MetLife 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

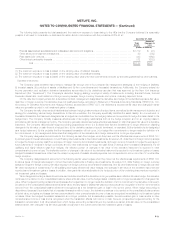

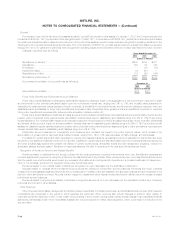

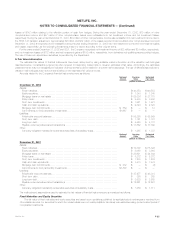

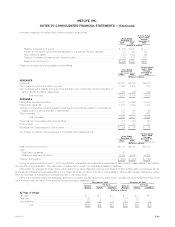

The cost or amortized cost and estimated fair value of bonds at December 31, 2002, by contractual maturity date (excluding scheduled sinking

funds), are shown below:

Cost or

Amortized Estimated

Cost Fair Value

(Dollars in millions)

Due in one year or less *************************************************************** $ 4,592 $ 4,662

Due after one year through five years **************************************************** 26,200 27,354

Due after five years through ten years**************************************************** 23,297 24,987

Due after ten years ******************************************************************* 35,507 38,452

Subtotal ******************************************************************** 89,596 95,455

Mortgage-backed and asset-backed securities ******************************************** 42,739 44,386

Subtotal ******************************************************************** 132,335 139,841

Redeemable preferred stock *********************************************************** 817 712

Total fixed maturities ********************************************************** $133,152 $140,553

Actual maturities may differ as a result of prepayments by the issuer.

Bonds not due at a single maturity date have been included in the above table in the year of final maturity. Actual maturities may differ from

contractual maturities due to the exercise of prepayment options.

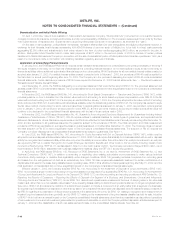

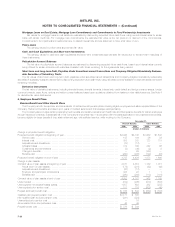

Sales of fixed maturities and equity securities classified as available-for-sale were as follows:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Proceeds ****************************************************************************** $37,427 $28,105 $46,205

Gross investment gains ****************************************************************** $ 1,661 $ 646 $ 599

Gross investment losses ***************************************************************** $ (979) $ (948) $ (1,520)

Gross investment losses above exclude writedowns recorded during 2002, 2001 and 2000 for other than temporarily impaired available-for-sale

fixed maturities and equity securities of $1,375 million, $278 million and $324 million, respectively.

Excluding investments in U.S. Treasury securities and obligations of U.S. government corporations and agencies, the Company is not exposed to

any significant concentration of credit risk in its fixed maturities portfolio.

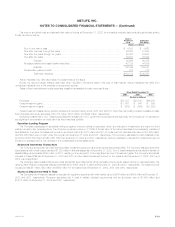

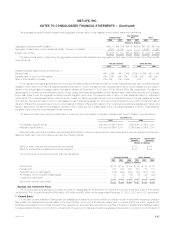

Securities Lending Program

The Company participates in securities lending programs whereby blocks of securities, which are included in investments, are loaned to third

parties, primarily major brokerage firms. The Company requires a minimum of 102% of the fair value of the loaned securities to be separately maintained

as collateral for the loans. Securities with a cost or amortized cost of $14,873 million and $11,416 million and an estimated fair value of $17,625 million

and $12,066 million were on loan under the program at December 31, 2002 and 2001, respectively. The Company was liable for cash collateral under

its control of $17,862 million and $12,661 million at December 31, 2002 and 2001, respectively. Security collateral on deposit from customers may not

be sold or repledged and is not reflected in the consolidated financial statements.

Structured Investment Transactions

The Company securitizes high yield debt securities, investment grade bonds and structured finance securities. The Company has sponsored five

securitizations with a total of approximately $1,323 million in financial assets as of December 31, 2002. Two of these transactions included the transfer of

assets totaling approximately $289 million in 2001, resulting in the recognition of an insignificant amount of investment gains. The Company’s beneficial

interests in these SPEs as of December 31, 2002 and 2001 and the related investment income for the years ended December 31, 2002, 2001 and

2000 were insignificant.

The Company also invests in structured notes and similar type instruments, which generally provide equity-based returns on debt securities. The

carrying value of such investments was approximately $870 million and $1.6 billion at December 31, 2002 and 2001, respectively. The related income

recognized was $1 million, $44 million and $62 million for the years ended December 31, 2002, 2001 and 2000, respectively.

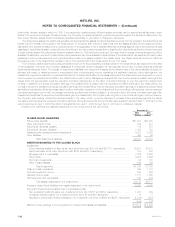

Assets on Deposit and Held in Trust

The Company had investment assets on deposit with regulatory agencies with a fair market value of $936 million and $845 million at December 31,

2002 and 2001, respectively. Company securities held in trust to satisfy collateral requirements had an amortized cost of $1,949 million and

$1,918 million at December 31, 2002 and 2001, respectively.

MetLife, Inc. F-19