MetLife 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

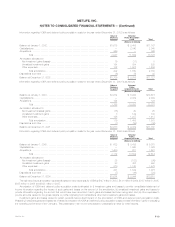

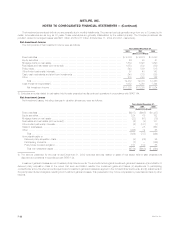

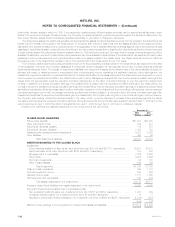

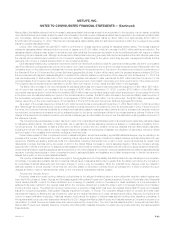

Net Unrealized Investment Gains

The components of net unrealized investment gains, included in accumulated other comprehensive income, were as follows:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Fixed maturities*************************************************************************** $ 7,371 $ 3,110 $ 1,677

Equity securities ************************************************************************** 45 604 744

Derivatives ******************************************************************************* (24) 71 —

Other invested assets ********************************************************************* 17 59 58

Total ******************************************************************************** 7,409 3,844 2,479

Amounts allocable to:

Future policy benefit loss recognition ******************************************************* (1,269) (30) (284)

Deferred policy acquisition costs ********************************************************** (559) (21) 119

Participating contracts ******************************************************************* (153) (127) (133)

Policyholder dividend obligation *********************************************************** (1,882) (708) (385)

Deferred income taxes********************************************************************* (1,264) (1,079) (621)

Total ******************************************************************************** (5,127) (1,965) (1,304)

Net unrealized investment gains ***************************************************** $ 2,282 $ 1,879 $ 1,175

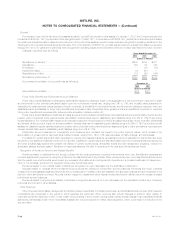

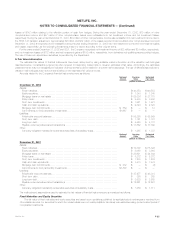

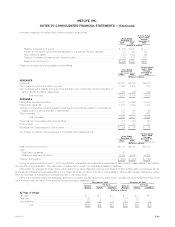

The changes in net unrealized investment gains were as follows:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Balance at January 1 *********************************************************************** $ 1,879 $1,175 $ (297)

Unrealized investment gains during the year **************************************************** 3,565 1,365 3,279

Unrealized investment gains (losses) relating to:

Future policy benefit (loss) gain recognition *************************************************** (1,239) 254 (35)

Deferred policy acquisition costs *********************************************************** (538) (140) (590)

Participating contracts ******************************************************************** (26) 6 (15)

Policyholder dividend obligation ************************************************************ (1,174) (323) (385)

Deferred income taxes********************************************************************** (185) (458) (782)

Balance at December 31 ******************************************************************* $ 2,282 $1,879 $1,175

Net change in unrealized investment gains ***************************************************** $ 403 $ 704 $1,472

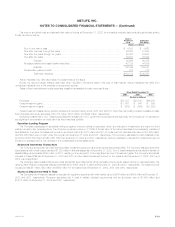

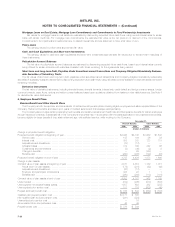

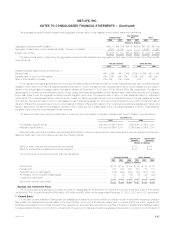

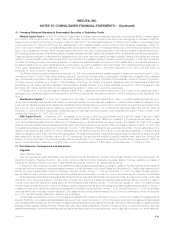

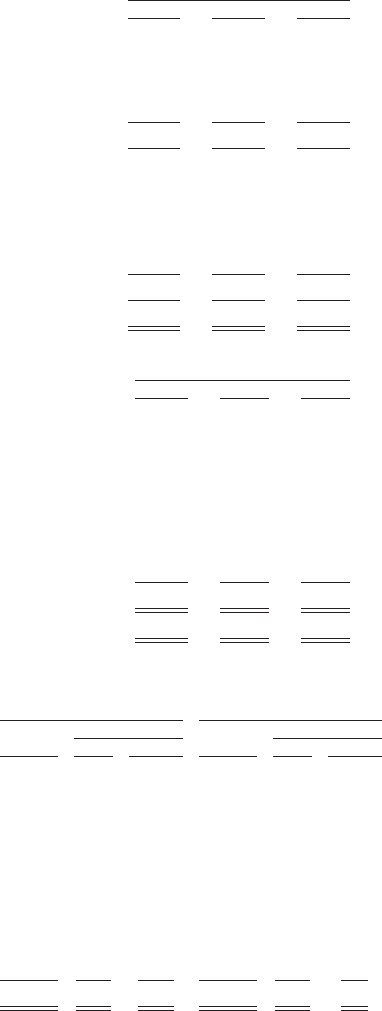

4. Derivative Instruments

The table below provides a summary of notional amount and fair value of derivative financial instruments held at December 31, 2002 and 2001:

2002 2001

Fair Value Fair Value

Notional Notional

Amount Assets Liabilities Amount Assets Liabilities

(Dollars in millions)

Financial futures ************************************************************** $ 4 $— $— $ — $— $—

Interest rate swaps ************************************************************ 3,866 196 126 1,823 73 9

Floors *********************************************************************** 325 9 — 325 11 —

Caps *********************************************************************** 8,040 — — 7,890 5 —

Financial forwards ************************************************************* 1,945 — 12 — — —

Foreign currency swaps******************************************************** 2,371 92 181 1,925 188 26

Options ********************************************************************* 78 9 — 1,880 8 12

Foreign currency forwards ****************************************************** 54 — 1 67 4 —

Written covered calls ********************************************************** —— — 40— —

Credit default swaps ********************************************************** 376 2 — 270 — —

Total contractual commitments ************************************************** $17,059 $308 $320 $14,220 $289 $47

MetLife, Inc. F-23