MetLife 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

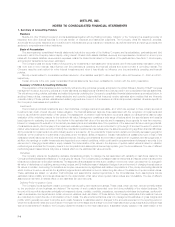

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

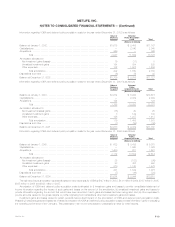

Goodwill

The excess of cost over the fair value of net assets acquired (‘‘goodwill’’) is included in other assets. On January 1, 2002, the Company adopted the

provisions of SFAS No. 142, Goodwill and Other Intangible Assets, (‘‘SFAS 142’’). In accordance with SFAS 142, goodwill is not amortized but is tested

for impairment at least annually to determine if a write down of the cost of the asset is required. Impairments are recognized in operating results when the

carrying amount of goodwill exceeds its implied fair value. Prior to the adoption of SFAS 142, goodwill was amortized on a straight-line basis over a period

ranging from ten to 30 years and impairments were recognized in operating results when permanent diminution in value was deemed to have occurred.

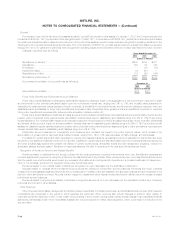

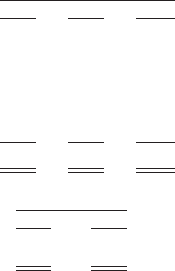

Changes in goodwill were as follows:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Net balance at January 1 ************************************************************************ $609 $703 $ 611

Acquisitions************************************************************************************ 166 54 286

Amortization************************************************************************************ — (47) (50)

Impairment losses******************************************************************************* (8) (61) —

Dispositions and other *************************************************************************** (17) (40) (144)

Net balance at December 31 ********************************************************************* $750 $609 $ 703

Accumulated amortization from goodwill was as follows at:

December 31,

2002 2001

(Dollars in millions)

Accumulated amortization ************************************************************************** $101 $101

Future Policy Benefits and Policyholder Account Balances

Future policy benefit liabilities for participating traditional life insurance policies are equal to the aggregate of (i) net level premium reserves for death

and endowment policy benefits (calculated based upon the nonforfeiture interest rate, ranging from 3% to 11%, and mortality rates guaranteed in

calculating the cash surrender values described in such contracts), (ii) the liability for terminal dividends, and (iii) premium deficiency reserves, which are

established when the liabilities for future policy benefits plus the present value of expected future gross premiums are insufficient to provide for expected

future policy benefits and expenses after deferred policy acquisition costs are written off.

Future policy benefit liabilities for traditional annuities are equal to accumulated contractholder fund balances during the accumulation period and the

present value of expected future payments after annuitization. Interest rates used in establishing such liabilities range from 2% to 11%. Future policy

benefit liabilities for non-medical health insurance are calculated using the net level premium method and assumptions as to future morbidity, withdrawals

and interest, which provide a margin for adverse deviation. Interest rates used in establishing such liabilities range from 3% to 11%. Future policy benefit

liabilities for disabled lives are estimated using the present value of benefits method and experience assumptions as to claim terminations, expenses and

interest. Interest rates used in establishing such liabilities range from 3% to 11%.

Policyholder account balances for universal life and investment-type contracts are equal to the policy account values, which consist of an

accumulation of gross premium payments plus credited interest, ranging from 1% to 13%, less expenses, mortality charges, and withdrawals.

The liability for unpaid claims and claim expenses for property and casualty insurance represents the amount estimated for claims that have been

reported but not settled and claims incurred but not reported. Liabilities for unpaid claims are estimated based upon the Company’s historical experience

and other actuarial assumptions that consider the effects of current developments, anticipated trends and risk management programs, reduced for

anticipated salvage and subrogation. Revisions of these estimates are included in operations in the year such refinements are made.

Recognition of Insurance Revenue and Related Benefits

Premiums related to traditional life and annuity policies with life contingencies are recognized as revenues when due. Benefits and expenses are

provided against such revenues to recognize profits over the estimated lives of the policies. When premiums are due over a significantly shorter period

than the period over which benefits are provided, any excess profit is deferred and recognized into operations in a constant relationship to insurance in-

force or, for annuities, the amount of expected future policy benefit payments.

Premiums related to non-medical health contracts are recognized on a pro rata basis over the applicable contract term.

Deposits related to universal life and investment-type products are credited to policyholder account balances. Revenues from such contracts

consist of amounts assessed against policyholder account balances for mortality, policy administration and surrender charges and are recognized in the

period in which services are provided. Amounts that are charged to operations include interest credited and benefit claims incurred in excess of related

policyholder account balances.

Premiums related to property and casualty contracts are recognized as revenue on a pro rata basis over the applicable contract term. Unearned

premiums are included in other liabilities.

Other Revenues

Other revenues include asset management and advisory fees, broker/dealer commissions and fees, and administrative service fees. Such fees and

commissions are recognized in the period in which services are performed. Other revenues also include changes in account value relating to

corporate-owned life insurance (‘‘COLI’’). Under certain COLI contracts, if the Company reports certain unlikely adverse results in its consolidated financial

statements, withdrawals would not be immediately available and would be subject to market value adjustment, which could result in a reduction of the

account value.

MetLife, Inc.

F-14