MetLife 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

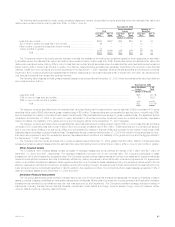

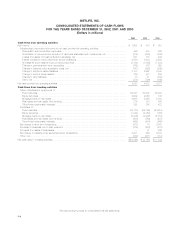

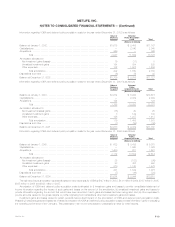

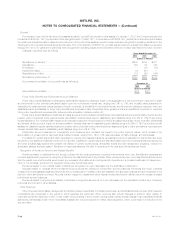

METLIFE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS — (Continued)

FOR THE YEARS ENDED DECEMBER 31, 2002, 2001 AND 2000

(Dollars in millions)

2002 2001 2000

Cash flows from financing activities

Policyholder account balances:

Deposits *********************************************************************************** $ 29,844 $ 29,167 $ 28,453

Withdrawals ******************************************************************************** (23,980) (25,704) (28,504)

Net change in short-term debt******************************************************************* 806 (730) (3,095)

Long-term debt issued ************************************************************************* 1,008 1,600 207

Long-term debt repaid ************************************************************************* (211) (372) (124)

Common stock issued ************************************************************************* — — 4,009

Treasury stock acquired ************************************************************************ (471) (1,321) (613)

Net proceeds from issuance of company-obligated mandatorily redeemable securities of subsidiary trust **** — 197 969

Cash payments to eligible policyholders *********************************************************** — — (2,550)

Dividends on common stock ******************************************************************** (147) (145) (152)

Net cash provided by (used in) financing activities **************************************************** 6,849 2,692 (1,400)

Change in cash and cash equivalents ************************************************************** (5,150) 4,039 645

Cash and cash equivalents, beginning of year******************************************************** 7,473 3,434 2,789

Cash and cash equivalents, end of year ******************************************************* $ 2,323 $ 7,473 $ 3,434

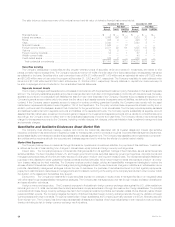

Supplemental disclosures of cash flow information:

Cash paid (refunded) during the year:

Interest ************************************************************************************ $ 424 $ 349 $ 448

Income taxes ******************************************************************************* $ 193 $ (262) $ 256

Non-cash transactions during the year:

Policy credits to eligible policyholders *********************************************************** $—$—$408

Business acquisitions — assets **************************************************************** $ 2,630 $ 1,336 $ 22,936

Business acquisitions — liabilities*************************************************************** $ 1,751 $ 1,060 $ 22,437

Business dispositions — assets **************************************************************** $ — $ 102 $ 1,184

Business dispositions — liabilities*************************************************************** $ — $ 44 $ 1,014

Real estate acquired in satisfaction of debt ****************************************************** $30$30$24

Purchase money mortgage on real estate sale *************************************************** $ 954 $ — $ 49

See accompanying notes to consolidated financial statements.

F-7