investment losses, including changes in valuation allowances, were as follows:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Fixed maturities ****************************************************************************** $(917) $(645) $(1,437)

Equity securities****************************************************************************** 224 65 192

Mortgage loans on real estate ****************************************************************** (22) (91) (18)

Real estate and real estate joint ventures(1)******************************************************* (6) (4) 101

Other limited partnership interests *************************************************************** (2) (161) (7)

Sales of businesses ************************************************************************** — 25 660

Other ************************************************************************************** (206) 74 65

Total *********************************************************************************** (929) (737) (444)

Amounts allocable to:

Deferred policy acquisition costs************************************************************** (5) (25) 95

Participating contracts*********************************************************************** (7) — (126)

Policyholder dividend obligation *************************************************************** 157 159 85

Total net investment losses **************************************************************** $(784) $(603) $ (390)

(1) The amount presented for the year ended December 31, 2002 excludes amounts related to sales of real estate held-for-sale presented as

discontinued operations in accordance with SFAS 144.

Investment gains and losses are net of related policyholder amounts. The amounts netted against investment gains and losses are (i) amortization of

deferred policy acquisition costs to the extent that such amortization results from investment gains and losses, (ii) adjustments to participating

contractholder accounts when amounts equal to such investment gains and losses are applied to the contractholder’s accounts, and (iii) adjustments to

the policyholder dividend obligation resulting from investment gains and losses. This presentation may not be comparable to presentations made by other

insurers.

MetLife, Inc.

F-22