MetLife 2002 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Life was negligent in the performance of certain of its obligations and duties under the sale agreement. Metropolitan Life is vigorously defending itself

against this lawsuit.

A putative class action lawsuit is pending in the United States District Court for the District of Columbia, in which plaintiffs allege that they were

denied certain ad hoc pension increases awarded to retirees under the Metropolitan Life retirement plan. The ad hoc pension increases were awarded

only to retirees (i.e., individuals who were entitled to an immediate retirement benefit upon their termination of employment) and not available to individuals

like these plaintiffs whose employment, or whose spouses’ employment, had terminated before they became eligible for an immediate retirement benefit.

The district court denied the parties’ cross-motions for summary judgment to allow for discovery. Discovery has not yet commenced pending the court’s

ruling as to the timing of a class certification motion. The plaintiffs seek to represent a class consisting of former Metropolitan Life employees, or their

surviving spouses, who are receiving deferred vested annuity payments under the retirement plan and who were allegedly eligible to receive the ad hoc

pension increases awarded in 1977, 1980, 1989, 1992, 1996 and 2001, as well as increases awarded in earlier years. Metropolitan Life is vigorously

defending itself against these allegations.

A reinsurer of universal life policy liabilities of Metropolitan Life and certain affiliates is seeking rescission and has commenced an arbitration

proceeding claiming that, during underwriting, material misrepresentations or omissions were made. The reinsurer also has sent a notice purporting to

increase reinsurance premium rates. Metropolitan Life and these affiliates intend to vigorously defend themselves against the claims of the reinsurer,

including the purported rate increase.

Various litigation, claims and assessments against the Company, in addition to those discussed above and those otherwise provided for in the

Company’s consolidated financial statements, have arisen in the course of the Company’s business, including, but not limited to, in connection with its

activities as an insurer, employer, investor, investment advisor and taxpayer. Further, state insurance regulatory authorities and other federal and state

authorities regularly make inquiries and conduct investigations concerning the Company’s compliance with applicable insurance and other laws and

regulations.

Summary

It is not feasible to predict or determine the ultimate outcome of all pending investigations and legal proceedings or provide reasonable ranges of

potential losses, except as noted above in connection with specific matters. In some of the matters referred to above, very large and/or indeterminate

amounts, including punitive and treble damages, are sought. Although in light of these considerations it is possible that an adverse outcome in certain

cases could have a material adverse effect upon the Company’s consolidated financial position, based on information currently known by the Company’s

management, in its opinion, the outcomes of such pending investigations and legal proceedings are not likely to have such an effect. However, given the

large and/or indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that an adverse outcome

in certain matters could, from time to time, have a material adverse effect on the Company’s consolidated net income or cash flows in particular quarterly

or annual periods.

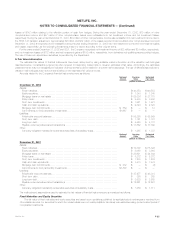

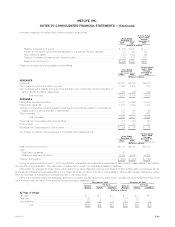

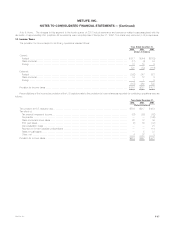

Leases

In accordance with industry practice, certain of the Company’s income from lease agreements with retail tenants is contingent upon the level of the

tenants’ sales revenues. Additionally, the Company, as lessee, has entered into various lease and sublease agreements for office space, data

processing and other equipment. Future minimum rental and sublease income, and minimum gross rental payments relating to these lease agreements

were as follows:

Gross

Rental Sublease Rental

Income Income Payments

(Dollars in millions)

2003 *************************************************************************** $ 673 $14 $192

2004 *************************************************************************** $ 637 $12 $166

2005 *************************************************************************** $ 575 $11 $149

2006 *************************************************************************** $ 525 $10 $133

2007 *************************************************************************** $ 470 $ 9 $116

Thereafter *********************************************************************** $2,139 $ 8 $643

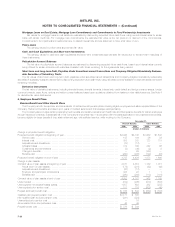

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded commit-

ments were $1,667 million and $1,898 million at December 31, 2002 and 2001, respectively. The Company anticipates that these amounts will be

invested in the partnerships over the next three to five years.

Guarantees

In the course of its business, the Company has provided certain indemnities, guarantees and commitments to third parties pursuant to which it may

be required to make payments now or in the future.

In the context of acquisition and disposition transactions, the Company has provided indemnities and guarantees, including those related to tax,

environmental and other specific liabilities, and other indemnities and guarantees that are triggered by, among other things, breaches of representations,

warranties or covenants provided by the Company. These obligations are often subject to time limitations that vary in duration, including contractual

limitations and those that arise by operation of law such as applicable statutes of limitation. In some cases, the maximum potential obligation under the

indemnities and guarantees is subject to a contractual limitation ranging from $1 million to $800 million, while in other cases such limitations are not

specified or applicable. Since certain of these obligations are not subject to limitations, the Company does not believe that it is possible to determine the

maximum potential amount due under these guarantees in the future.

In addition, the Holding Company and its subsidiaries indemnify their respective directors and officers as provided in their charters and by-laws.

Since these indemnities are generally not subject to limitation with respect to duration or amount, the Company does not believe that it is possible to

determine the maximum potential amount due under these indemnities in the future.

MetLife, Inc. F-35