MetLife 2002 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Auto & Home. The charges to this segment in the fourth quarter of 2001 include severance and severance-related costs associated with the

elimination of approximately 200 positions. All terminations were completed as of December 31, 2002. The costs were recorded in other expenses.

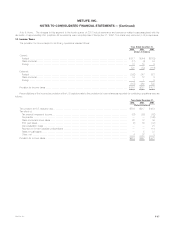

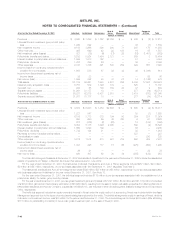

14. Income Taxes

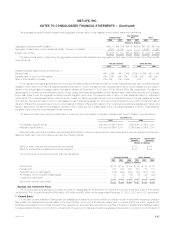

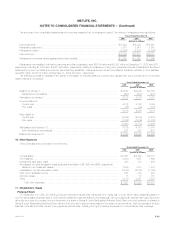

The provision for income taxes for continuing operations was as follows:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Current:

Federal ************************************************************************************* $ 817 $ (44) $(153)

State and local******************************************************************************* (17) (4) 34

Foreign ************************************************************************************* 31 15 5

831 (33) (114)

Deferred:

Federal ************************************************************************************* (332) 247 521

State and local******************************************************************************* 16 12 8

Foreign ************************************************************************************* 11 6

(315) 260 535

Provision for income taxes *********************************************************************** $ 516 $227 $ 421

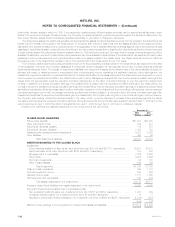

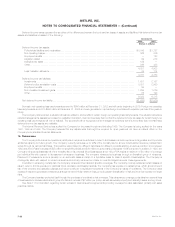

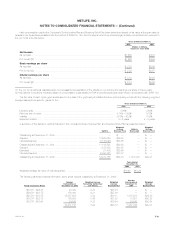

Reconciliations of the income tax provision at the U.S. statutory rate to the provision for income taxes as reported for continuing operations were as

follows:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Tax provision at U.S. statutory rate***************************************************************** $584 $217 $ 454

Tax effect of:

Tax exempt investment income****************************************************************** (87) (82) (52)

Surplus tax ********************************************************************************** — — (145)

State and local income taxes ******************************************************************* 22 12 30

Prior year taxes******************************************************************************* (7) 38 (37)

Demutualization costs ************************************************************************* —— 21

Payment to former Canadian policyholders ******************************************************** — — 114

Sales of businesses*************************************************************************** —531

Other, net *********************************************************************************** 437 5

Provision for income taxes************************************************************************ $516 $227 $ 421

MetLife, Inc. F-37